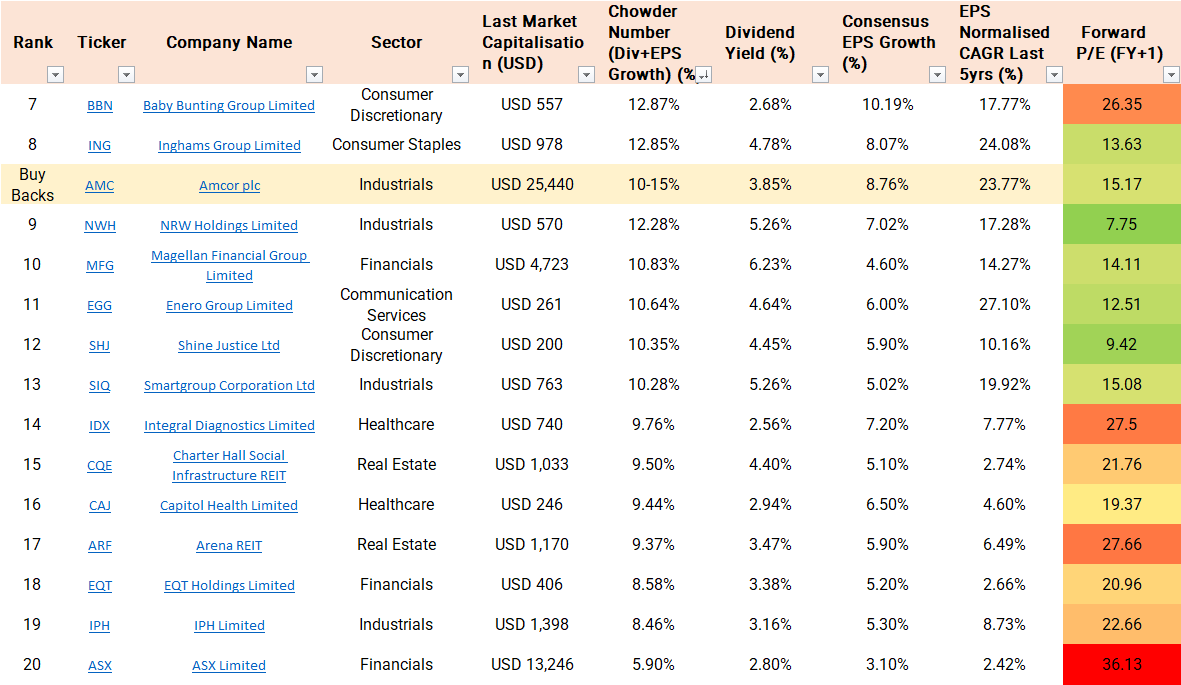

Baby Bunting (ASX: BBN) in its short history has developed a reputation as a quality growth business with reasonable dividends – coming in at #7 on the Dividend Growth Investor’s list.

Baby Bunting is yielding 2.68% fully franked dividends or 3.82% gross. Analysts are predicting over 10% earnings per share (EPS explained) growth over the next five years, resulting in an impressive 12.87% Chowder Number.

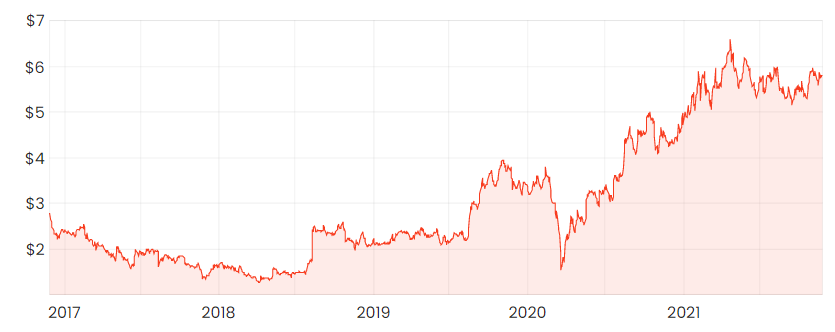

BBN share price

What does Baby Bunting do?

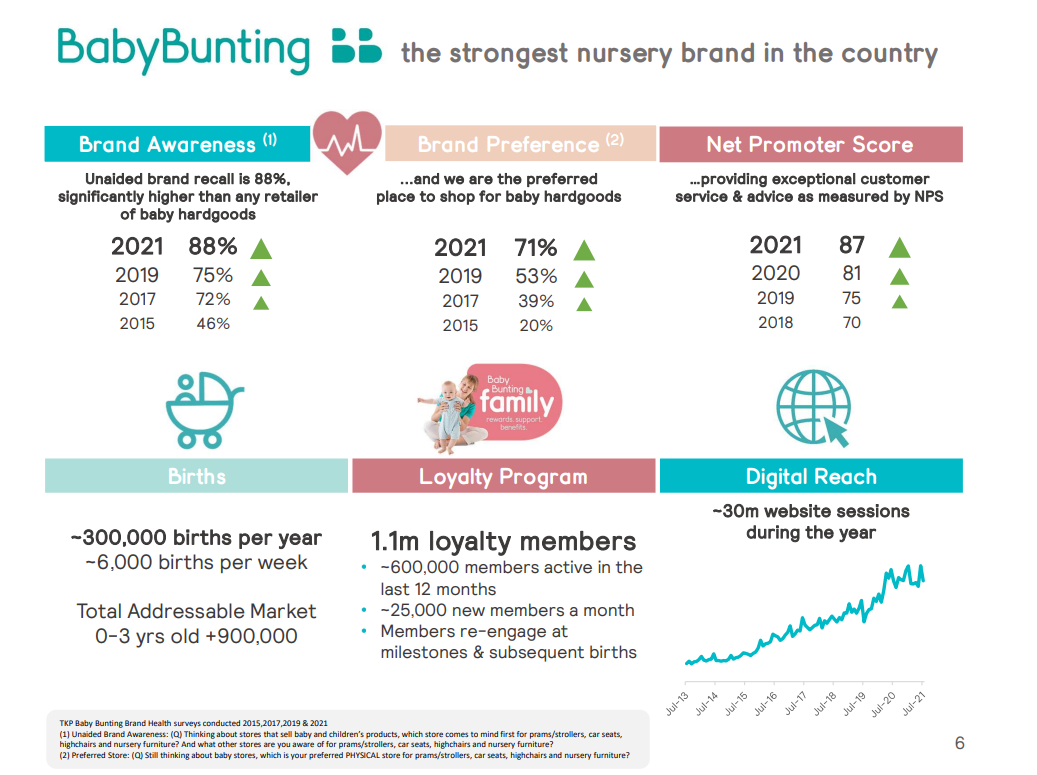

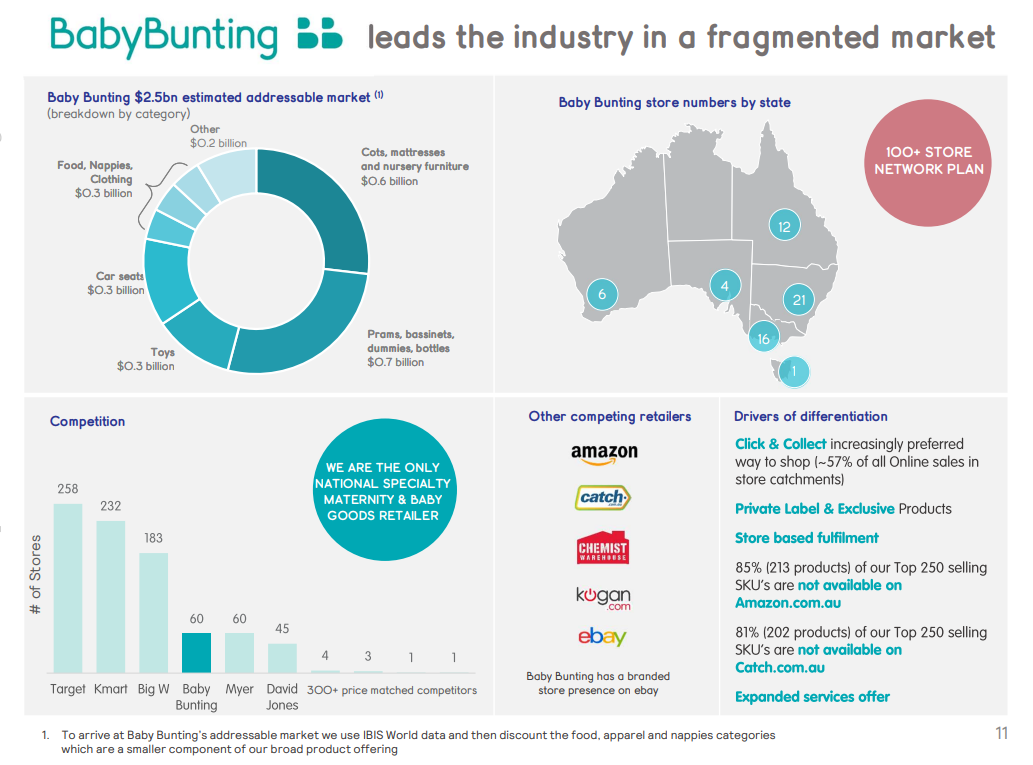

Baby Bunting is a retailer that specialises in baby goods with over 6,000 lines such as prams, cots, car safety equipment, toys, feeding and other accessories. Starting in Melbourne in 1979, the company now has over 60 stores in Australia with plans to grow the store count beyond 100 over the next few years.

If you are not aware of Baby Bunting, it’s fair to say you’re in the minority. I’ve got two little rugrats, and it would be difficult to imagine not knowing, visiting, or buying major products from Baby Bunting during their formative years.

As the strongest nursery brand in Australia, they have 6,000 new clients born every week. Modest population growth will provide a tailwind – the Australian Bureau of Statistics estimates ~307,000 births per year, which is projected to increase to 384,000-626,400 by 2066.

Though the major growth catalysts will be the increased spending per mother and baby, and the increasing market share that Baby Bunting hopes to achieve. They have a long runway of store rollouts, supported by the fragmented market. My colleague, Jaz Harrison recently highlighted this, supported by the shift to e-commerce that Baby Bunting is leading.

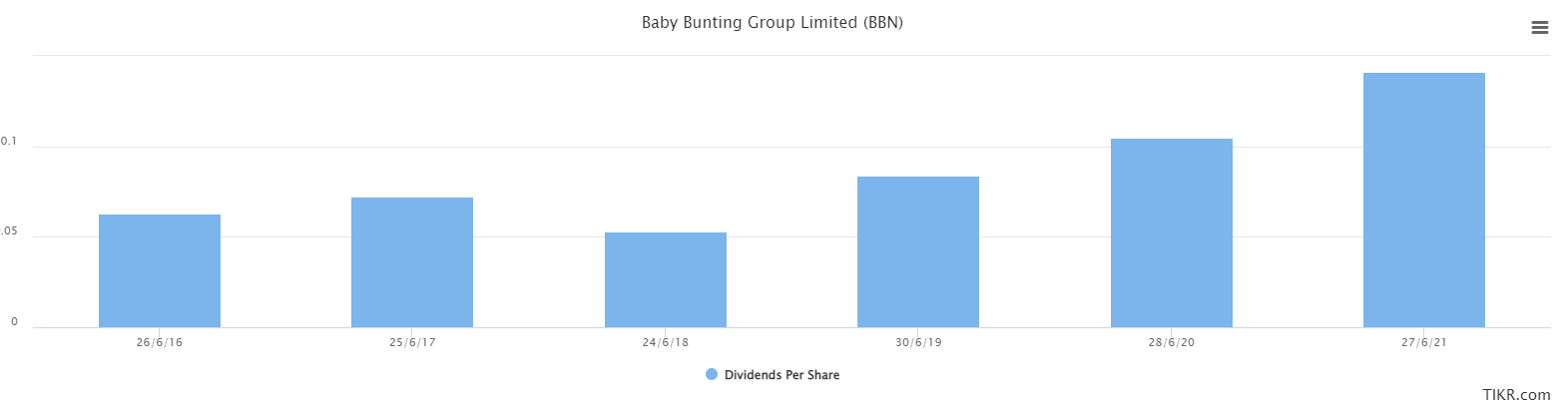

Baby Bunting’s Dividends

The Board’s dividend policy is to pay out 70-100% of pro forma NPAT. This means part of their growth CAPEX will continue to be funded by debt. While dividends have grown, the drop in 2018 means it is often missed in dividend growth investor’s screeners. It may be worthwhile to look past that and focus on the earnings potential.

Looking to forward returns

Analysts are bullish on Baby Bunting. At the top end, some are expecting 5-year EPS growth of ~16% CAGR – far above its historical 6.21% CAGR.

There is great optimism with growth in private labels driving up margins, new stores maturing and being rolled out, and its online platform. I would not be surprised if my choice of 10.19% EPS Growth for the Chowder Number ends up being conservative.

Valuation

In March 2020, Baby Bunting’s share price dropped to $1.65. At the time of writing, it’s trading at $5.79 – a ~350% increase.

All key valuation metrics point towards Baby Bunting being fully valued on historical, trailing, and forward multiples. For example, the trailing price to earnings ratio is 44x, while the historical average is closer to 20x. The forward PE is 26x, though this also remains elevated.

Risks

The most substantial short-term risk is valuation. If the share price trended to the long-term multiples, this could see shareholders losing ~20-40% of their investments.

In the long term, international expansion is perhaps the most substantial strategic risk. Currently, they are expanding into New Zealand, which seems a low risk. Though if they pivot to the UK, the US or Asia like many other retailers have, this poses other more substantive risks.

Final thoughts

Baby Bunting is a high-quality business providing decent dividend yields with good growth opportunities. Buying at reasonable valuations could turbocharge the dividend yield of your portfolio.

For more on Dividend Growth Investing, see my recent article that outlines the screener approach being used here.