In this week’s edition of Watchlist Wednesday, we’ll be taking a closer look at Audinate Group Ltd (ASX: AD8).

You may not have heard of Audinate, but this sticky audio software business is definitely one to keep an eye on.

Fast facts

Napkin summary: Global leader in audio networking solutions

Sector: Technology

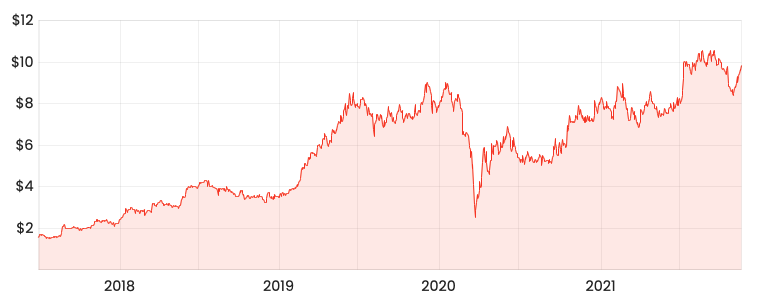

Market Capitalisation: $755 million

Profitable: Not meaningfully

Dividends: No

Risk: Medium-high

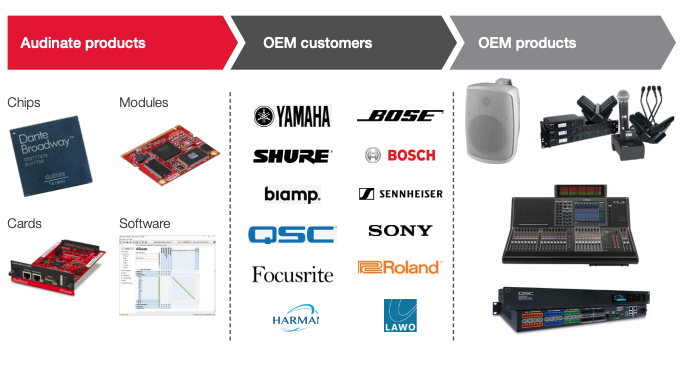

Audinate digitises audio systems through its proprietary digital audio network through ethernet (Dante) hardware and software.

Traditionally, a concert or theatre would run-heavy and specialised analog cables from device to device. This is labour-intensive, expensive and unfeasible over distance.

Audinate replaces all these connections with a computer network, run over slender ethernet cables.

Original equipment manufacturers (OEMs) such as Yamaha and Bose design new equipment with Dante chips, modules and cards already inbuilt.

Then audio professionals can use Audinate to control channels and equipment from one centralised software platform.

What to like

Audinate has several attractive features as both a company and investment:

- It dominates its market niche with 19-times enabled products compared to its nearest competitor

- 371 OEMs ship their products

- Gross margins above 75% and growing revenue at a fast rate

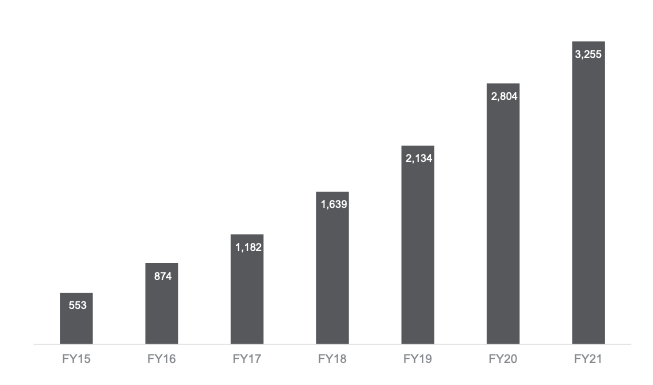

- EBITDA positive despite revenue of only $33.4 million in FY21

The company is currently shifting its revenue mix from hardware to software.

Software is a lower upfront cost for customers since it does require additional hardware, but is better for Audinate over the long-term as it can earn more reliable revenue.

“We expect that Audinate will double revenue in the medium term, and consequently, it is essential that the company has a scalable cost base to grow profitably”

The company has a long runway of growth ahead, illustrated by its design wins. For context, it typically takes up to 2 years for a product to go from the design win stage to the market release.

It’s also building a switching cost moat. In FY21, it trained 33,000 audio professionals with its software. Notably, 39% were trained in languages other than English.

Similar to the Microsoft or Apple operating systems, once you learn one, you’re very unlikely to switch and learn a new system.

Finally, Audinate is also expanding into video solutions.

The company has set up a 12-person team based out of Cambridge in the UK and has released six products thus far.

What to look out for

The global chip crunch is impacting Audinate’s supply chain.

The company recently announced 43% of its revenue would be impacted in the upcoming year. Subsequently, revenue growth will fall below historical levels.

It is unknown how long this will impact the business, but it’s worth keeping an eye out for.

The other big risk is valuation. Audinate trades on above 20x revenue. If it were to miss market expectations (or grow at a slower rate), expect the share price to take a dive.

My take

While it’s an expensive business, Audinate is the clear market leader in audio and pushing into the video segment.

I suspect the chip difficulties could be a bigger headwind than the market currently believes.

But I would consider any meaningful price fall to be a wonderful buying opportunity for new investors.

If you enjoyed this comparison, consider signing up for a free Rask account and accessing our full stock reports.

Alternatively, check out other Watchlist Wednesday editions on Tyro, Telstra, Alliance Aviation and Whispir.