NEXTDC Ltd (ASX: NXT) share price is largely unmoved today after the data centre developer and operator provided a trading update at its annual general meeting (AGM).

In fact, the NEXTDC share price is up just 2% over 2021.

However, after reaffirming FY22 guidance, I think the NEXTDC share price could be heading higher.

NXT share price

Strong start to FY22

The NEXTDC share price should be well supported in the near term after management reiterated its FY22 forecasts:

- Revenue between $285 million and $295 million, up 16% to 20% year-on-year (YoY)

- Underlying EBITDA between $160 and $165 million, up 19% to 23% YoY

- Capital expenditure between $480 million and $540 million

Notably, management said it’s been a “strong start to FY22”.

NEXTDC has inventory available across all markets to drive further customer uptake, particularly in metro areas.

Data is the new oil

At the AGM presentation, management outlined why data is so important and how NEXTDC is set to benefit.

The rate of data consumed and produced by the world is growing exponentially.

Furthermore, by 2025, data will consume up to 20% of the world’s electricity.

“Almost 70% of organisations using cloud services today plan to increase their cloud spending”.

Anecdotally, even everyday devices demand more data capacity.

The first iPhone released in 2007 had base storage of 4GB.

The minimum storage for the latest iPhone 13 is 128GB, a 32-fold increase over 14 years.

“Data is the world’s most valuable commodity, playing a core role at the heart of commerce, government and community. Its rise is best demonstrated by the outstanding success of companies like Amazon, Netflix, Google, Microsoft, Apple and Atlassian to name a few.”

Plenty of growth ahead

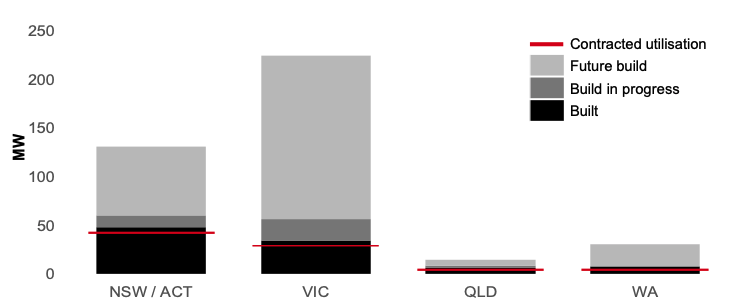

As of June 30, NEXTDC had completed just 24% of its planned data capacity.

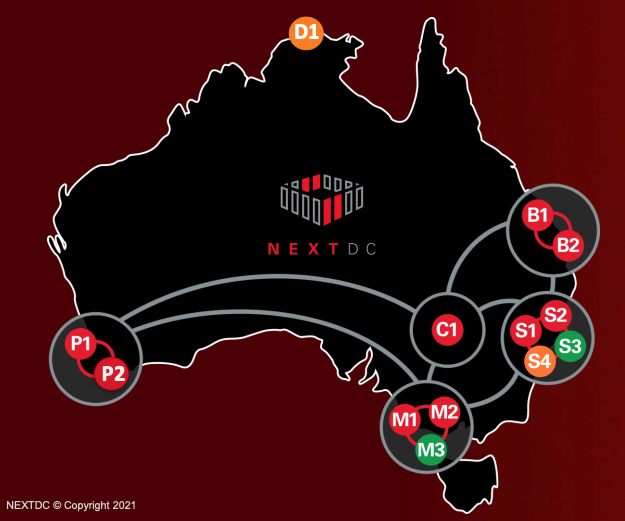

The business is rolling out further capacity – measured in megawatts (MW) – across the four largest Australian states.

Currently, the company has completed 95.8MW of the planned 400.1MW, with 79% already contracted to customers.

NEXTDC is also expanding into other cities such as Darwin and Canberra and emerging regions, including Asia.

“In FY21 we continued to review emerging market opportunities across Asia Pacific and Japan… A major priority is securing land in key markets that will drive our next decade of digital growth in Asia.

My take

With a market capitalisation of $5.8 billion, NEXTDC looks extremely expensive on a forward EBITDA multiple of 36.

But given its multi-year growth runway, I think the business is undervalued over a longer time horizon.

Subsequently, I’m bullish on the NEXTDC share price over the near and long term.

If you’re looking to learn how to do your own ASX company valuations, take our free share valuation course.

Or try our Beginner Shares Course if you’re just starting out. Both are free!