Howdy Folks! We’re trying something new at Rask Media. It’s called Rask bulls vs bears club. Two writers will provide the bull and bear case for a popular company our readers are interested in

On Friday you would have seen the Appen bull case from Lachlan. The bear case I put forward here was written at the same time.

Please feel free to send us your feedback or any companies you’d be interested in hearing about. We’re here to serve you, so don’t be shy!

You’re going to hear from Appen (ASX: APX) bulls that artificial intelligence (AI) is the future. You’re going to hear from those same bulls that the share price in Appen has fallen so far, you can’t lose from here. Well, today I’m going to give you three reasons I’m bearish on Appen – and why the current bet doesn’t provide a good risk-reward opportunity for investors.

Buffett says short the horses

It’s true, AI is the future. AI is going to improve our health outcomes, for example with improved cancer screening through the likes of Volpara (ASX: VHT). AI will improve the environment, for example through better monitoring through the likes of Envirosuite (ASX: EVS). AI is already improving our internet experience, with better-targeted advertising from Meta a.k.a. Facebook (NASDAQ: FB) and better search from Google (NASDAQ: GOOG).

However, being in a winning industry doesn’t make for a winning investment. In the early 20th century, it was clear that the horse was going to be displaced by the automobile. Since then, there have been over 3,000 car makers in the U.S., and only a handful exist today.

As Warren Buffett said, “what you really should have done in 1905 or so, when you say what was going to happen with auto is, you should have gone short horses”. It’s easy to figure out the loser in legacy industries, but the winner was the auto industry, not any specific car maker.

To adopt a winning strategy, one needs a venture capitalist approach like Softbank (TYO: 9984). They account for almost 10% of AI seed funding, with over 380 investments seeking out the next unicorn or golden egg such as Nvidia or Arm.

Appen is the Airtasker for FAANGS

Even if AI is the future, Appen is not an AI company. As my esteemed colleague, Lachlan quipped, “Appen is the Airtasker for FAANGs”. Appen “makes most of its money in the US from crowdsourcing a global workforce that does the low-level grunt work for the technology giants”.

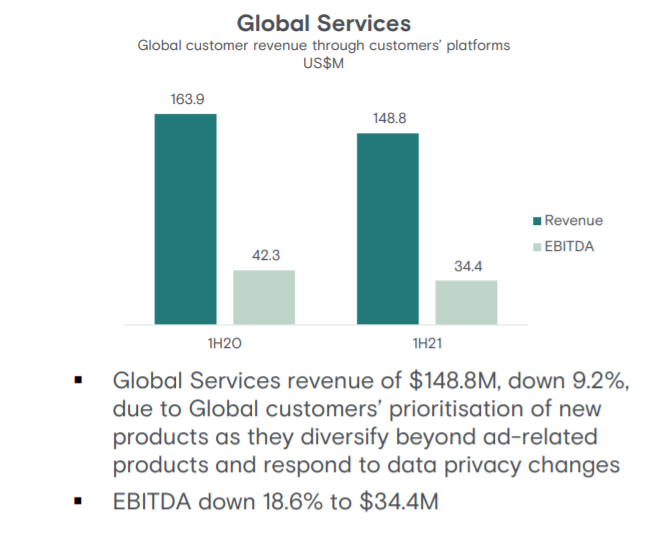

Approximately ~75% of their revenue is from data collection, cleaning, and annotation for the major US technology customers (FAANG). Bulls will tell you that they have new emerging markets including China or virtual reality. And while that’s true, they require 3% growth in new markets to replace each 1% lost in their core business.

Picks and shovels can also be disrupted

Appen is a pick-and-shovel investment. As Mark Twain said, “When everyone is looking for gold, it’s a good time to be in the pick and shovel business”. Though eventually picks and shovels were replaced by drills.

There are two major risks for Appen’s business. First, the FAANG may in-source the data process. They have the cash, though have previously not wanted the hassle. If there is a ‘secret sauce’ they can create, or if they can improve the quality, then players such as Google and Facebook would consider in-sourcing these tasks.

Secondly, the AI of the future may not need these data solutions. Indeed, at some point en route to the AI singularity in the Matrix, The Architect was cleaning its own data.

Lynch’s warns of a halving

Bulls will tell you that Appen has already fallen 80%, how much further can it go? Well as Peter Lynch understood, “a stock that’s fallen 90% is a stock that’s fallen 80%, then halved”.

The valuations are still not asymmetric. A price to free cash flow of 16x is reasonable for a growing business. A forward price to earnings

ratio of ~21x is not enough to entice a ‘Buy’. And a 1% dividend yield is not going to fund your retirement.

There is nothing to suggest the bottom is in. Paper-hand Appen shareholders sold the stock down 25% this week when Macquarie put out their underperform rating. Paper-hand directors have been no different since early 2020.

Final thoughts

It’s difficult to get excited by Appen at the moment. The company is in a downgrade cycle, and further pain may be on the horizon. I’ll happily wait on the sidelines from here.