Kogan.com Ltd (ASX: KGN) might just be the most divisive company on the ASX.

Bulls will point to its rapid historical growth and passionate founder Ruslan Kogan.

Conversely, bears argue it’s a poor man’s Amazon, with a raft of competition, no real competitive advantage with a share price that’s fallen 60% in 2021.

Independent of the bull and bear cases, here are three reasons I’m avoiding shares for now.

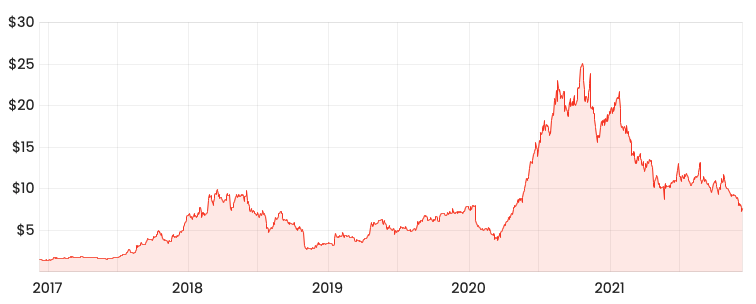

KGN 1-year share price

KGN 5-year share price

1. Lack of focus

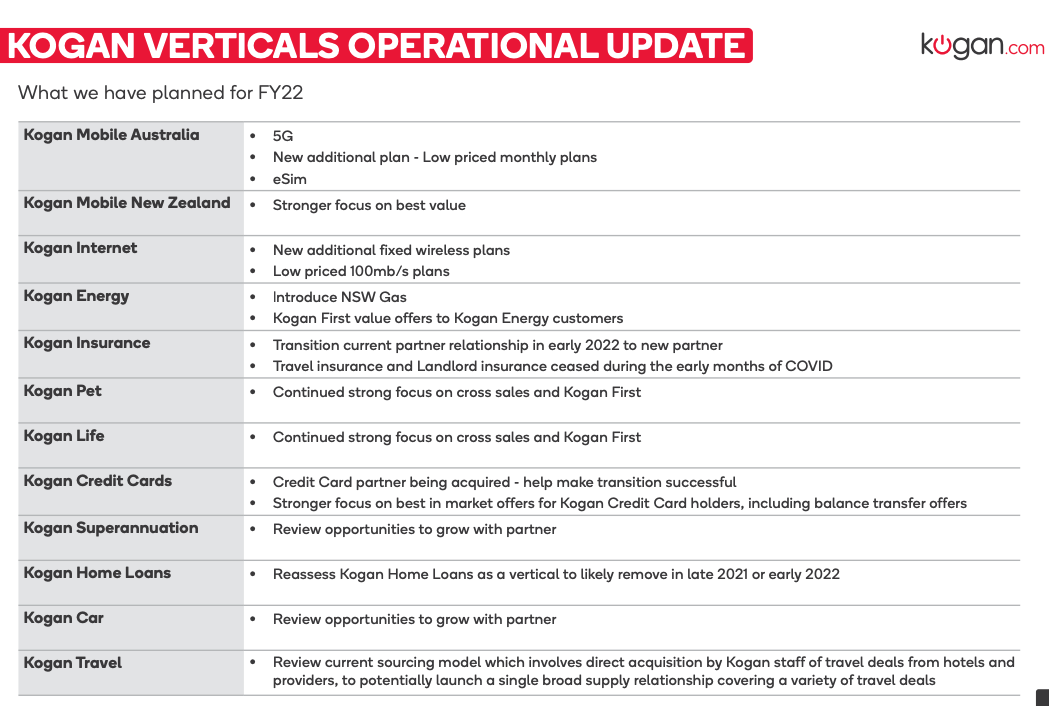

At its most recent annual general meeting, Kogan outlined its ambitions for the coming year.

In addition to its e-commerce site, Kogan is expanding or launching mobile, internet, energy, insurance, pet, life, credit, superannuation, home loans, car and travel products.

While it’s great to see a business set ambitious targets, how does Kogan expect to achieve all of this within one year?

A business can’t be everything to everyone. However, Kogan seems to lack focus on what it does best: provide a competitive e-commerce experience.

The lack of focus potentially led to the inventory issues, which have plagued profits and the share price throughout 2021.

Personally, I prefer to see a business doing one or two things really well, rather than doing many things with mediocrity.

2. Reporting metrics

To confess from the start, Kogan is not the only business guilty of poor disclosure.

However, in its most recent annual report, the business quoted “Adjusted EBITDA” as a proxy for earnings.

Let’s delve into what adjusted EBITDA actually adjusts for:

- Interest – $0.3 million

- Tax – $7.7 million

- Depreciation & amortisation – $10.9 million

- Unrealised FX gain/(loss) – $1.4 million

- Equity-based compensation – $15.6 million

- Donations – $2.5 million

- COVID-19 stock provisions – $2.2 million

- COVID-19 logistic costs – $7.7 million

- People costs – $12.0 million

- Other costs – $0.8 million

While I concur many of these costs are one-off or non-cash, there are also many that directly reduce shareholder’s profit.

3. Governance

It’s been well covered publicly the 6 million in equity options granted to CEO Mr Kogan and CFO/COO David Shafer.

Put simply, the two were issued options to incentivise them to stay with the business until 2023. No revenue or profitability hurdles. Just stick around.

Even more bewildering, the options were issued at market lows from February to April 2020.

This kind of shareholder dilution is non-negotiable for me.

I sympathise with the concept. Provide equity to keep management motivated.

But the structure of this options package put a red line through Kogan for me.

If you enjoyed this analysis, consider signing up for a free Rask account and accessing our full stock reports.