You’re going to hear from Flight Centre Travel Group Ltd (ASX: FLT) bears that people won’t fly as often as they used to. You’re going to hear that the profitable corporate segment won’t bounce back to pre-Covid levels. You’re going to hear that the bricks-and-mortar travel industry will be eaten by low-cost digital platforms. Well today, I’m going to outline why I’m bullish on Flight Centre. Let’s take off.

Not an airline

Airline industries have terrible unit economics. They require vast amounts of capital and then provide poor returns in a highly competitive environment. Warren Buffett famously said he’d never invest in an airline, though twice he forgot to call his emergency hotline and lost billions.

When bears say the airline industry will never be the same, they may be right. But Flight Centre is not an airline.

Flight Centre ‘clips the ticket’ on travel. In addition to providing excellent advice, they arrange the flights, transport, hotels, and any other needs. They have multiple brands tailored to clients’ needs such as Corporate Traveller, FCM, BYOJet.com, StudentUniverse, MyHoliday as well as the bricks-and-mortar Flight Centre. The holistic and targeted service they provide is why customers rank Flight Centre as #1 in their segments.

Corporate strength

Before Covid, in FY19, corporate travel accounted for ~37% of total transaction values (TTV). Being the #1 brand and having scale gives them an advantage. Even if corporate travel never fully returns to pre-Covid levels, this may benefit Flight Centre. The weak wither, and the strong survive.

In the first half of 2021, corporate travel was back to 47% of pre-Covid TTV. They have been winning new clients and have an excellent 98.5% retention rate. Its possible Flight Centre will end up with a larger share of a smaller pie.

Leisure is an opportunity, not a threat

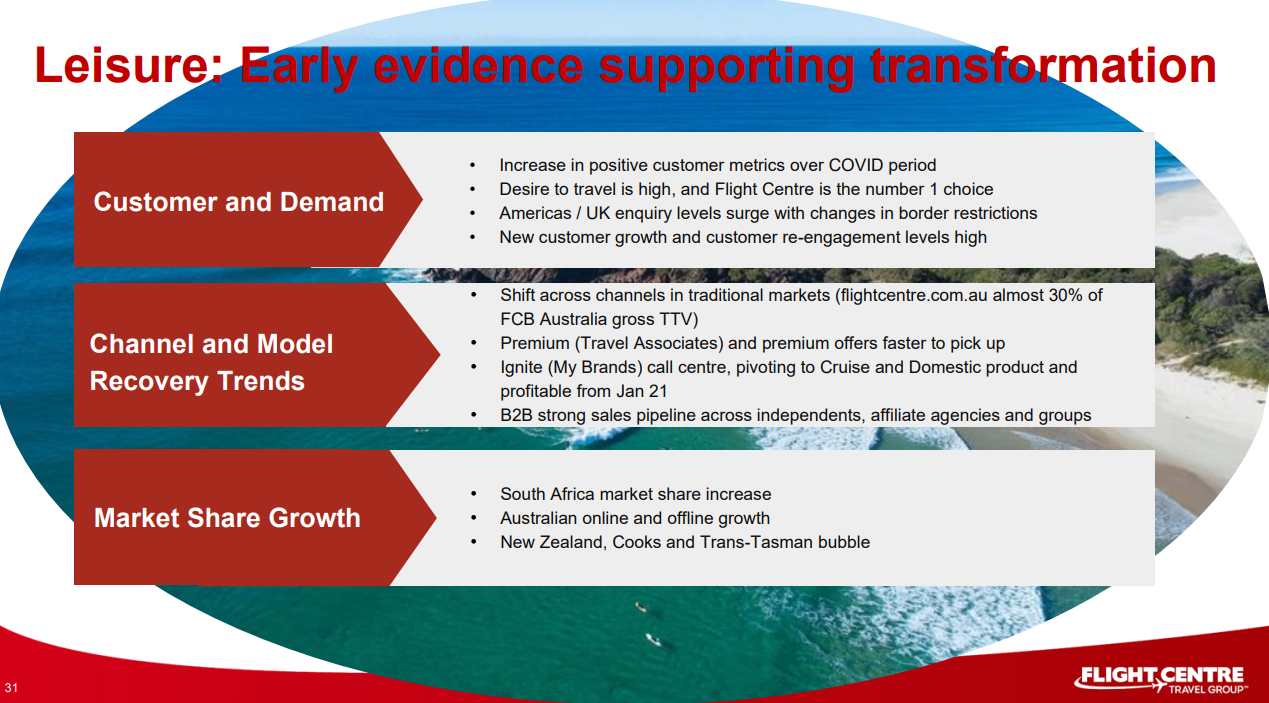

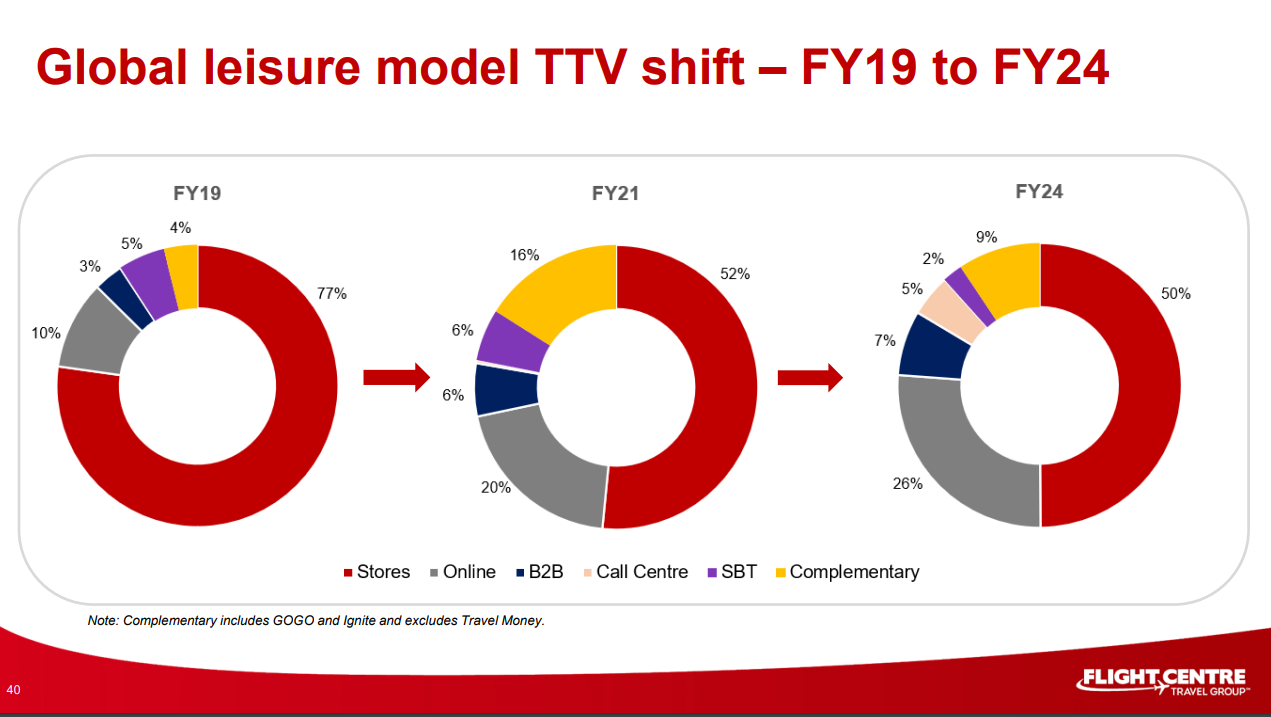

The mainstay for Flight Centre is Leisure & Other, which accounts for ~63% of TTV. There is significant pent-up demand – as lockdowns have ended, borders have opened, people have travelled again.

Source: Flight Centre Investor Presentation, 2021.

Flight Centre’s strategy has been to grow market share in the leisure market and position themselves for the recovery. They have increased their bricks-and-mortar market share by 2% since Covid, albeit the market is temporarily still inhibited. The online channel that was supposed to disrupt Flight Centre? Well, they increased their online market share by 8% in Australia since Covid. The strong get stronger.

Spawning into new verticals

Airbnb Inc (NASDAQ: ABNB) started as a short-term accommodation rental company. Now, people are finding accommodation to work from home, and they’re booking experiences in the cities they travel to. Spawning into new verticals significantly increases the total addressable market.

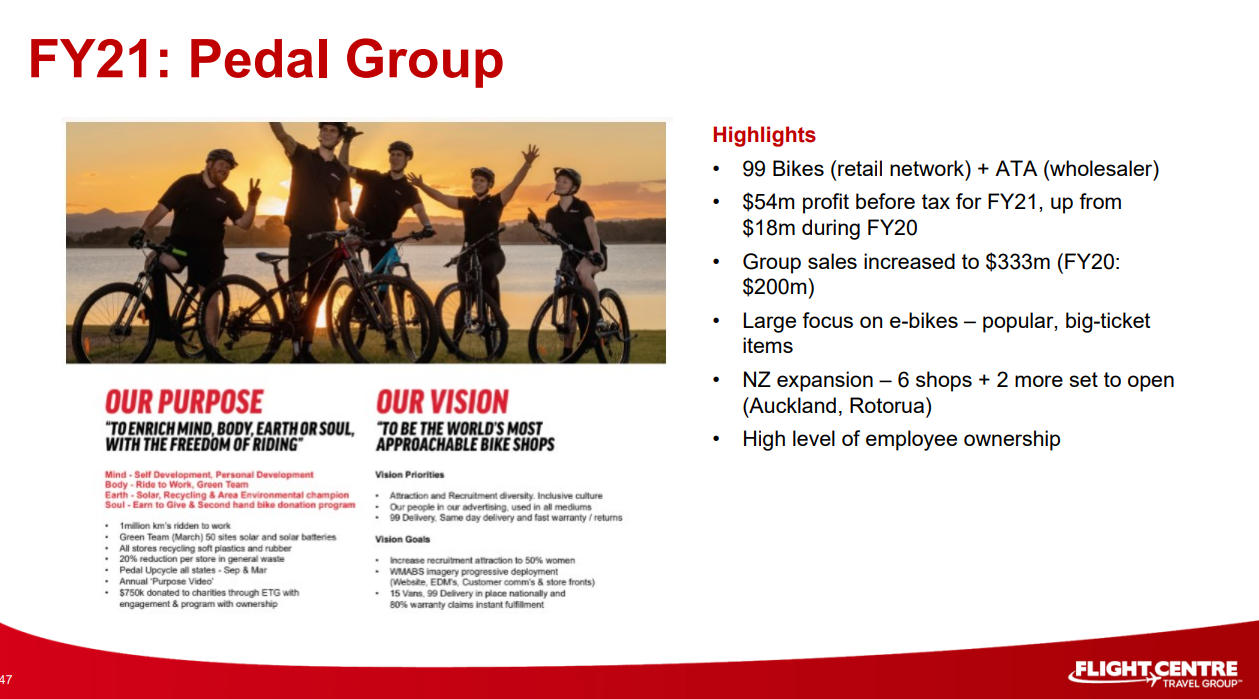

Similarly, Flight Centre is expanding into new verticals. People are booking a wider range of experiences through Flight Centre; they have new partnerships with hotels in Japan, and they own half of Pedal Group, which retails and wholesales bicycles. They’re finding new pathways to win.

Back the Skroo

Winners keep on winning. And backing the right management team is crucial if you are looking for compounders that’ll keep on winning.

Graham “Skroo” Turner in the 1970s started a bus touring company called Top Deck Travel. In the 1980s this pivoted to become Flight Centre. Way back when Ansett, Trans Australian Airlines, and Qantas Airways Limited (ASX: QAN) were the major players. During these formative years, Skroo says that they learned the basic principles of business and developed an understanding of how people wanted to work and belong.

From there, they pivoted to focusing on flight-based travel. Then they added: Cruise ships. Student travel. Corporate travel. Experiences. And in 2015, they pivoted to online travel, buying a 70% stake in BYOtravel and then creating the Aunt Betty brand. Through the busts and booms of the airline industry, Skroo and his colleagues have found a way to win.

Throughout all these twists and turns, Flight Centre found ways to make money. From 1999 to 2019 (pre-Covid), Flight Centre’s share price compounded at ~11% CAGR. During this period, they also generally paid around 3-4% dividends per year. Regardless of the challenges thrown up, Skroo and the team have managed a +20% return on invested capital until Covid hit. That’s winning.

Final thoughts

In December 2019, Flight Centre was trading at $44. Today, it’s $17.78, down 60%. I think the bears are right that travel won’t go back to normal – but I don’t think it will remain 60% below the pre-Covid levels. On a risk-reward basis, I reckon Skroo and Co will find a way to win.

This article is part of the bulls vs bear debate club. To see the bear case, check out Lachlan’s article tomorrow.

If you want to know more about Flight Centre as a company, check out the Flight Centre webpage on Rask Media.