The Treasury Wine Estates Ltd (ASX: TWE) share price is moving into the green today after the business announced the acquisition of Californian-based Frank Family Vineyards (FFV).

Currently, the Treasury Wine share price is up 2.76% to $11.56.

From commercial to luxury

Treasury Wines will acquire FFV for US$315 million (A$432 million).

The purchase price values the vineyard on an enterprise value to EBITDAS (EV/EBITDAS) multiple of 13.2.

In simple terms, Treasury Wine is buying the vineyard 13.2x earnings, which is a reasonable multiple for a profitable and growing business.

The purchase will be funded through a combination of debt and cash.

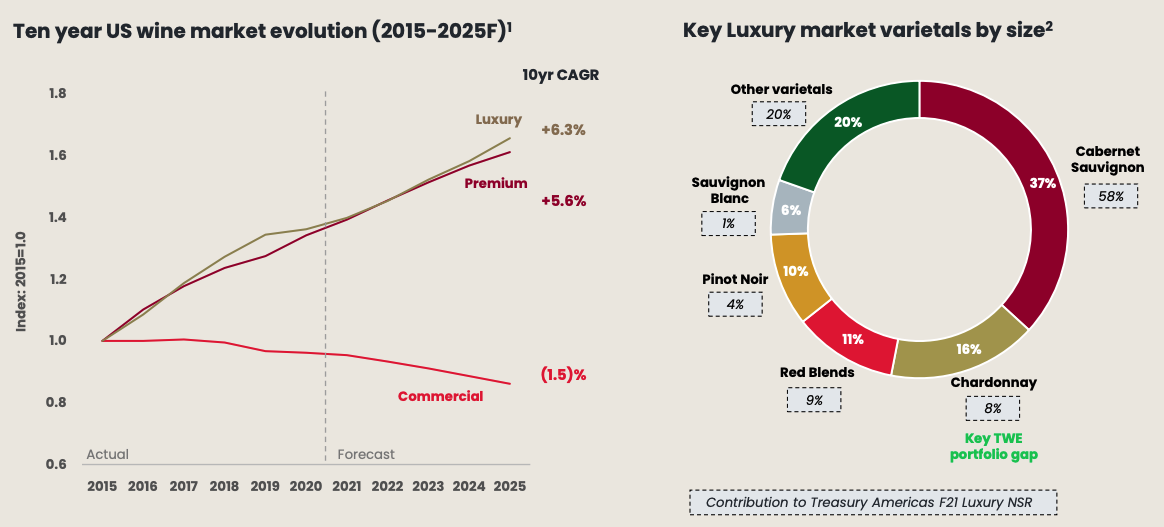

FFV fills an existing gap in Treasury’s Americas portfolio where Chardonnay is the second biggest luxury wine variety in the US.

Treasury Wine has recently shifted its product mix towards the growing luxury segment. Subsequently, it’s sold its commercial Americas portfolio for A$300 million.

Highly acclaimed Napa Valley luxury brand

FFV owns a stable of luxury wines focusing on the Chardonnay market located in Napa Valley, California.

Revenue has grown on average 13% per year over the past 12 years. Additionally, the business has high margins in the 35% to 40% range.

Treasury will be able to leverage its national distribution and sales channels to push FFV into venues such as off-premise and new regions.

The vineyard will be earnings accretive from day one and should yield cost synergies of about $5 million per year by 2024.

Commenting on the acquisition, Chief Executive Tim Ford said:

“This is a compelling strategic and financial investment, comfortably meeting our investment criteria and one we expect will deliver attractive growth and financial returns for TWE’s shareholders over the long-term.”

My take

This looks to be a savvy move by Treasury Wine.

It’s effectively substituted a low-margin, highly-competitive commercial portfolio for a luxury brand with better margins and growth prospects.

FFV founders Rich Frank and wife Leslie will remain involved with FFV and take on leadership roles within Treasury Americas.

Additionally, the amount that Treasury paid is not demanding given the current market momentum and hot M&A markets.

To keep up to date on all the latest news regarding Treasury Wine and the ASX, be sure to bookmark the Rask Media home page.