Despite announcing it had opened stores in all Japan’s 47 regions, the Domino’s Pizza Enterprises Ltd (ASX: DMP) share price has drifted today.

Currently, the share price is down 1.32% to $123.01.

Domino’s Pizza Enterprises owns the rights to franchise and operate stores in Australia, New Zealand, Belgium, France, Taiwan, The Netherlands, Japan, Germany, Luxembourg and Denmark.

If you’re wanting to learn more about Domino’s through the lens of a fund manager, check out Raymond’s interview with Wayne Jones below.

National footprint complete

With the opening of store number 862 and the first in the Shimane prefecture, Domino’s Japan is now the first pizza company with a national footprint.

The company has a long-term ambition to open 2,000 stores across Japan over the next 12 years.

Management has noted that to gain national recognition, quick-service restaurants (QSRs) such as Domino’s need to roll out at least 1,000 stores.

Turnaround on track

It hasn’t all been rosy for Domino’s and Japan. The company for some time failed to resonate with the local Japanese preferences and consumer tastes.

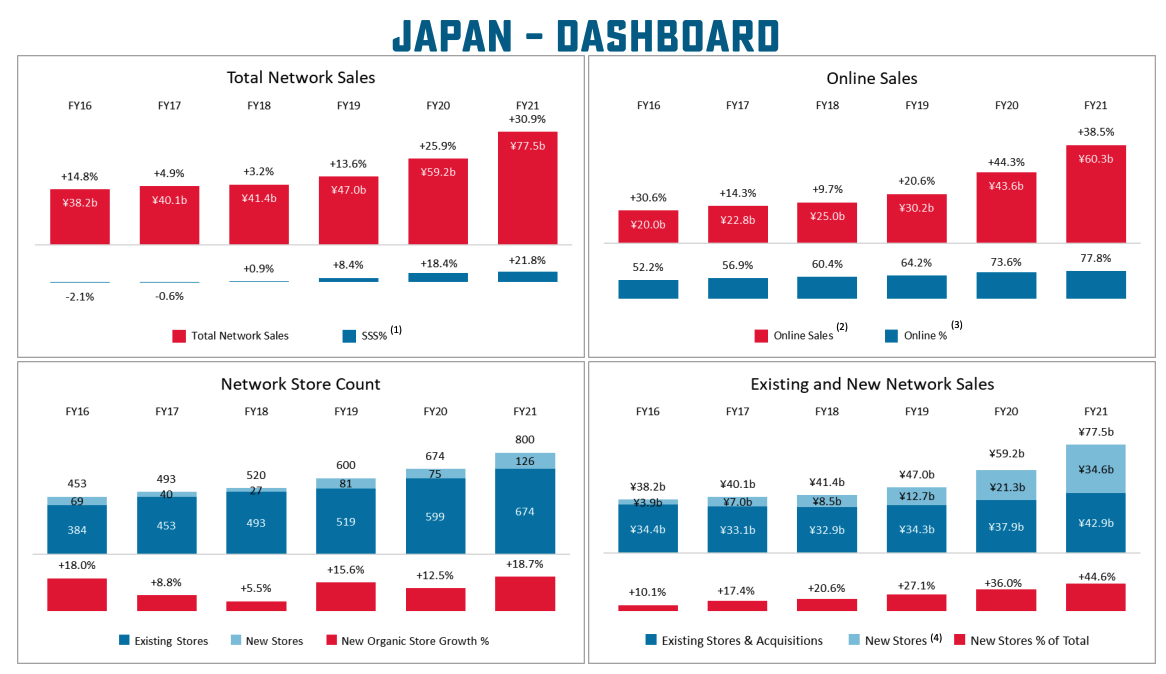

Same-store sales growth was non-existent from FY16 to FY19, requiring management to review its strategy in the region.

Commenting on the turnaround, Group CEO & Managing Director Don Meij said:

“By taking care to understand how to access more customers, to offer value to families and individuals on more occasions, and how we make and distribute our ingredients – we have unlocked tens of millions of new customers, now served through almost 900 stores.

“We have the franchisee base, customer-focused menu, and food distribution model that allows us to access prefectures that were previously inaccessible, reinforcing our confidence in the long-term potential of Japan.”

Is now the time to buy Domino’s shares?

Japan has historically been the problem child for Domino’s.

Even in its most recent trading update sales in Japan had fallen year on year due to pandemic restrictions.

But the company now looks to be firing on all cylinders.

At a free cash flow multiple of 51 or less than a 2% yield, it’s a very expensive business.

But management has shown an ability to execute. Furthermore, its shown when the wind is blowing the other way, it can still turn things around.

Domino’s is definitely one for the watchlist and a business I’d love to own on any pullback.

If you’re looking to learn how to do your own ASX company valuations, take our free share valuation course, which takes you through 6 common share valuation techniques, step by step.

Or try our Beginner Shares Course if you’re just starting out. Both are free.