The Pinnacle Investment Management Group Ltd (ASX: PNI) share price is unmoved today while the company raises $105 million to fund the purchase of a 25% stake in Five V Capital.

Five V Capital is an Australian based private equity firm focused on high-growth small to medium-sized businesses.

Pinnacle’s purchase of Five V will be its first expansion into private equity, with its existing 14 affiliates primarily concentrated in public markets.

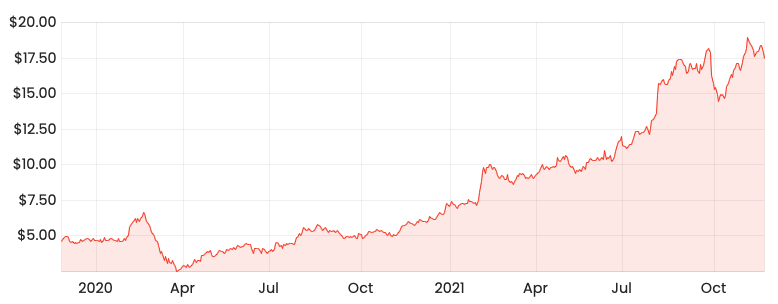

PNI share price

Pinnacle expands into private equity

Pinnacle will use $75 million of the $105 million capital raising to purchase a 25% stake in Five V capital.

The purchase will be paid upfront, however, $10 million is subject to future fundraising milestones.

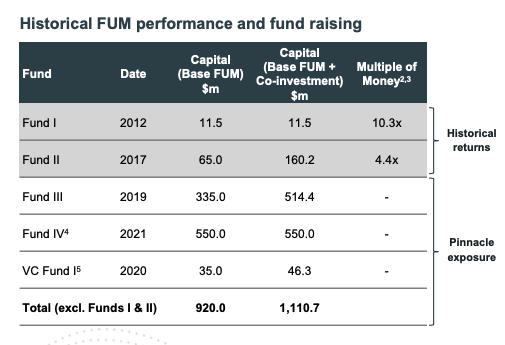

Five V provides Pinnacle exposure to $1.1 billion in funds under management across Fund III, Fund IV, VC Fund 1 and future funds.

Pinnacle will be able to assist Five V’s in its growth by providing access to its distribution network.

While Pinnacle won’t have exposure to Fund I and Fund II – which have returned 10.3x and 4.4x respectively – it’s a positive sign of what is to come.

Commenting on the acquisition, Pinnacle Managing Director Ian Macoun said:

“The investment announced today is consistent with Pinnacle’s strategy of diversifying into higher growth alternative asset classes such as private equity; and demonstrates the attractiveness of Pinnacle as a trusted partner to fund managers across all asset classes”

None of the $75 million will go to selling Five V shareholders. Instead, funds will be used to support co-investment in funds and business development.

However, current Pinnacle Executive director Adrian Whittingham will sell 875,000 shares worth $14.6 million in conjunction with the capital raising.

Nitty-gritty

Pinnacle will raise a total of $105 million at a placement price of $16.70.

As previously mentioned, $75 million will go toward the Five V purchase while the remaining $30 million will go towards beefing up its balance sheet.

Current retail shareholders will be able to participate in a share purchase plan of up to $30,000.

Growth momentum continues

In addition to announcing the Five V purchase and subsequent capital raising, Pinnacle provided a trading update.

Its affiliates recorded an increase in funds under management (FUM) of 1.7% to $90.9 billion.

Affiliates recorded net inflows in retail FUM of $2.0 billion. However, this was offset by the loss of a $3.9 billion passive client, which had previously been flagged in August.

Pinnacle expects FY22 FUM growth of more than 30% compared to the average FY21 FUM.

My take

It looks like a great acquisition by Pinnacle.

Private market investing has been gathering plenty of interest recently given the rapid rise of public equity markets over the past 18 months.

Zooming out over a longer time horizon, private capital FUM has grown 13.4% per annum for the past 20 years.

Five V will also help Pinnacle diversify its exposure, which is a common issue for listed fund managers.

If markets fall, the underlying investments also go down, leading to lower FUM and a drop in share price.

Private markets aren’t marked-to-market each day, therefore movements in FUM occur less frequently, but are of greater magnitude.

To keep up to date on all the latest news regarding Pinnacle and the ASX, be sure to bookmark the Rask Media home page.