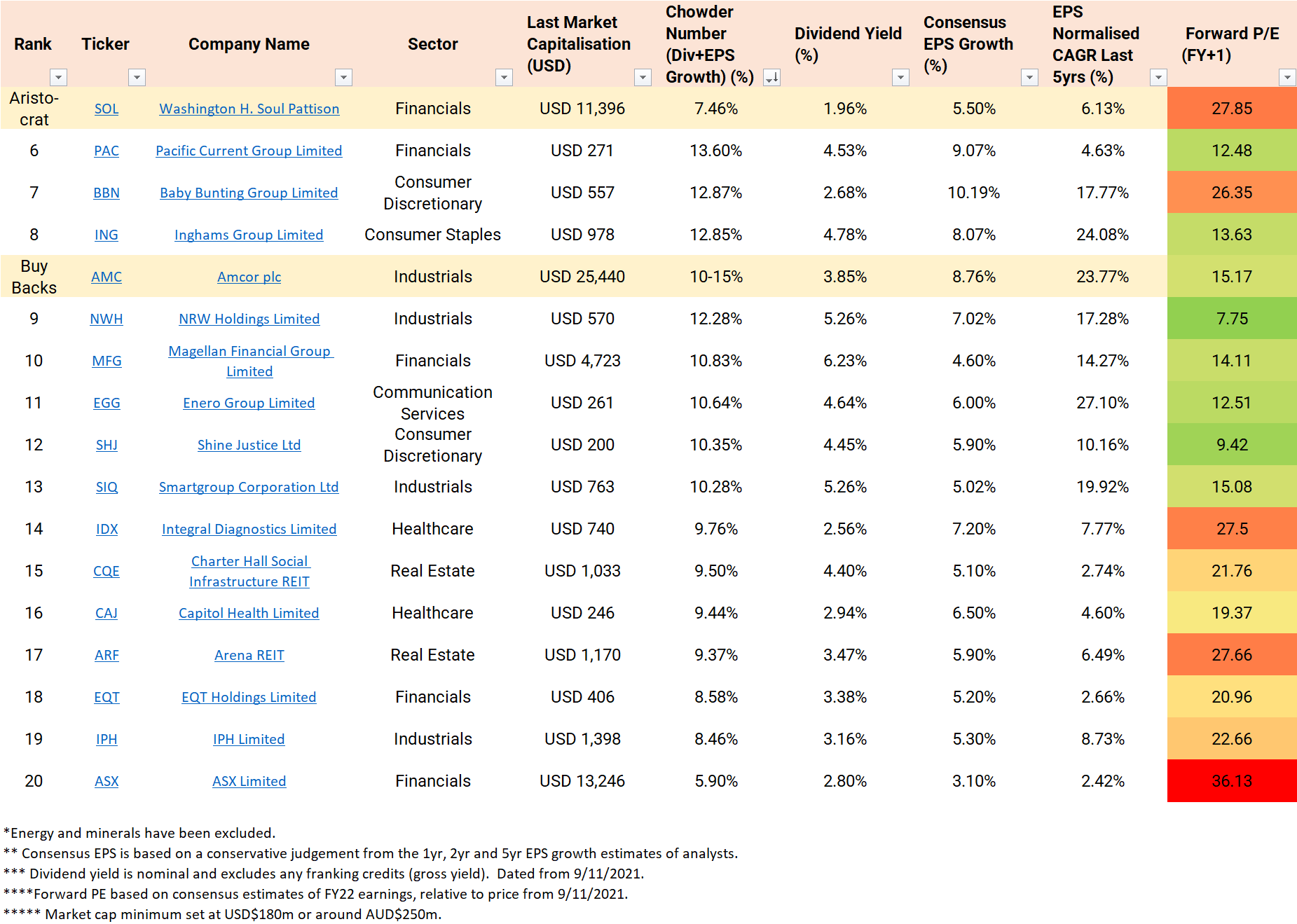

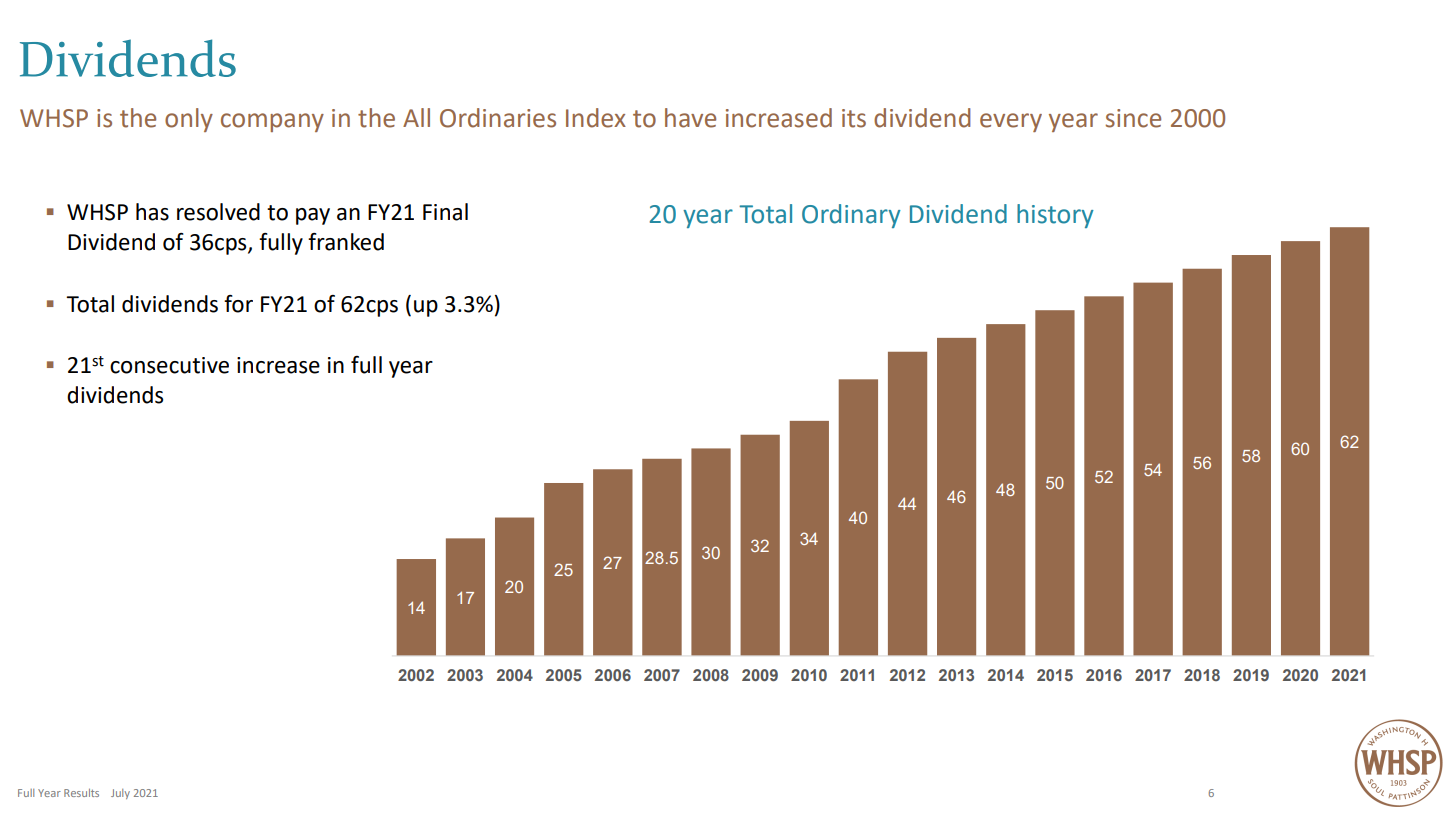

Washington H. Soul Pattinson (ASX: SOL) has increased its dividend every year since 2000, the longest dividend growth streak on the ASX. WHSP has a modest yield of 1.96% fully franked dividends or 2.80% gross. Forecast dividend growth is for 5.50% over the coming two years, resulting in a modest yet reliable 7.46% Chowder Number.

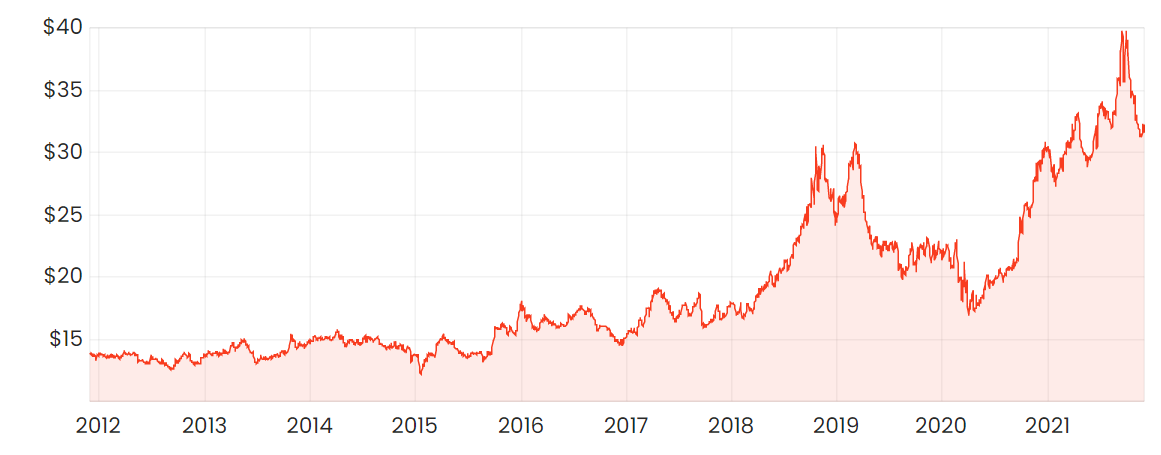

SOL share price

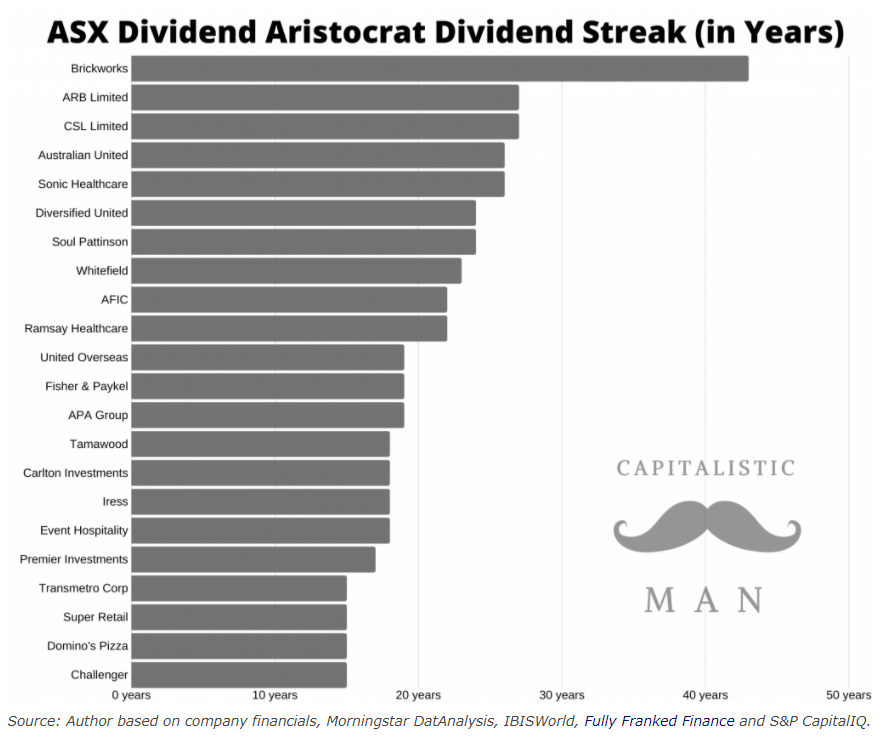

Dividend aristocrats

A dividend aristocrat is a company that has increased its dividends for 25+ consecutive years – while a dividend king is 50+ consecutive years. Only 65 aristocrats and 33 kings have achieved these feats in the US, and none in Australia.

This omission of the ASX is likely due to the largest companies typically being cyclical miners and financials. Capitalistic Man analysed companies that hadn’t reduced their dividends and excluded special dividends. Brickworks (ASX: BKW), ARB Corporation (ASX: ARB) and CSL (ASX: CSL) were the top performers. But being true to the definition, the longest dividend growth streak is 21 years from WHSP – almost a Dividend Aristocrat.

History of WHSP

Caleb Soul and his son Washington opened a pharmacy in Sydney in 1872. After 30 years of trading success, they listed on the Sydney Stock Exchange in 1903. WHSP is the second oldest company on the ASX – with BHP (ASX: BHP) listing in 1885.

Robert Millner is the Chair of WHSP, Brickworks, New Hope Corporation (ASX: NHC), and more. He is widely regarded as a doyen of Australian business, likening himself to Warren Buffett. That’s a big call. But read the WHSP annual reports and listen to Millner’s interviews, and you will see some similarities in their investment philosophies.

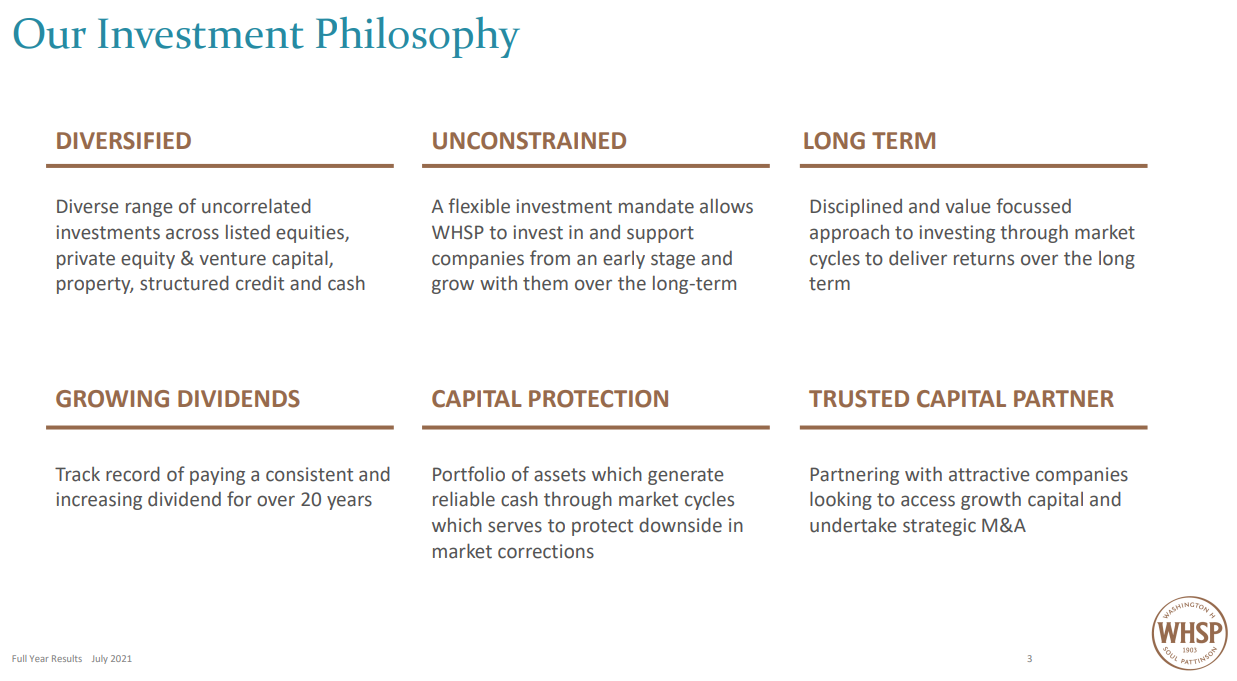

What does WHSP do?

WHSP’s origins as a pharmacy were spun off into Australian Pharmaceutical Industries (ASX: API), while WHSP became a diversified investment house. WHSP invests in a variety of industries such as construction, resources and telecommunications.

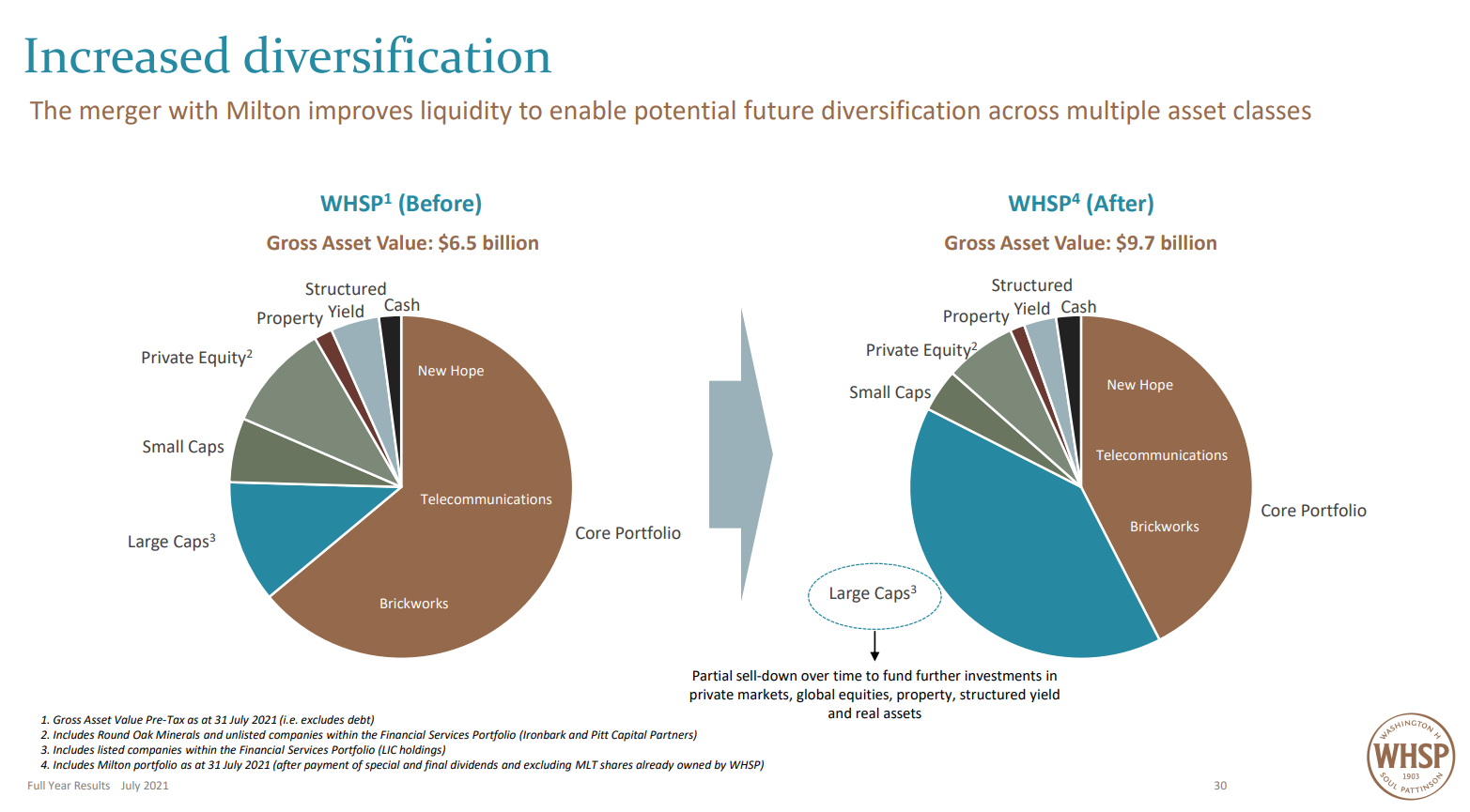

The recent merger with Milton LIC expands the total portfolio to ~$10 billion. Strategically, this increases their exposure to large caps on the ASX. In the long-term, WHSP will aim to redeploy this capital to alternative asset classes and megatrends.

WHSP’s current dividends

WHSP is committed to the dividend and has increased it for 21 years straight. This has grown at an impressive 7.34% CAGR.

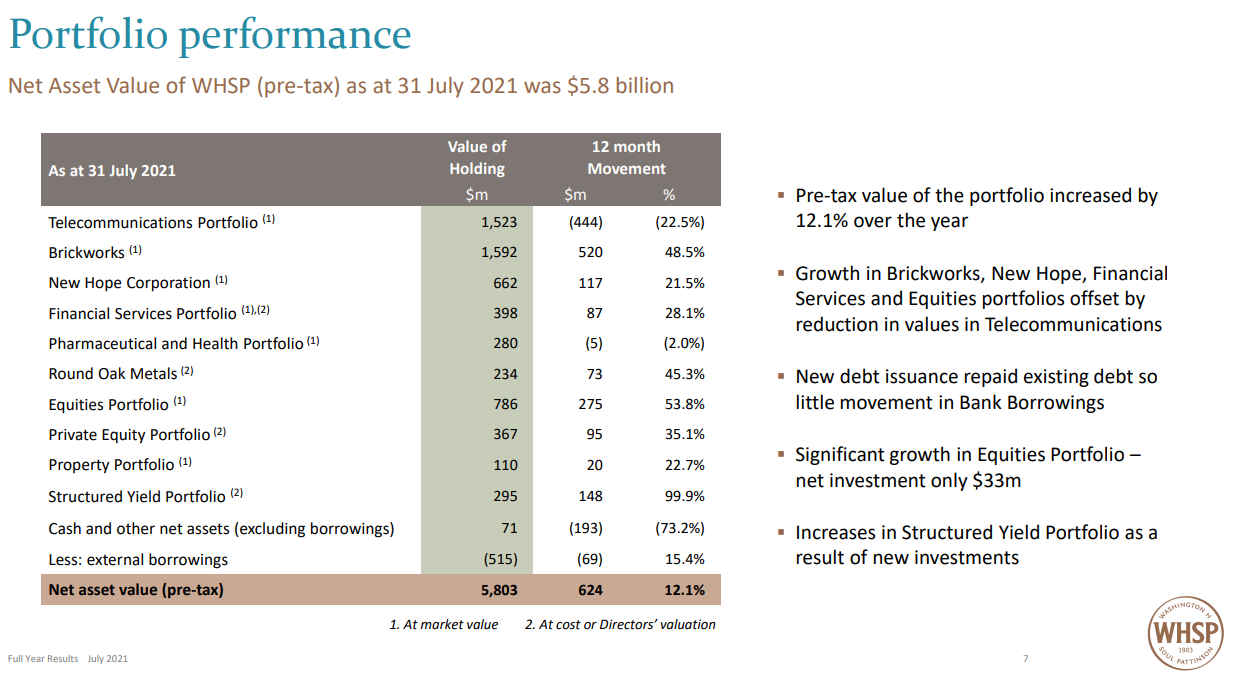

WHSP reported total shareholder returns of 13.4% CAGR over 20 years, including significant price multiple expansion. This is not sustainable, which is why I prefer book value for WHSP. Over the past five years, book value has compounded at 6.13%, which I have included in the summary table.

Looking to forward returns

Analysts are expecting dividend growth of 5.5% in the near term. I have included this as a substitute for earnings per share (EPS) growth in the Chowder Number calculations.

Valuation

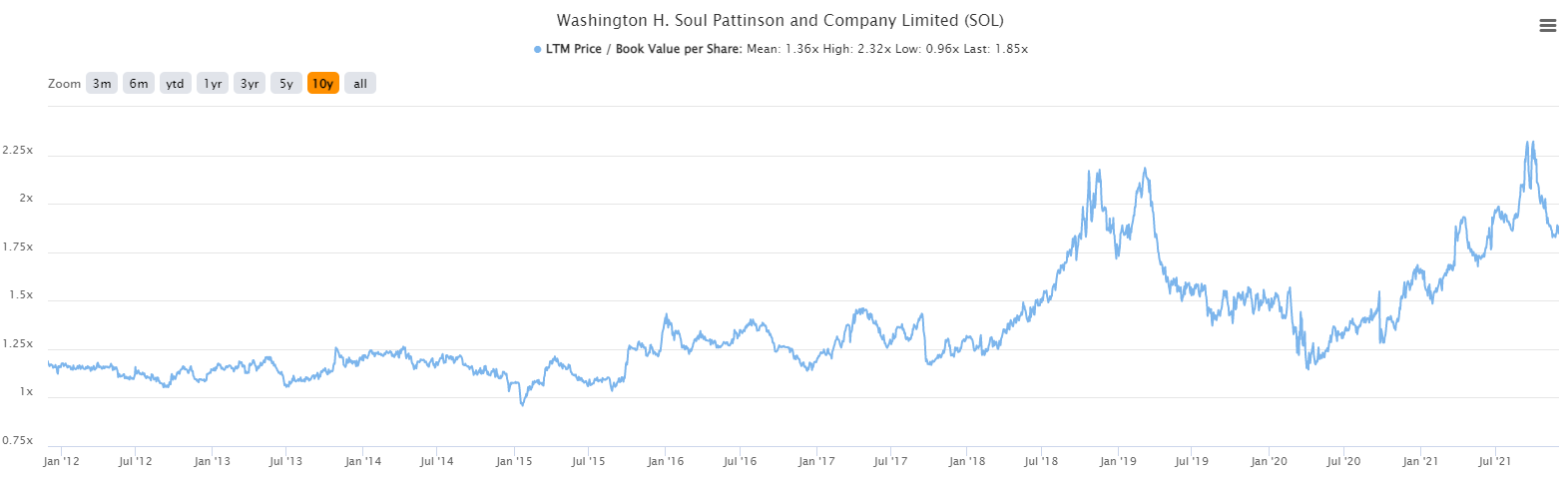

WHSP is trading at ~1.85x book value. While the share price has come back from ~$39 in September to ~$31 today, the price to book value is still well above the average of 1.36x.

A rule of thumb for some is to invest when the price to book value approaches 1.2x, similar to Berkshire Hathaway (NYSE: BRK.A). March 2020 was the trigger for that.

Risks

Capital allocation has been very impressive. The risk that Millner steps down is probably high, though it’s likely that the strategic focus will not change. In the short term, the major risk is valuation.

Final thoughts

WHSP and Millner missed some opportunities in March 2020 to deploy capital. However, the long-term focus and the emphasis on dividend growth help investors sleep easy. One for the watchlist.

For more on Dividend Growth Investing, see my recent article that outlines the screener approach being used here.