Data centre builder and operator NEXTDC Ltd (ASX: NXT) today announced a $17 million investment in Sovereign Cloud Holdings Limited (ASX: SOV).

Sovereign Cloud trades under AUCloud, an Australian-based cloud service and security provider servicing the Australian Government, Defence and other critical national organisations.

The NEXTDC share price is largely moved on the news.

Meanwhile, the Sovereign Cloud share price remains on hold while it completes the remainder of its $35 million capital raising.

NEXTDC enters infrastructure-as-a-service (IaaS)

NEXTDC will become a strategic investor, owning 19.99% of Sovereign Cloud.

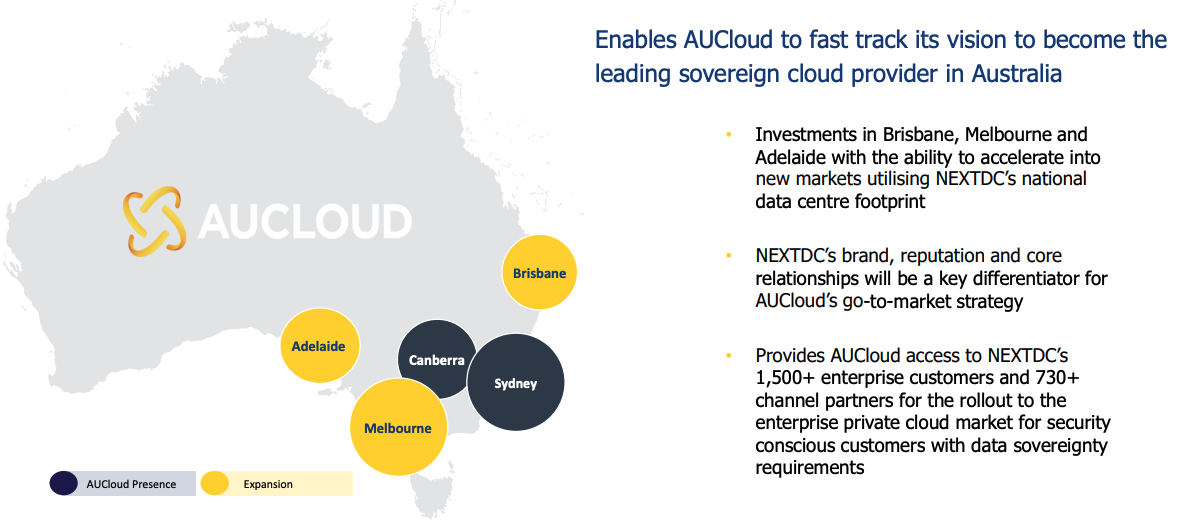

The company will be able to accelerate AUCloud’s national expansion by providing access to 1,500 customers and 730 channel partners.

In return, NEXTDC will be allowed to appoint one director to the Sovereign Cloud board, which will initially be CEO Craig Scroggie.

Why Sovereign Cloud?

NEXTDC’s foray into the IaaS provides exposure to high-security solutions for the Australian market.

There is a growing shift towards Australian partners, with governments aiming to spend 20% to 30% with local service providers.

While it might be somewhat of an arbitrary target, it shows a shift away from the big IaaS providers like Amazon Web Services

and Google Cloud

toward homegrown offerings.

NEXTDC will be able to provide bespoke solutions for AUCloud’s clients, given all its data centres are located in major Australian capital cities.

Following the injection of growth capital into AUCloud, we believe Phil and the team are very well positioned to benefit from the increasing trend towards sovereign IaaS cloud and high security solutions”.

Notable members of the AUCloud team include Brad Bastow, formerly the Chief Technology Officer of the Prime Ministers Office.

Additionally, Chief Executive Phil Dawson founded UKCloud

in 2011, a comparable firm located in the United Kingdom.

My take

It’s a reasonably low-risk investment for NEXTDC.

If AUCloud gains traction, NEXTDC will be able to stay ahead of competing operators with an inside look at the business.

Conversely, if AUCloud fails, NEXTDC will only lose its $17 million investment.

I like the move, and will be keeping track of both NEXTDC and Sovereign Cloud going forward.

To keep up to date on all the latest news regarding the ASX, be sure to bookmark the Rask Media home page.