ASX growth shares have had a brilliant run over 2021.

Subsequently, the local benchmark S&P/ASX 200 (ASX: XJO) is just 2.9% off its all time high. In fact, 10% of the index doesn’t even make a profit.

Despite the market looking quite toppy, here are three ASX growth shares I’m bullish on.

1. Alliance Aviation Services Ltd (ASX:AQZ)

Alliance Aviation is a plane charter business based in Queensland.

Its primary business is flying workers in and out of remote locations where commercial airlines like Qantas Airways Limited (ASX: QAN) and Virgin don’t service.

However, the secret sauce is management. When the airline industry or markets as a whole sell-off, Alliance goes and buys planes for pennies on the dollar.

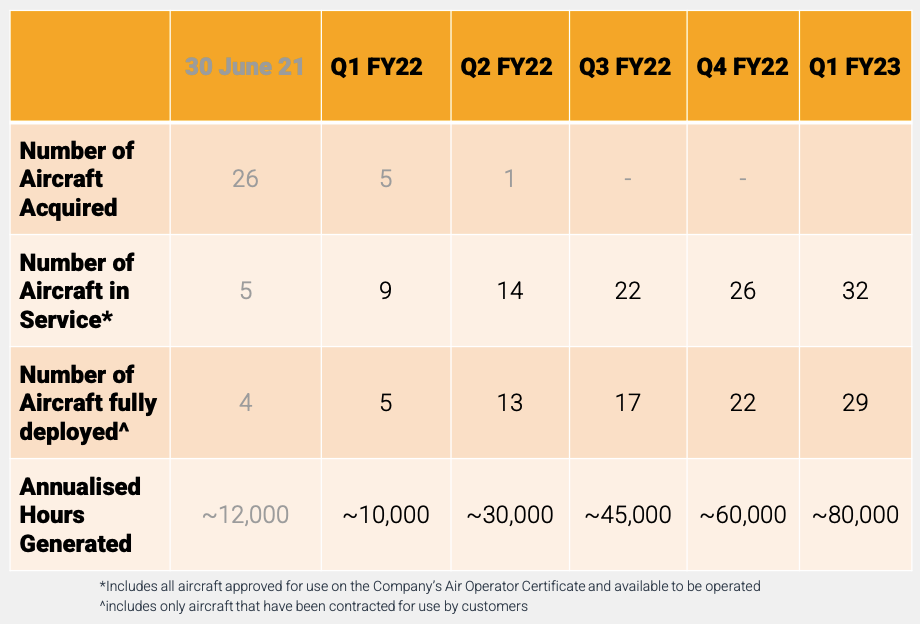

Recently, the company added 32 new aircraft to its fleet and will ramp up flight hours from 30,000 in FY19 to 80,000 in FY22.

That’s nearly a three-fold increase and should translate into a similar increase in revenue and profits.

For more on the business, check out my Rask Media Alliance Aviation guide.

2. Temple & Webster Group Ltd (ASX: TPW)

Several ASX retailers have provided trading updates in FY22 including:

- Harvey Norman Holdings Limited (ASX: HVN) sales are down 8.6%

- Kogan.com Ltd (ASX: KGN) sales are up 4% once removing the effect of Mighty Ape

- Accent Group Ltd (ASX: AX1) sales are down 26%

- JB Hi-Fi Limited (ASX: JBH) sales are down 7.9% in Australia, 6.3% in New Zealand and 6.1% at The Good Guys

But Temple and Webster has blown all of them out of the water, recording a 56% jump in sales over the first three and a half months of FY22.

The company is investing for growth, sacrificing short-term profit for long-term gains.

As a result, its margins don’t look that flash. But eventually, a lot of that extra spending should drop and profits start to accelerate.

Travel will eventually get back to normal, but I believe over the long run that will be more than offset by the shift to e-commerce.

3. EML Payments Ltd (ASX: EML)

After a difficult 2021 where the payment company came under the scrutiny of the Central Bank of Ireland (CBI), EML looks to have finally turned a corner.

EML share price

On Thursday, the company announced favourable conditions relating to the CBI investigation. The market jumped at the news, sending the EML share price 31% higher.

I suspect in 2022, the CBI issue will be largely behind EML and the market will see the underlying growth of the business.

If you enjoyed these 3 ASX growth shares ideas, consider signing up for a free Rask account and accessing our full stock reports.