The Dubber Corp Ltd (ASX: DUB) share price will be on watch today after announcing it has added another telco to its rapidly expanding customer base.

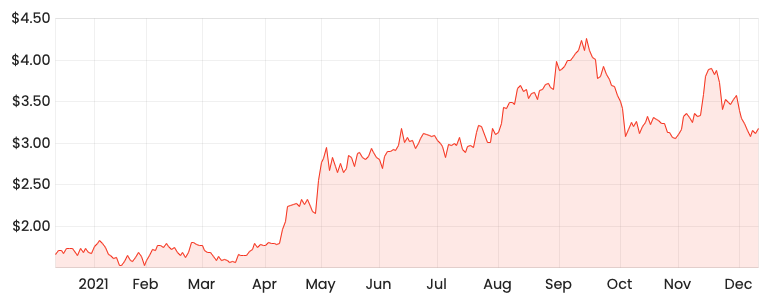

Currently, the Dubber share price is down 0.94% to $3.15.

Dubber provides call recording and data insights across the most popular communication mediums such as Zoom and Microsoft Teams.

DUB share price

Dubber rolled out across Optus

Optus will include Dubber across its Enterprise Services base marketed as Optus Mobile Voice Recording and AI-powered by Dubber.

After an initial testing stage, the service will be rolled out in 2022.

The addition will enable Optus customers to access a cost-effective and complete recording and conversation insights solution across most forms of communication.

Furthermore, Optus customers will be able to access transcripts, sentiment data and search in real-time for every call.

This will aid with broader compliance requirements of Optus customers.

“Through our strategic partnership with Dubber we can now boost our customers productivity, visibility and effectiveness”. – Zorawar Singh, Head of Core Product at Optus Enterprise

Commenting on the partnership, Dubber CEO Steve McGovern said:

“With Dubber at the heart of one Australia’s largest and most critical mobile networks, we are making the native recording available with AI on every participating phone.

“… [this] opens up a significant addressable market, provides a key solution where, historically, there has been a tangible compliance gap”

A foot in the door

The deal is a great foot in the door for Dubber.

Optus is owned by Singtel, a telecommunications conglomerate listed in Singapore.

Singtel owns and operates mobile companies such as:

- Amobee and Trustwave (United States)

- AIS and Intouch (Thailand)

- Airtel (South Africa)

- Globe (Philippines)

- Telkomsel (Indonesia)

- Singtel (Singapore)

Should the Optus integration go smoothly, Dubber could be rolled out across other regions within the Singtel stable.

My take

The lack of price movement in response to today’s announcement isn’t too surprising.

Dubber has been signing up clients left, right and centre over 2021 including AT&T, Cisco and BT.

However, the investment thesis for Dubber is playing out as expected. It continues to add its platform to more and more telcos with the vision of “AI for every phone”.

The platform is becoming increasingly ubiquitous and validated by several new partner announcements.

If you enjoyed this comparison, consider signing up for a free Rask account and accessing our full stock reports.