Enterprise software provider TechnologyOne Ltd (ASX: TNE) share price has fallen into the red despite releasing a positive FY21 result.

Currently, the TechnologyOne share price is down 3.41% to $12.48.

SaaS revenue soars 43%, record dividends and profits

Key highlights from FY21 include:

- Revenue of $312.0 million, up 9% year-on-year (YoY)

- Profit before tax (PBT) of $97.8 million, up 19% YoY

- Total dividends of 13.91 cents per share, up 8% YoY

- Cash of $142.9 million, up 14% YoY

The company continued its shift from license systems to recurring software-as-a-service (SaaS).

To add some colour, license systems expire after a fixed term and incur a one-off upfront cost for the customer.

Conversely, SaaS is paid periodically with a lower capital outlay but ongoing recurring revenues.

Customers like SaaS because they receive two updates per year and save about 30% on the total cost of ownership. Additionally, it’s better for TechnologyOne because its revenue is far more reliable year-on-year.

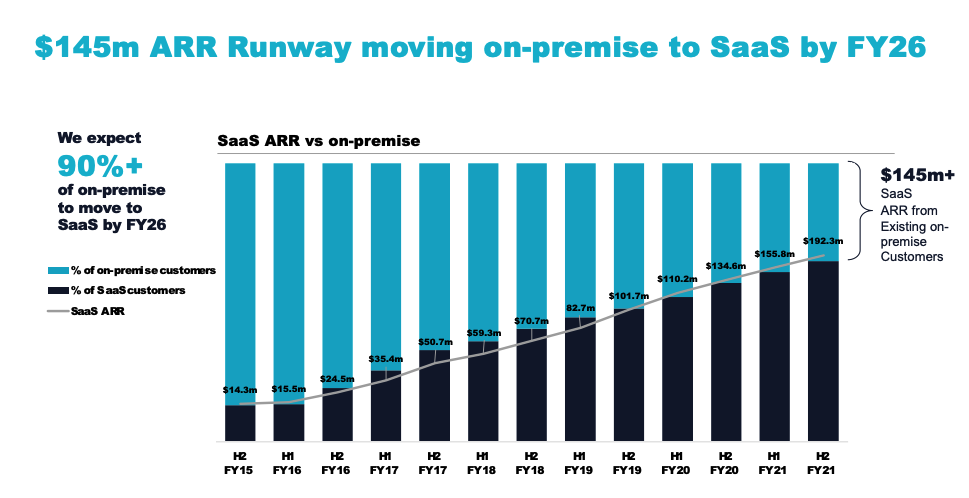

Subsequently, SaaS revenue jumped 43% to $192.3 million, at the expense of a 39% fall in legacy licenses.

Management announced the end of on-premise solutions by October 2024, flagging to customers and the market that TechnologyOne is set to become a pureplay SaaS business.

“We expect 90%+of all our remaining On-Premise customers to move to our SaaS solution, driving the growth of our SaaS business”

Annual recurring revenue increased 16% to $257.5 million, spurred by the onboarding of 100 enterprise customers.

Notably, TechnologyOne is taking market share from competitors while maintaining a churn rate below 1%.

“This year we continued to win new, large enterprise customers from our competitors. 30+ organisations replaced our competitors’ systems, including systems from Oracle, SAP, Microsoft, Tribal and Workday”

Expenses fall despite R&D acceleration

Total expenses for the year fell 1% despite research and development (R&D) increasing 13% to $77 million.

The drop was chiefly the result of a $9 million decrease in employee expenses.

Bullish outlook

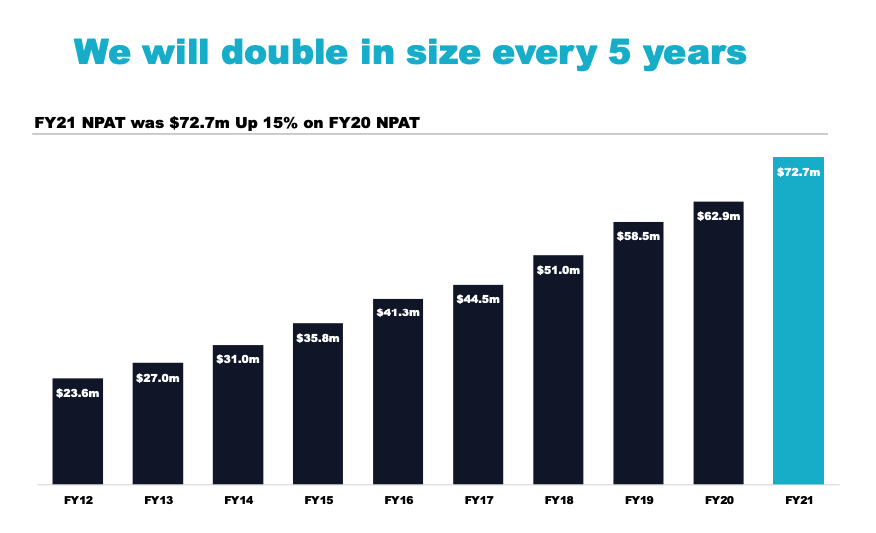

The most notable part of the FY21 results was management’s confidence in achieving its medium targets, particularly doubling over the next five years.

TechnologyOne is expecting to grow revenue at 15% per annum for the next four years while increasing its PBT margin to 35%.

Subsequently, the business is on track to hit annual recurring revenue of $500 million by FY26.

My take

A brilliant result by TechnologyOne.

Its share price is up over 63% this year, so it’s not too surprising to see a minor pullback today after the result release.

Nonetheless, the business is tracking in the right direction and has a long runway of growth ahead especially after its recent acquisition of Scientia.

If you enjoyed this analysis, consider signing up for a free Rask account and accessing our full stock reports.