Hey there! We’re trying something new at Rask Media. It’s called the Rask bulls vs bears club.

Each Friday, two writers will provide the bull and bear case for a popular company our readers are interested in.

Please feel free to send us your feedback or any companies you’d be interested in hearing about. We’re here to serve you, so don’t be shy!

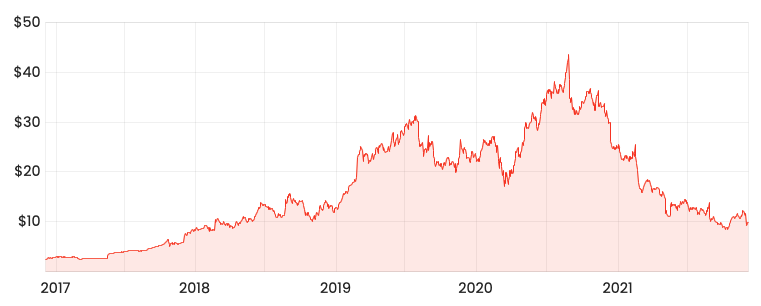

The Appen Ltd (ASX: APX) share price has sunk nearly 80% from its highs in 2020 to now rest at $9.81.

Multiple guidance downgrades, bearish analysts reports and shifting customer priorities have presented major challenges for the business.

Despite the share price fall, the selling could be potentially overdone. Here, I’ll be presenting the bull case and it might not all be bad for Appen.

APX share price

Reframing the story

The author of Sapiens: A Brief History of Humankind, Yuval Noah Harari noted the world as we know it is essentially just a collection of stories:

“Humans think in stories, and we try to make sense of the world by telling stories”

Appen’s story was a fast-growing business mission-critical to powering the world’s biggest companies’ artificial intelligence (AI) projects.

This was supported by the rapid rise in revenue, from $82 million in 2015 to $599 million in 2020.

Subsequently, the Appen share price rocketed (as shown above) as everyone wanted a slice of the action.

But when big tech reallocated budgets elsewhere, sales fell, guidance was cut and the market panicked.

Reframing the Appen story another way: Appen is reliant on a small number of global tech giants wanting to outsource largely one-off labour-intensive tasks.

Both stories are correct. But the framing is different.

Mr Market is a fickle beast. Appen’s narrative changed, and the market reacted accordingly.

Not nearly as bad you think

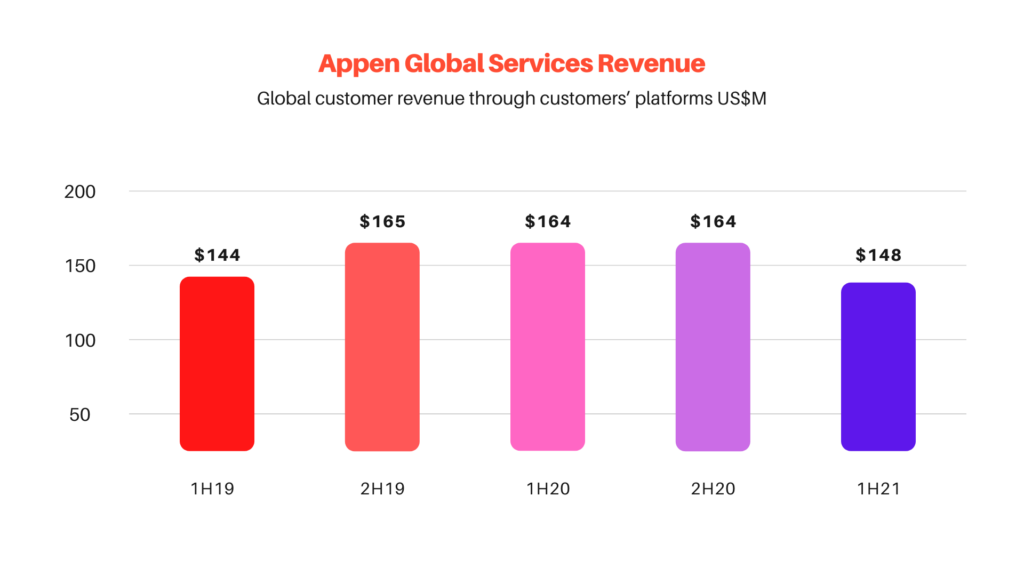

The reallocation of big tech budgets is not nearly as bad as suggested in the share price.

Global services dipped just 9.2% in the most recent half.

Sure, Appen is at the mercy of the tech giants and their AI budgets.

But this has always been a risk and one that should be baked into any valuation of the business.

Positively, the data annotation (Appen’s bread and butter) industry is expected to grow at 25% per annum over the next five years.

AI is not just reserved for big tech, with many companies from e-commerce through to logistics searching for AI data.

Derisking through diversification

To counter the concentration of its revenue and customer base, Appen has recently taken steps to diversify its revenue base.

New markets such as China have become a bigger focus, in addition to Enterprise and Government applications.

Additionally, the business has recently expanded in location analytics through the acquisition of Quadrant.

Albeit of a smaller base, new markets revenue increased 31.5% to $47.8 million in the last half.

My take

No doubt the Appen share price got ahead of itself in 2020. But it’s unfair to blame management entirely.

The market got hot, everyone jumped on and then the story changed.

Admittedly, management could have done a better job diversifying earlier. It also should have forewarned the earnings drop-off earlier and more clearly.

But for a business trading on an EBITDA multiple of just 15, Appen presents compelling value if management can execute.

To get both sides of the debate, don’t forget to check out Valuedownunder’s bear case for Appen shares on Monday.