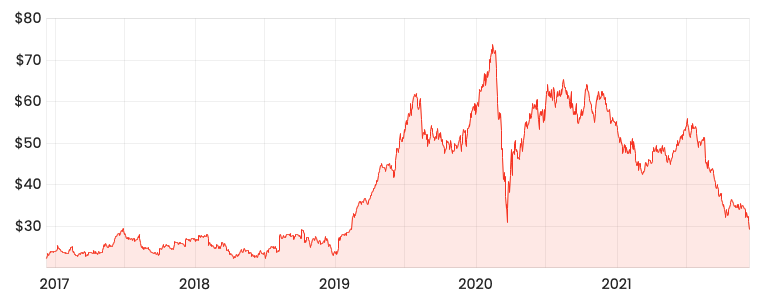

The Magellan Financial Group Ltd (ASX: MFG) share price has taken a beating this week losing 14% of its value.

It’s been an even tougher year for the fund manager, with its share price down 43%.

Is now the time the enter Magellan shares? Or is there further pain ahead for the company?

MFG share price

CEO departs

This week’s dip directly relates to Magellan’s former Chief Executive Officer (CEO).

After trading on Monday, Magellan announced its CEO Brett Cairns would resign for personal reasons.

The release was noticeably short on details given Mr Cairns originally started as a non-executive director in 2007 before joining the management ranks.

External influences

The Australian Financial Review’s Rear Window column revealed that founder, Executive Chairman and Chief Investment Officer Hamish Douglass may have separated from his wife of 30 years.

Mr Douglass owns about 12% of Magellan and has never sold a share in his time at the company.

However given a separation of assets, 6% of the shares could be up for sale in the near future.

While this alone isn’t enough to impact a buy or sell decision, the fact it also doesn’t have a permanent CEO infers potential instability.

Bargain or value trap?

A value trap is when something looks cheap on a valuation basis but may be cheap for a reason.

Magellan is trading on a dividend yield of nearly 7%, which is a lot better than earning next to zero per cent in a bank account.

However, a bear would say that the Magellan has further to fall, and hence a 7% yield is not nearly enough compensation to jump in right now.

What matters

At the end of the day, a fund manager lives and dies on its fund’s performance.

Magellan has underperformed its benchmark by over 20% in the past year, which has subsequently dragged down past performance over three, five and ten year periods.

Unless the business can radically turn around its performance, outflows will continue and potentially snowball as more investors redeem.

Final thoughts

Magellan initial underperformance was something I thought could be turned around and had been misframed by the market.

Additionally, it’s more than simply a fund manager with external investments via Magellan Capital Partners.

However, I’ve come to realise the downside risk of outflows, fee cuts or management reshuffles outweighs any upside over the near term.

For that reason, I’ll be watching Magellan from the sidelines for now.

If you enjoyed this analysis, consider signing up for a free Rask account and accessing our full stock reports.