Aussie Broadband Ltd (ASX: ABB) today announced it has agreed to purchase Over The Wire Holdings Ltd (ASX: OTW) for $5.75 per share via a scheme of arrangement.

The OTW board has unanimously recommended the takeover and will vote their respective interests in favour of the scheme.

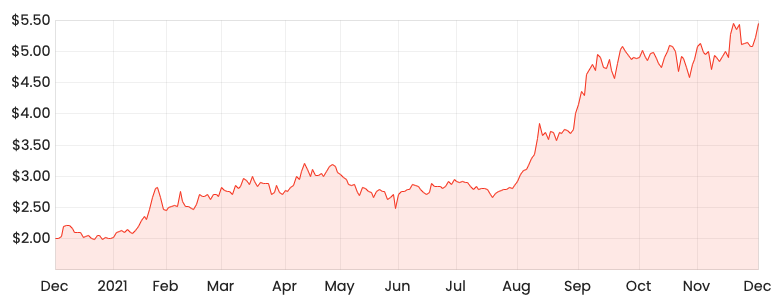

Subsequently, the OTW share price has risen 5.56% to $5.70 as a result of the deal.

Conversely, the ABB share price has fallen 3.67% to $5.25 today.

Let’s unpack the details of the acquisition and what it means for both companies.

OTW share price

ABB share price

Sign, sealed and delivered

Aussie Broadband’s offer of $5.75 per share was originally revealed on October 22.

After discussions between the two companies, both have agreed to the $5.75 price tag.

Notably, the proposal is just a 15% premium to OTW’s undisturbed share price.

On a valuation basis, the deal values OTW on an EBITDA multiple of 11.8 based on guidance of $33 million.

In total, Aussie Broadband will purchase OTW for $344 million with a combination of cash and shares.

As part of the acquisition co-founder, Managing Director and Chief Executive Michael Omeros will join the Aussie Broadband role.

Shareholders will be able to vote on the deal in the first quarter of 2022.

Mix and match

OTW shareholders will receive $5.75 per share in either cash, Aussie Broadband shares or a combination of both.

The default option will be $4.60 in cash (80%) and 0.23 Aussie Broadband shares for every 1.00 OTW share owned (20%).

The deal assumes an Aussie Broadband share price of $5.00 per share.

Greater scale brings better margins

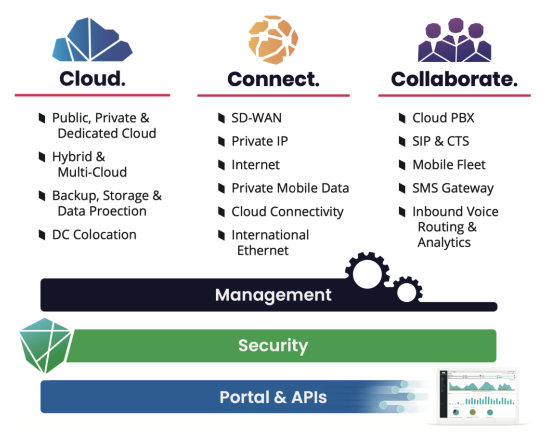

OTW is an enterprise and government telco providing voice, cloud and security services.

OTW will share in the benefits of a bigger telecommunication entity. The combined business expects to achieve $8 to $12 million in annual cost synergies.

It will also be able to leverage Aussie Broadband’s extensive fibre network and internal billing and customer management software.

Aussie Broadband expands into enterprise

Management has flagged for some time its ambitions to accelerate growth via acquisition and expand into managed services.

Fortunately, it’s landed two birds with one stone by acquiring Over The Wire.

Aussie Broadband will be able to introduce new enterprise solutions to its existing customer cohort.

It will also no longer need to rely on third-party voice carriers, bringing this in-house under the OTW network.

Furthermore, it will be able to leverage OTW knowledge of the industry to gain a stronger foothold in the lucrative cloud and hosting market.

Finally, from day one the deal will be earnings accretive.

My take

Surprisingly, OTW didn’t request a bigger takeover premium, especially given it was Aussie Broadband’s only offer.

But it looks to be a sound deal for both entities.

A majority of the deal is priced in shares, making both sides aligned in the success of one another.

If you enjoyed this analysis, consider signing up for a free Rask account and accessing our full stock reports.