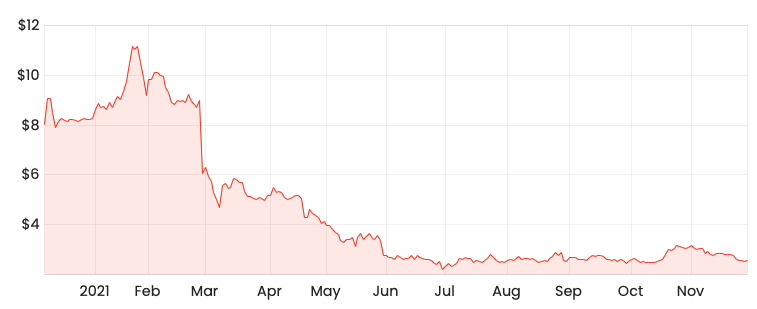

The Nuix Ltd (ASX: NXL) share price is sliding further into the red this morning after the company provided a disappointing trading update at its first annual general meeting (AGM) as a public company.

Subsequently, the Nuix share price finished the day down 12.30% to $2.24.

Nuix is an investigative technology business that helps governments convert big data sets into actionable insights. However, it’s been under its own investigations since its 2020 IPO leading to a share price capitulation over 2021.

NXL share price

Another day, another disappointment

It’s not quite a downgrade since it hasn’t given any guidance for FY22. Still, Nuix is tracking behind its FY21 results, which in turn was a disappointment on FY20.

In the first four months (July – October) of FY22 Nuix achieved:

- Statutory revenue up 10% year on-on-year (YoY)

- Annualised contract value (ACV) flat YoY

- New customer revenue 40% lower YoY

- EBITDA down 27% YoY

- Net cash of $57 million

Nuix re-signed a big advisory client in addition to other deals leading to a 10% jump in statutory revenue.

However, because of Nuix’s accounting, this result is somewhat misleading.

ACV – which strips the lumpiness of multi-year deals – remained flat as new customer revenue dropped 40%.

In what looks like a response to the declining new customer revenue, the business will sacrifice near-term earnings to expand its sales teams.

Additionally, it is facing higher labour costs to retain engineering talent and incurring $4 million in legal costs relating to two-class actions and the corporate regulator investigation.

Subsequently, EBITDA dropped as the cost base ballooned.

Nuix signs many of its deals in December and June each year therefore the four-month trading update is not necessarily predictive of the remainder of FY22.

Two years of low growth

The positive for Nuix is that despite all the external noise around the business, the core Nuix engine product remains intact.

Net revenue retention – a measure of how much customers spend in one year compared to the prior period – remains at 97.5% or 102.6% in constant currency.

Additionally, churn remains low at 3.6%, inferring current customers remain happy with the service.

Nonetheless, the business looks set to record a second consecutive year of low growth, a far cry from the original hype around the business when it floated.

My take

As an investor, Nuix is a frustrating case study in a good business overshadowed by mismanagement.

From all reports – financial and anecdotal, the Nuix engine is a world-class product.

With new CEO Jonathan Rubinzstein set to begin next week, further disappointing news could be on the horizon as he resets market expectations.

Can the Nuix share price revive? It’s yet to be seen.