The $40 billion blockbuster merger of BHP Group Ltd’s (ASX: BHP) oil and gas portfolio with Woodside Petroleum Limited (ASX: WPL) has been completed after both companies signed a binding share sale agreement (SSA).

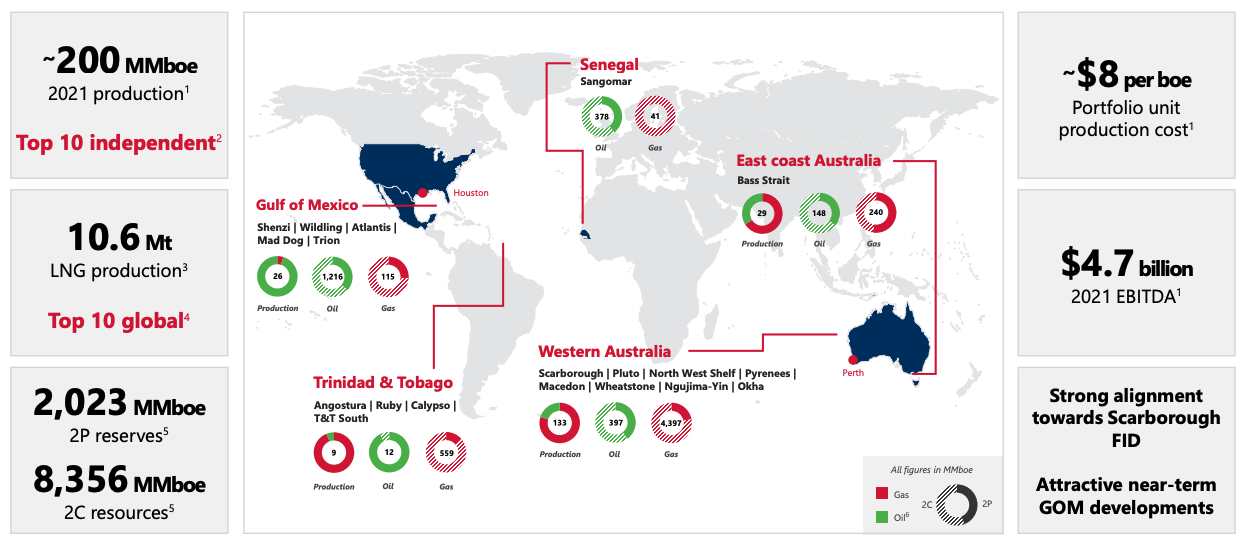

The deal, previously announced in August, will create a global top 10 energy company and the largest of its kind on the ASX.

Given the SSA announcement was released after Monday trading, shareholders will need to wait until tomorrow to see how the BHP and Woodside share prices trade.

Bigger means better

The combined entity will have a diversified geographical foothold, with high margin and long life oil and gas assets around the globe.

Woodside estimates the merger will yield US$400 million in annual savings, largely from integrating operations, systems and leveraging combined expertise.

“Woodside and BHP’s respective oil and gas portfolios and experienced teams are better together. The combination will deliver the increased scale, diversity and resilience to better navigate the energy transition.

In exchange for control of BHP’s petroleum business, Woodside will issue new shares equal to 48% of its post-merger capital.

In simple terms, existing Woodside shareholders will own 52% of the petroleum giant. Meanwhile, BHP shareholders will own the remaining 48% of shares via an in-specie fully franked dividend.

The deal remains subject to regulatory, shareholder and other customary conditions.

Assuming all goes smoothly, Woodside shareholders will vote on the deal in the second quarter (April to June) of 2022.

A convenient marriage

BHP had considered simply exiting its petroleum arm via a demerger and listing the segment as an independent company – as it had previously done with South32 Ltd (ASX: S32).

However, given the significant benefits (financial and knowledge) of a combined major oil and gas player, the Woodside deal made more sense.

It could squeeze a better price out of Woodside, albeit all in shares and not cash.

BHP frees itself of old-world commodities in oil and gas. Moreover, it eases shareholders wanting more action on climate and environmental, social and governance (ESG) issues.

On the other side of the trade, Woodside extends its growth profile without the need to put out any cash.

Sure, oil and gas are on the way out. But there’s still plenty of money to be made keeping the lights on as the world shifts to renewables.

Final thoughts

It’s likely BHP shareholders didn’t sign up for a top 10 global energy company when purchasing its shares.

So receiving Woodside shares is of little interest, despite the big profits and dividends potentially on offer.

Subsequently, most BHP shareholders will sell their Woodside shares, especially the pension and sovereign funds unable to own fossil fuels.

Therefore expect the in-specie contribution to weigh on the Woodside share price for the foreseeable future.

Overall, I think Woodside wins this deal. It’s basing its decision largely on financial motives.

BHP on the other hand is primarily driven by non-financial reasons.

If you enjoyed this analysis, consider signing up for a free Rask account and accessing our full stock reports.