Despite announcing a record FY21 result., the Aristocrat Leisure Limited (ASX: ALL) share price fell by as much as 9% today.

The company has recovered most of those losses in afternoon trade, down just 3.4% to $45.70.

ALL share price

Revenue up, profits soar

Key results for the financial year ending 30 September include:

- Operating revenue of $4.7 billion, up 14% year-on-year (YoY) and 25% in constant currency

- Net profit after tax of $820 million, down 40.5% on FY20

- Earnings per share before non-cash amortisation of 135 cents per share, up 81% YoY

- Total fully franked dividends of 41 cents per share

The 40% profit drop is not illustrative of Aristocrat’s true performance.

The business receives most of its revenue in US dollars but reports in Australian dollars. Moreover, large non-cash amortisation and one off-items obscure profit.

Subsequently, currency movements can mask underlying performance in addition to non-cash expenses depressing profits.

A better indicator of performance is normalised profit, which increased 114% or 139% in constant currency to $765.6 million.

The rapid jump resulted from strong divisional performance, particularly Gaming.

Gaming – which is software used in pokie machines and other gambling hardware – increased its installed base resulting in high operating leverage.

To illustrate, revenue increased 28% while profits soared 83%.

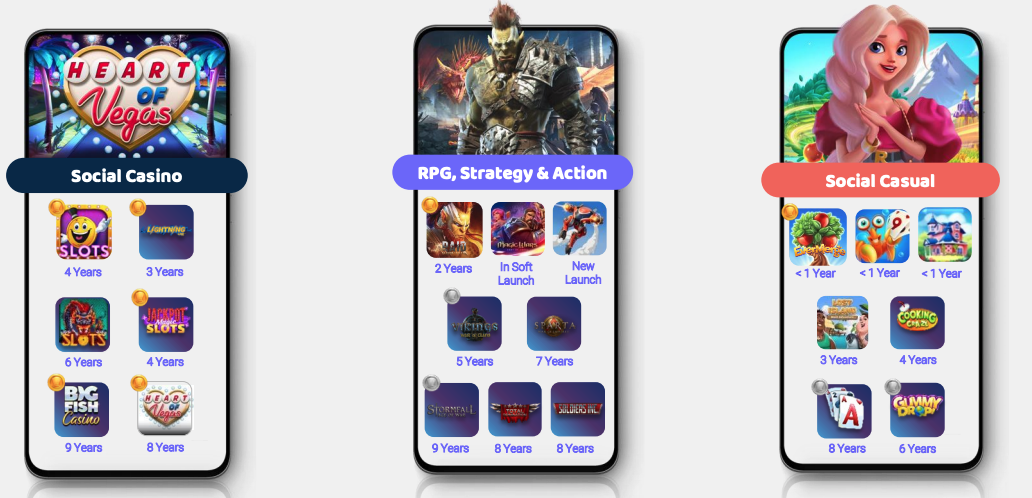

Pixel United – which is focused on digital mobile content – grew at a slower rate of 15%.

Positively, the adoption of new games remains strong and average bookings per active user are rising.

Commenting on the FY21 result, Chief Executive Officer and Managing Director, Trevor Croker said:

“Our progress is reflected in the share growth and margin expansion achieved across key segments during the year, with industry-leading games and products and further diversification across our Aristocrat Gaming and Pixel United portfolios.

Playtech battle heats up

Aristocrat expects to close its $3.8 billion deal for UK-based Playtech despite interest from competitors heating up.

JKO Play Limited has requested due diligence to formulate a potential offer for Playtech. Gopher Investments also made a request for due diligence on November 7.

Aristocrat’s takeover offer has already been recommended by the Playtech board with regulatory and shareholder approvals advanced.

“Aristocrat urges Playtech shareholders to vote in favour of the recommended acquisition by Aristocrat at these meetings”

My take

Aristocrat didn’t provide any concrete guidance for FY22 other than it expects another full year of growth.

Maybe this spooked the market? Or the possibility that the Playtech deal falls over?

Otherwise, it was a pretty strong result by the 15th biggest company on the ASX.

It’s by no means cheap with a price-to-earnings ratio of 33 and a dividend yield of just 1%.

But this is arguably the best growth stock inside the ASX 20, and likely be a key driver of index performance over the long term.

To keep up to date on all the latest news regarding Aristocrat and the ASX, be sure to bookmark the Rask Media home page.