Embattled wealth incumbent AMP Ltd (ASX: AMP) has provided an update on its demerger plans as it prepares to spin off its Capital Markets division into a separately listed company.

The market has reacted favourably to the news, with the AMP share price up 5.47% to $1.06.

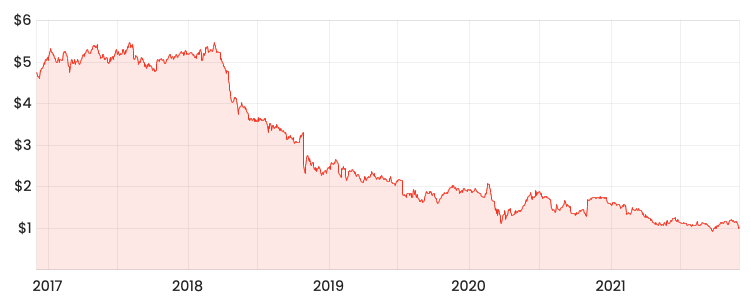

AMP share price

Split set for June 2022

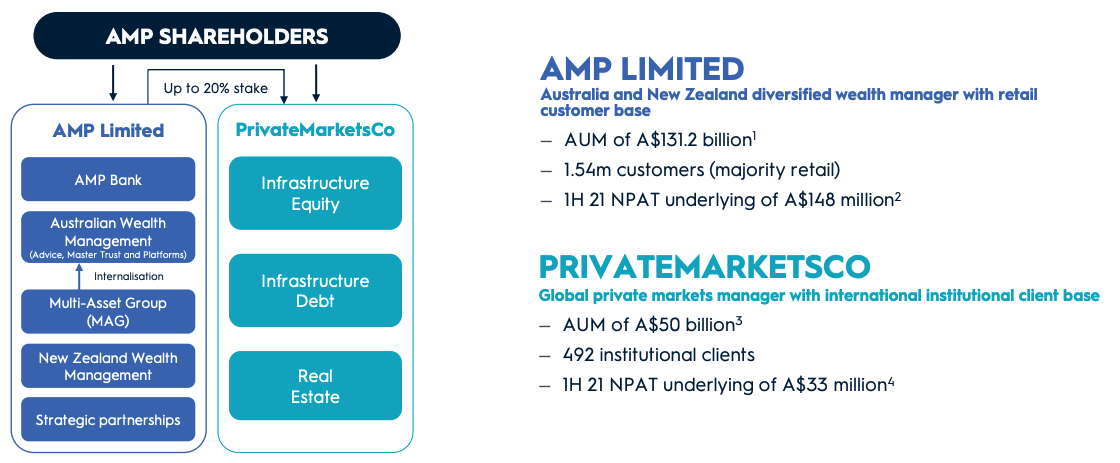

The business will be split into two, with separated listed companies on the ASX:

- AMP Limited

- AMP Capital Private Markets business (PrivateMarketsCo)

The current listing – AMP Limited, will house AMP Bank, Wealth Management and strategic partnerships.

Additionally, the global equities and fixed income (GEFI) and multi-asset group (MAG) teams will be transferred to AMP Limited.

AMP has previously announced GEFI would be sold to Macquarie Group Ltd (ASX: MQG) by year-end.

Meanwhile, the new listing – AMP Capital, will house the asset management divisions including infrastructure equity, infrastructure debt and real estate.

It’s a clear distinction for AMP Capital, allowing it to promote itself as a capital-light fund manager of institutional capital similar to that of Magellan Financial Group Ltd (ASX: MFG) or GQG Partners Inc. (ASX: GQG).

“In AMP Limited and PrivateMarketCo we have two business with considerable growth opportunities, but which operate in very different markets, with different customers, and geographic focus. Separation and demerger will enable both businesses to accelerate their growth strategies, as well as simplify and improve efficiency” – AMP Chief Executive Alexis George

The demerger is expected to be completed for the first half of FY22 (January to June) while the two entities will begin operating separately from the start of 2022.

Shareholders will be able to vote on the proposal in May 2022.

My take

The split of AMP Capital is a smart move.

AMP needed to slim down and demonstrate to the market the underlying value of its divisions.

Personally, I wouldn’t be surprised if further divisions were spun off. For example, AMP Bank could be sold to enable the business to focus solely on wealth advice.

Nonetheless, it’s a positive for shareholders who have seen the AMP share price plummet 80% over the past five years.

If you enjoyed this guide, consider signing up for a free Rask account and accessing our full stock reports.