The New Zealand based EBOS Group Ltd (ASX: EBO) share price is on hold after announcing the acquisition of LifeHealthcare from Pacific Equity Partners for $1.16 billion.

The business will raise up to $742 million to fund the purchase, hence why the share price won’t be moving today.

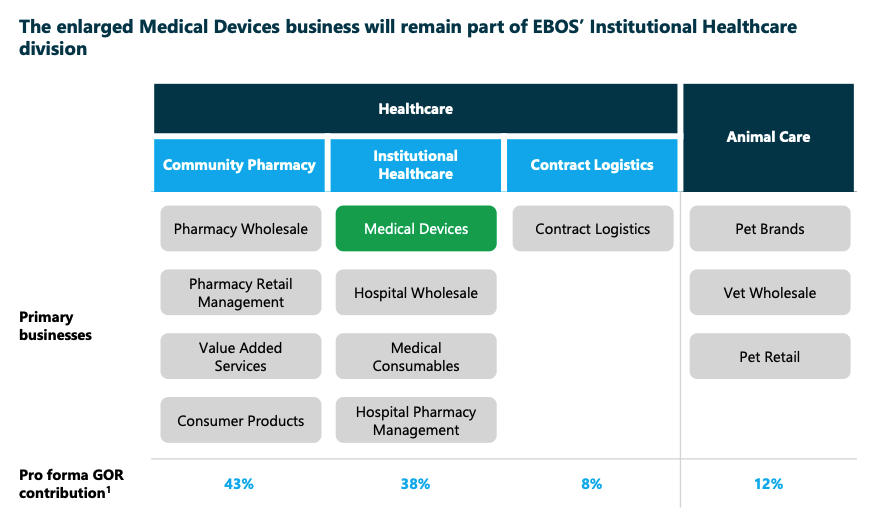

EBOS is the largest wholesaler and distributor of healthcare, medical, animal food and pharmaceutical products across Australasia.

EBO share price

EBOS expands into South-east Asia

LifeHealthcare is a large distributor of third party medical devices across spine, neurosurgery and orthopaedics.

It has over 120 relationships with equipment manufactures, with an average tenure of the top 10 suppliers of 13 years.

Acquiring the business will significantly accelerate EBOS’s exposure to medical devices and provide a gateway into South East Asia.

LifeHealthcare is expected to generate $110-$114 million in EBITDA for 2022, which will add 30% to EBOS earnings before synergies.

The acquisition is EBOS’s 20th over the past ten years, as the company positions itself as a dominant wholesaler in the Asia-Pacific region.

Raising details

The deal for LifeHealthcare will be funded through a combination of cash, debt and equity:

- $100 million non-underwritten retail offer to existing shareholders

- $642 million fully-underwritten placement to eligible institutional investors

- $540 million in new loan facilities

- $23 million in new EBOS shares issued to LifeHealthcare management

Major shareholder Sybos Holdings, which owns 18.9% of EBOS, has agreed to take up its full entitlement.

The new shares will be issued at a 5.5% discount to the EBOS last closing price and represent 11.9% of the existing EBOS shares on issue.

Strong start to FY22

In addition to announcing the purchase of LifeHealthcare, EBOS provided a trading update for the first four months of FY22.

Revenue is up 10.6% across the group led by 14.3% growth in Animal Care.

This has translated into earnings before interest and tax (EBIT) growth of 13.1% and a net profit after tax (NPAT) increase of 14.2%.

Dividends for FY22 are expected to be between 60-80% of NPAT.

Final thoughts

PEP originally purchased LifeHealthcare in 2018 for $179 million. Now it’s selling it to EBOS for $1.16 billion.

Without including any capital injected and acquisitions joined onto LifeHealthcare, that’s a 59% annual return on its purchase.

Regardless of the earnings and synergies EBOS extracts, it looks like PEP has done very well out of this deal.