The Link Administration Holdings Ltd (ASX: LNK) share price will be on watch today after the company provided a market update at its annual general meeting.

Currently, the Link share price is largely unmoved, up just 0.40% to $4.92.

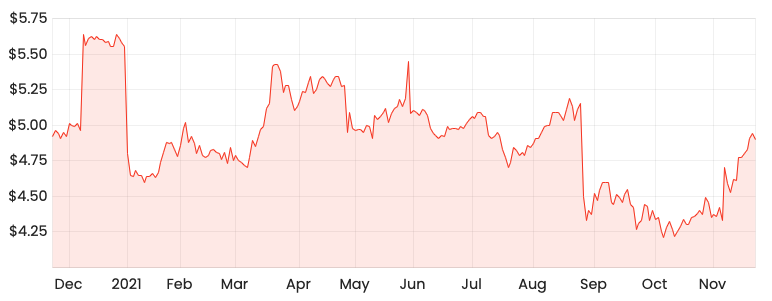

LNK share price

FY22 on track

Link notes current year trading to date is above management expectations, therefore the business is confident of meeting its FY22 guidance.

In August, the following ambitions were outlined:

- Revenue growth in the low single digits (FY20: $1.16 billion)

- Operating earnings before interest and tax (EBIT) broadly in line with the previous year (FY20: $141.4 million)

- Reduce $75 million in costs by June 2022

Running the ruler

Private equity outfit Carlyle Group is currently completing due diligence over the entire Link Group.

Carlyle previously made an offer to acquire 100% of Link earlier this month for $3.00 per share in cash and distribution of PEXA Group Ltd (ASX: PXA) shares to current Link shareholders.

Link has provided access to a virtual dataroom, Q&A process and access to Link’s senior leadership team.

No further update on the offer has been provided.

Anyone else?

After receiving an $86.5 million offer by Pepper European Servicing Limited just last week for its Banking and Credit Management (BCM) division, Link has received a superior offer from LC Financial Holdings (LCFH).

LCFH has proposed a $101 million takeover of the BCM division and has subsequently been granted due diligence.

Unlike Carlyle, Pepper and LCFH are only interested in BCM.

Distributing the jewel

Undoubtedly the best division within Link, digital property platform PEXA is set to be distributed to shareholders by mid-2022.

Link owns 42% of PEXA ($1.3 billion) and is expected to transfer at least 80% of its PEXA shares to shareholders via an in-specie distribution.

Effectively, a shareholder will own shares in both Link and PEXA, rather than Link holding the shares.

The company has applied to the Australian Tax Office for tax roll-over relief on behalf of shareholders.

Sum of parts greater than the whole

It’s nearly holiday season, but the Christmas ham is going to have to wait while the butcher slices up Link Group.

Link current market capitalisation is $2.5 billion. Assuming all the deals on the table go through, its sum of parts is worth:

- $1.3 billion for PEXA Group

- $101 million for BCM

This leaves about $1.1 billion for Carlyle Group to stump up for the remainder of the company.

Its outstanding offer of $3.00 per share implies a $1.6 billion valuation for the entire Link business.

Take away $101 million for BCM and that represents $1.5 billion for the rest of Link or a 36% takeover premium.

The maths may be tedious, but the central point is that Link’s sum of parts is worth more than the whole.

I expect all deals get done when it’s all said and done, assuming no red flags come up in due diligence.

If you’re looking to learn how to do your own ASX company valuations, take our free share valuation course, which takes you through 6 common share valuation techniques, step by step.

Or try our Beginner Shares Course if you’re just starting out. Both are free.