The embattled payments facilitator EML Payments Ltd (ASX: EML) share price has moved higher today after the business provided a trading update at its Annual General Meeting.

Currently, the EML share price is up 3.74% to $2.92.

EML share price

No Europe, no worries

Key highlights from the first quarter ending 30 September 2021 include:

- Gross debit volume (GDV) of $5.5 billion, up 14% of year-on-year (YoY)

- Revenue of $52.4 million, up 29% YoY

- Overheads were $23.2 million, up 24% YoY

- Underlying EBITDA of $11.2 million, up 11% YoY

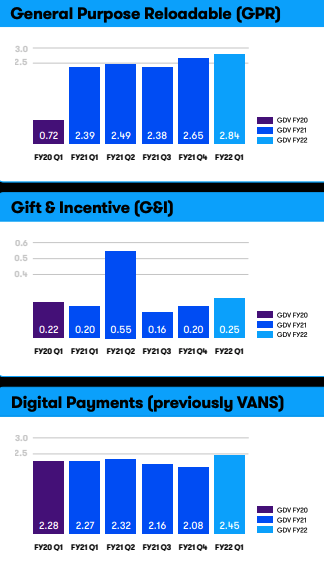

The company recorded growth across all three of its divisions – General Purpose Reloadable (GPR), Gift & Incentive (G&I) and Digital Payments.

GPR – which provides reloadable cards for business and government – grew 7% on the prior quarter as a result of growth in large card orders and gaming programs.

Similarly, G&I achieved solid growth, increasing volumes by 27% on the prior quarter.

As pandemic restrictions ease, customers are returning to shopping centres and purchasing gift cards. However, key markets (US, UK, Germany) remain below pre-COVID-19 levels.

Given EML has been unable to launch new programs in Europe (due to the CBI investigation), the fact its recorded double-digit growth is a credit to the business.

CBI remediation on track

The investigation into EML’s Irish subsidiary PCSIL, which has plagued the business and its share price over 2021, is making good progress.

EML is implementing a Remediation Plan that will see PCSIL meet or exceed the Central Bank of Ireland’s (CBIs) expectations by Q3 FY22.

The business meets monthly with the CBI and has completed 45% of Level 1 tasks as part of the Remediation Plan.

Management believes the company will emerge stronger post the investigation and be able to grow within the new risk control frameworks.

No further regulatory matters relating to other geographies have been raised.

“We are obviously very disappointed with the large drop in our share price related to the CBI matter. In our view, the present valuation significantly understates the fundamental value and the upside potential of EML”.

Revenue forecasts narrowed, earnings unchanged

Management provided updated forecasts for FY22.

Revenue guidance has been narrowed to $230-$250 million from $220-$255 million. Meanwhile, expenses are expected to increase to $103-$122 million, up from $96-$106 million.

Gross profit margin, underlying EBITDA and profit guidance remained unchanged.

My take

Overall, I think it was a solid update by EML.

Growth across all divisions is positive and demonstrates the business is a lot more than just its European activities.

Management has been transparent on the CBI investigation. The saga looks to be coming to a close, barring any unforeseen news from the CBI.

The EML share price has been battered over the past six months.

Sentiment remains low, but if the company executes, I think today offers a decent buying opportunity.

If you are interested in keeping to date with EML, consider signing up for a free Rask account and accessing our full stock reports.