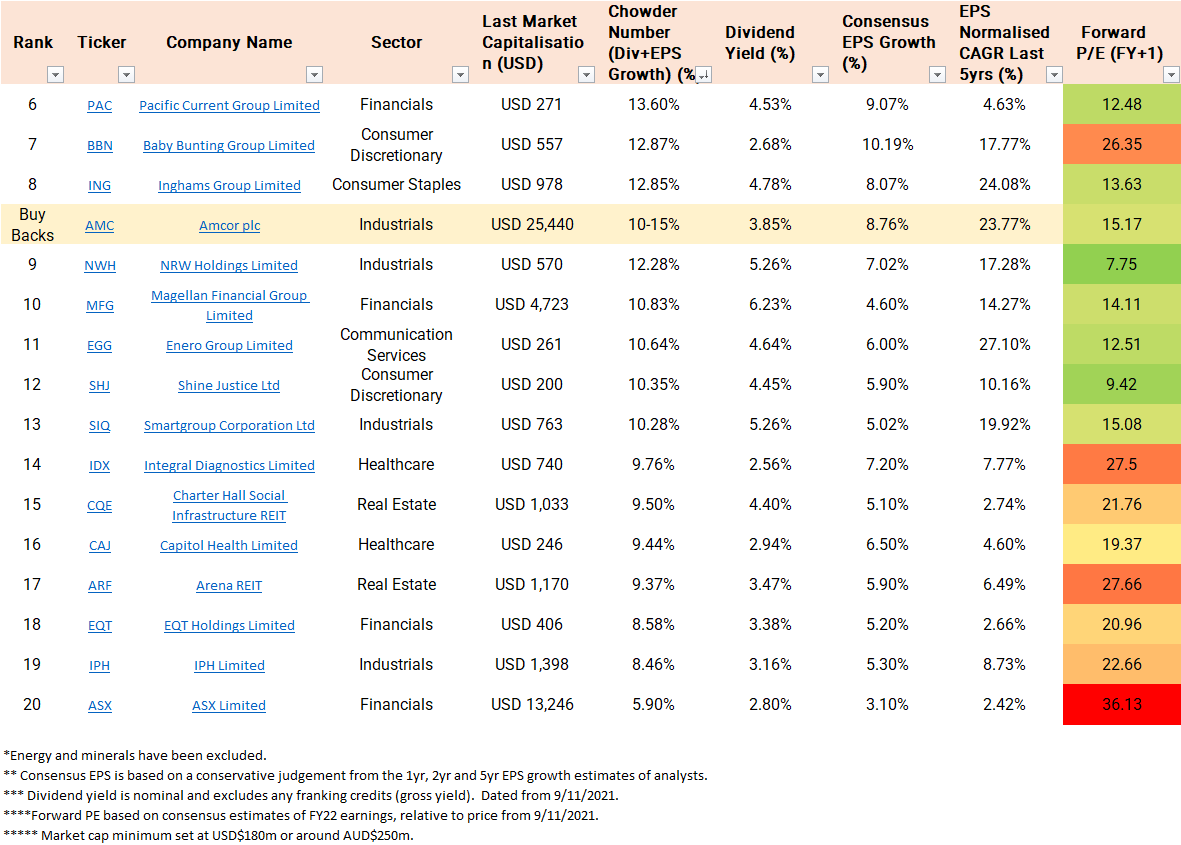

Pacific Current Group (ASX: PAC) is a fund manager of fund managers with a five-year dividend growth streak. Pacific Current is paying an impressive 4.53% fully franked dividends or 6.47% gross. Analysts are predicting a bullish 9.07% earnings per share (EPS explained) growth over the next five years, resulting in an impressive 13.60% Chowder Number.

PAC share price

What does Pacific Current do?

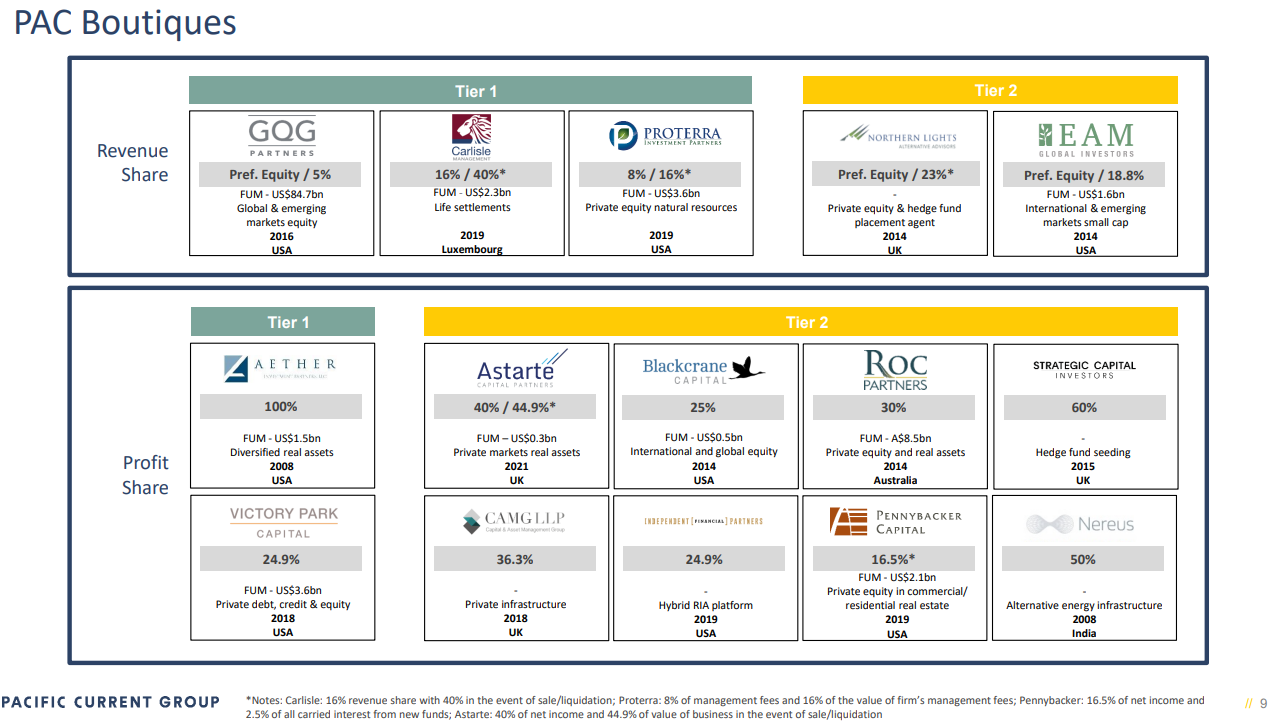

Pacific Current is a fund manager of fund managers that was born out of the merger of Treasury Group and Northern Lights in November 2014. This was followed by a rocky period where several funds underperformed, profit deteriorated, dividends declined, and the share price tanked. However, history is history, and since 2017, performance has been much stronger.

Pacific Current has equity ownership in 14 boutique funds. Each of the funds has its investing universe, management team, portfolio construction, investment process, and clientele.

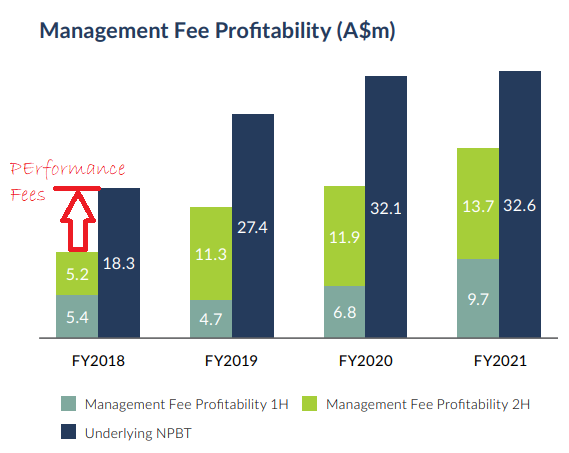

Pacific Current receives a revenue or profit share from each of the 14 funds. As with funds management in general, this is largely driven by:

- Funds under management (FUM) and management fees; and

- Performance and performance fees.

Funds under management

FUM has been increasing, driving up management fees. FUM sits at $150.1 billion as of 30 September 2021. However, this is an aggregation of all funds and does not reflect the equity ownership of Pacific Group. I wrote about this misrepresentation, as a more accurate figure would be to pro-rata Pacific Current’s equity stake.

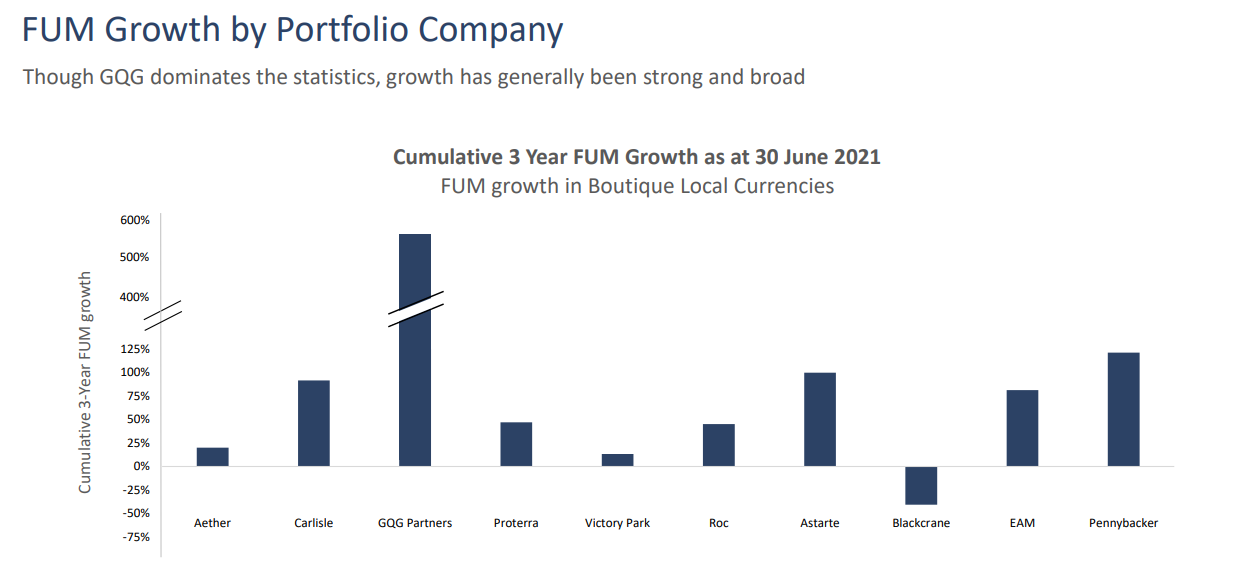

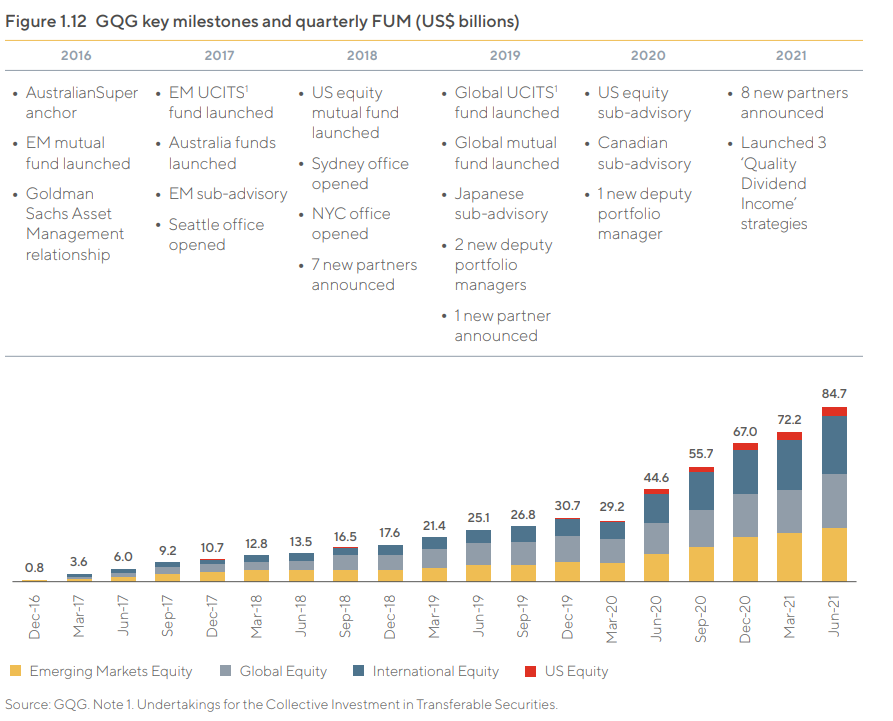

GQG Partners (ASX: GQG) is the jewel in their crown, accounting for most of the FUM increase. GQG’s FUM increased by 90% in the most recent financial year, and as of 31 October 2021 sits at $US90.4 billion (AUD$126.2 billion).

GQG recently IPO’d and now has a market capitalisation of $5.2 billion – dwarfing Pacific Current’s market capitalisation of $325 million. Their 5% equity ownership in GQG is worth $250 million alone. This has been a stellar investment for Pacific Current.

Performance fees

Performance fees were reduced from $9.8m in FY20 to $6.8m in FY21. This was largely due to underperformance in Carlisle, SCI, and Victory Park funds.

Source: Pacific Current Annual Report 2021.

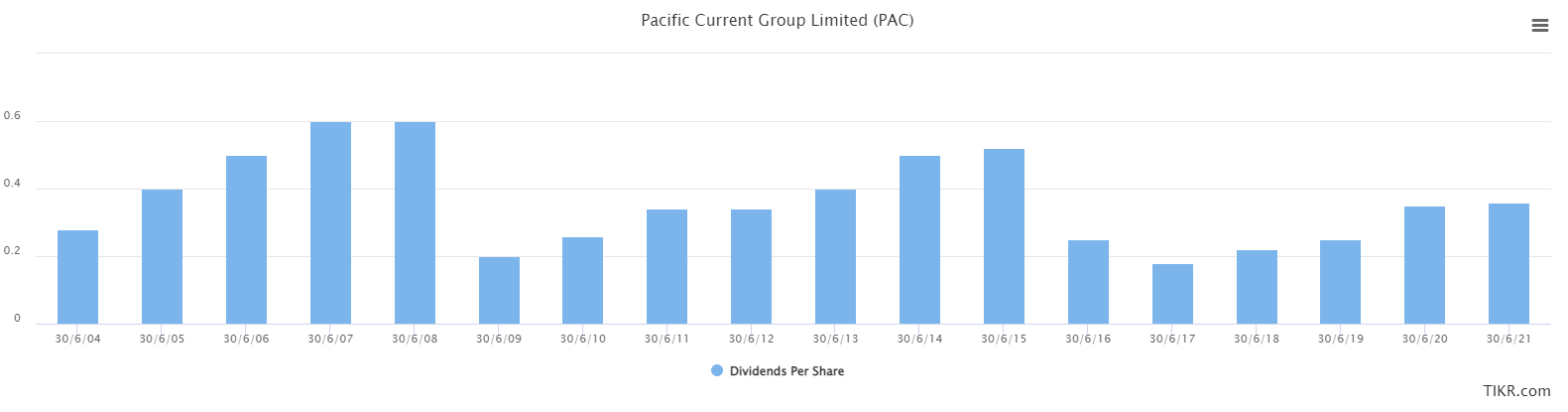

Pacific Current’s Dividends

Dividends have doubled since 2017, from 18c to 36c per share. The current yield is an impressive 4.53% fully franked dividends or 6.47% gross. However, consistent growth has alluded Pacific Current.

Looking to forward returns

Analysts are bullish on Pacific Current and in particular GQG Partners. Expectations are for earnings growth of 6-8% in the short term, increasing to 10-12% over five years. As there is only one analyst providing growth estimates for Pacific, a conservative figure of 9.07% (lowest long-term figure) has been used for the Chowder Number.

Valuation

Pacific Current is trading around ~14.5x on price to earnings multiple. This is on par with peers such as Magellan Financial Group (ASX: MFG), which is #10 on the DGI list. This valuation may be considered cheap if Pacific Current can continue to grow at its current pace.

Risks

The investment in GQG has grown to be the lion’s share of Pacific Current’s holdings. This concentration represents the greatest risk if there is outgoing FUM or underperformance.

Final thoughts

Pacific Current is a high-yielding dividend investment. The cyclical nature of funds management may mean this is not a ‘set and forget’ bottom-drawer DGI investment. However, the future is looking bright with GQG.

For more on Dividend Growth Investing, see my recent article that outlines the screener approach being used here.