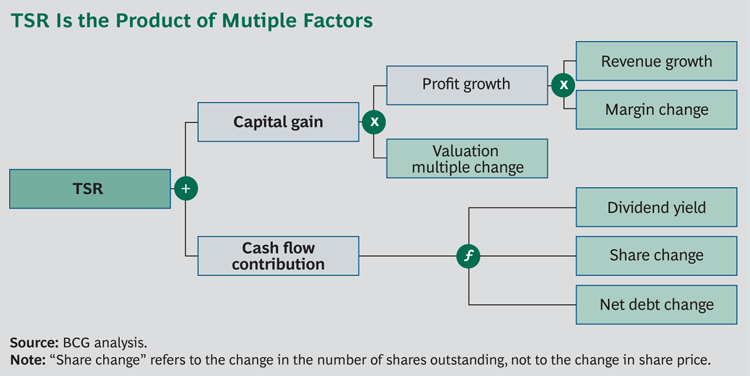

Share buybacks are an often-overlooked tool in the capital allocation toolbox of management. However, it is one of the three key pillars of cash flow management and can be even more rewarding for shareholders than dividends.

What are share buybacks?

I recently wrote an article about long term value creation that highlighted three mechanisms in which management can generate returns for shareholders outside of growth:

- Dividends

- Share buybacks, and

- Debt management

Rask Education has an easy-to-use overview on share buybacks as a form of ‘capital management’. In essence, if a company has surplus capital, it can elect to return this to shareholders through a buy-back.

How do share buybacks impact your returns?

As there are fewer shares on issue, buy-backs can boost metrics such as earnings per share (EPS), which is calculated by dividing profit by the numbers of shares on issue. All things being equal, a higher EPS will lower a company’s price-earnings ratio.

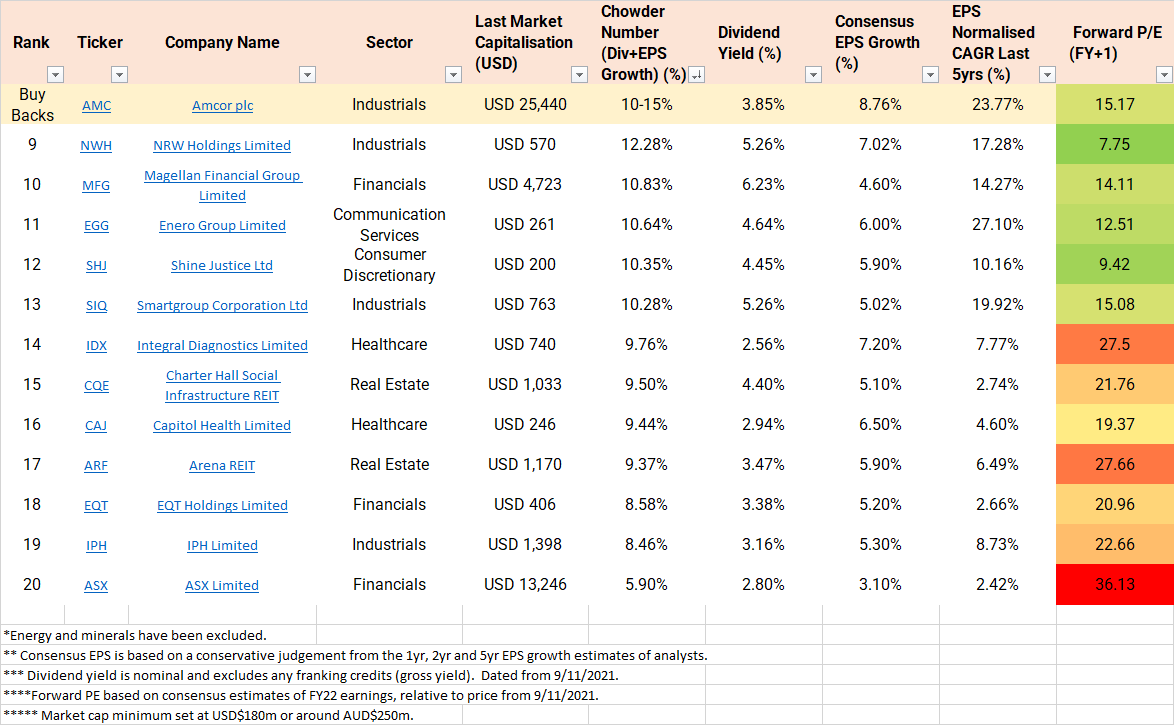

Returning back to the Chowder Number, to include share buybacks one should consider it as: Dividend Yield plus Percentage of Shares Bought Back plus Consensus EPS Growth.

So if a company has a 4% Dividend Yield, 1% Share Buybacks, and 7% EPS growth, that’s a total return of 12% for the investor.

Few Aussie companies do share buybacks

Unfortunately, in Australia, few companies do share buybacks. Sure, recently the banks announced multi-billion buybacks, though since the GFC they have been a net issuer of shares. Other notable exceptions include CSL (ASX: CSL), Boral (ASX: BLD) and Telstra (ASX: TLS).

There are perhaps two major impediments to buybacks. First, quality companies that generate significant free cash flow tend to trade at high valuations, reducing the returns on share buybacks. Second, the tax imputation system and franked dividends provide better returns to shareholders, particularly for retirees with low marginal tax rates.

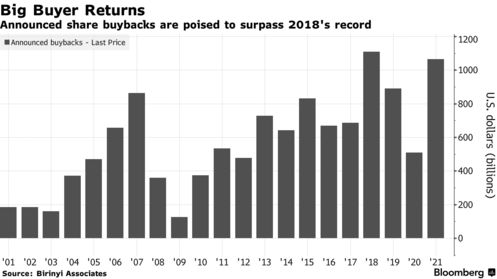

Meanwhile, in the US, 2021 is expected to set a new record for share buybacks with over US$1.1trn already announced. While over in Japan, Softbank (TYO: 9984 or OTCMKTS: SFTBY) shares rocketed over 10% on the announcement of a new US$9bn share buyback.

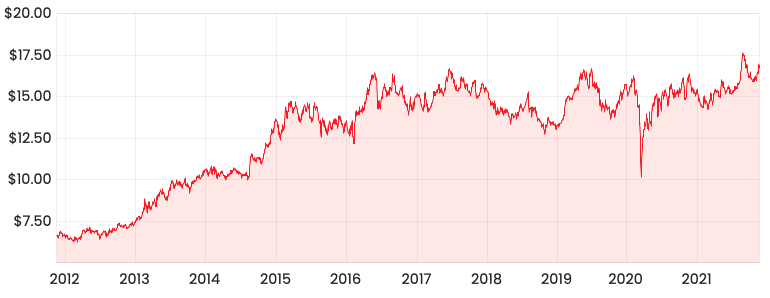

Amcor – a Dividend Aristocrat

Amcor (ASX: AMC or NYSE: AMCR) recently acquired Bemis, and with that has become a Dividend Aristocrat. A Dividend Aristocrat has increased dividends every year for more than 25 years straight – that requires a helluva good business to achieve.

There are only 65 Dividend Aristocrats in the S&P 500 (where most of them are), and Amcor has the 10th highest dividend yield at 3.85% and has increased it for 38 years consecutively.

Let that sink in.

AMC share price

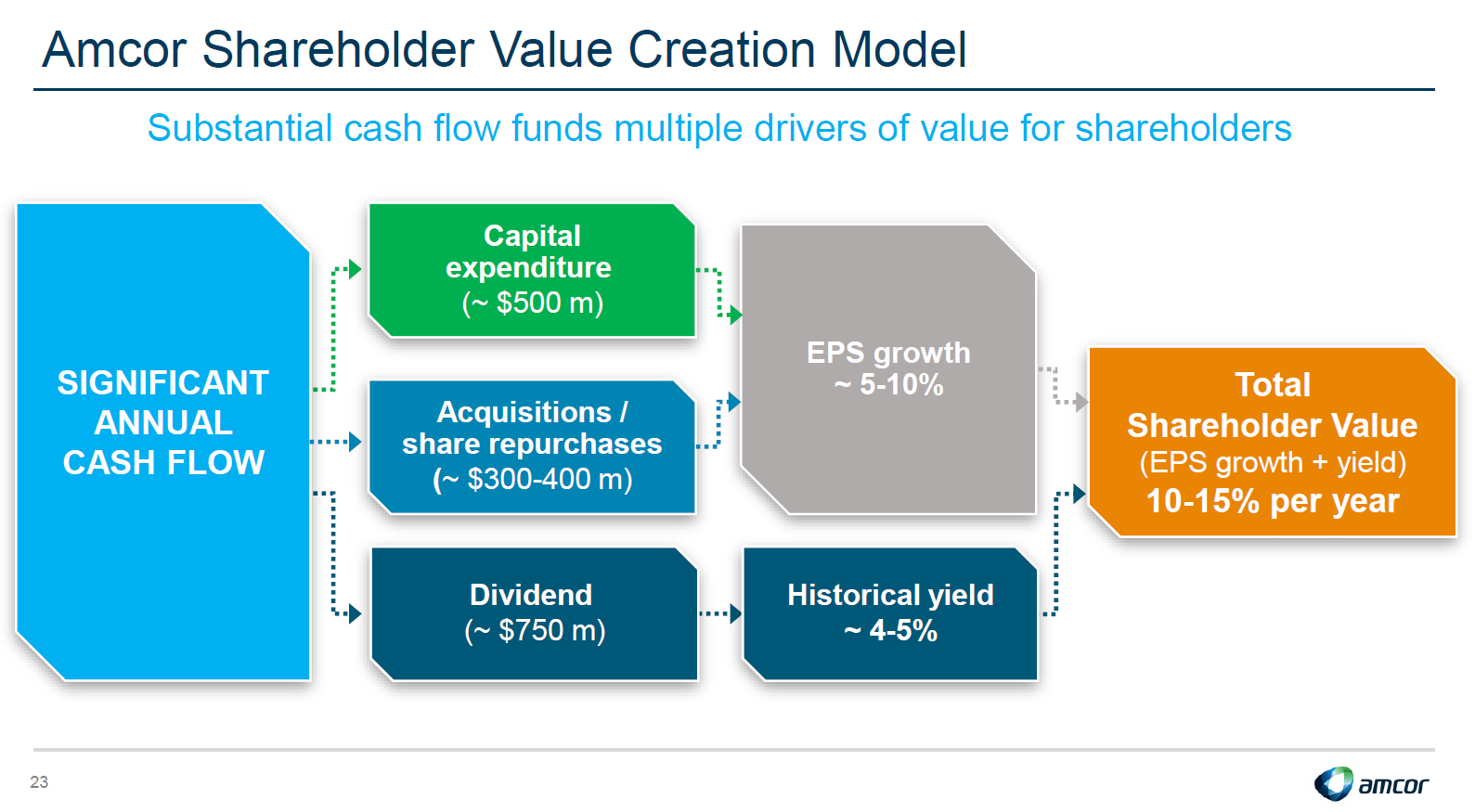

Amcor has achieved a 15% total shareholder return from 2010-21. This has been achieved through the pillars of organic growth, growth CAPEX (particularly acquisitions), dividends and buybacks. Buybacks are being used from the free cash flow to offset the issuing of shares to partially fund the acquisitions.

Looking forward, management has set a lofty ambition of 10-15% CAGR. This will require ~4% dividend yield and ~2% buybacks on top of analysts forecast of ~8% EPS growth over the next five years. If they achieve this, not only will they be a Dividend Aristocrat, but they’ll become the ASX Share Buyback King.

Final thoughts

It’s difficult for an investor to get a good grasp on share buybacks. Rarely do they get much attention. Share buybacks can turbocharge your returns, and conversely share based compensation and issuance can do the exact opposite.

For more on Dividend Growth Investing, see my recent article that outlines the screener approach being used here.