The Australia and New Zealand Banking Group Limited (ASX: ANZ) share price will be on watch today after the Australian Securities and Investments Commission (ASIC) commenced civil proceedings against the bank in the Federal Court.

ASIC claims ANZ breached the Credit Act as a result of its home loan ‘introducer program’ where ANZ accepted loan applications from third-party professions such as cleaners and real estate.

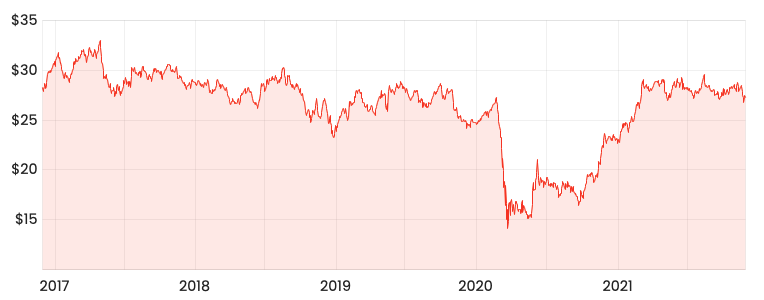

Currently, the ANZ share price is indifferent to the court case, up 0.40% to $27.38.

ANZ share price

Nitty-gritty

The proceedings relate to 74 home loans issued from 2016 to 2018.

ASIC alleges ANZ failed to conduct proper checks and balances on information supporting the loans from introducers and other unlicensed individuals.

Under the Credit Act, this is not allowed.

As a result, some of the loans may have been granted on false information and beyond what customers may be able to pay.

“If banks are going to accept referrals of consumers seeking a home loan from unlicensed individuals, who receive commission payments for the referrals, they need to make sure they have the right systems in place to properly process those referrals”

From 2015 to June 2020, more than 50,000 loans were referred to ANZ under the introducers program resulting in lending of more than $18.5 billion.

As of September 2018, this referral program equalled 10% of the home loans sold by ANZ Australia.

ANZ responds

In a short announcement to the market, ANZ acknowledges the proceedings and is cooperating with the regulator.

Additionally, the bank has established a customer remediation program and is improving its home loan processes and controls.

ASIC strikes again

ANZ isn’t the first big bank to come under scrutiny for questionable introducer programs.

National Australia Bank Ltd (ASX: NAB) received a $15 million fine after it used hairdressers and gym instructors to attract new borrowers who were unable to repay loans.

ASIC is seeking similar punishments including declarations, financial penalties and an independent review of ANZ’s home loan referral arrangements.

My take

It’s somewhat surprising the ANZ share price is indifferent to the proceedings. However, the market likely believes it won’t have a material impact on the business.

In fact, it might be a positive for ANZ. It will be able to review loans it possibly shouldn’t have made, and subsequently be able to improve its lending book.

The ANZ share price hasn’t gone anywhere for the last five years. Subsequently, I’d be looking elsewhere for investment ideas.

If you’re looking for growth, check out these 3 ASX shares I’m bullish on for 2022.