CSL Limited (ASX: CSL) has announced a blockbuster US$12.3 billion (AU$17.2 billion) tender offer for Vifor Pharma after trading hours today.

The deal is CSL’s first major transaction since 2008 and will bring together two globally leading biotech companies.

CSL finishes the year with a bang

Speculation around the deal had been gaining momentum in recent days.

On Monday CSL confirmed discussions between the two companies but said there was no certainty that any transaction would result.

However, on Tuesday shares were placed in a trading halt pending “an announcement regarding a potential material acquisition and associated capital raising“.

Then after hours came the announcement of the US$179.25 per share offer, which has been unanimously recommended by the Vifor Pharma Board of directors.

CSL’s offer is a 40% premium to the undisturbed Vifor Pharma share price from the 60 days prior to December 1.

Vifor Pharma’s share price had increased in the past two weeks as speculation about a takeover emerged.

The Switzerland-based company largest shareholder Patinex AG, which owns 23.2% of the company, has agreed to the deal.

Subject to the usual regulatory and shareholder approvals, CSL expects the tender offer to commence around January 18.

Commenting on the deal, CSL Chief Executive Officer and Managing Director Paul Perreault said:

“Vifor Pharma enhances CSL’s patient focus and ability to protect the health of those facing a range of rare and serious medical conditions. It brings an outstanding team and a leading portfolio of products across Renal Disease and Iron Deficiency and a proven partnering and business development and licensing strategy. Vifor Pharma will also expand our presence in the rapidly growing nephrology market, while giving us the opportunity to leverage our complementary scientific expertise”

Nitty-gritty

CSL will fund the purchase of Vifor Pharma through:

- A fully underwritten placement of US$4.5 billion (AU$6.3 billion)

- New debt facilities of US$6.0 billion (AU$8.4 billion)

- Existing cash and undrawn debt facilities of US$2.0 billion (AU$2.8 billion)

- Share purchase plan for eligible existing shareholders of US$534 million (AU$750 million)

Post completion of the deal, CSL will have a net debt/EBITDA ratio of 2.65 with a path to reducing this in the coming years.

It’s a huge deal for CSL, which hasn’t had to turn to the equity markets for capital since 2008.

The last time CSL made a major acquisition was back in 2008 when it made a US$3.1 billion offer for Talecris Biotherapeutics.

The acquisition subsequently failed to go through after the Fair Trade Commission (FTC) blocked the deal.

Two market leaders join together

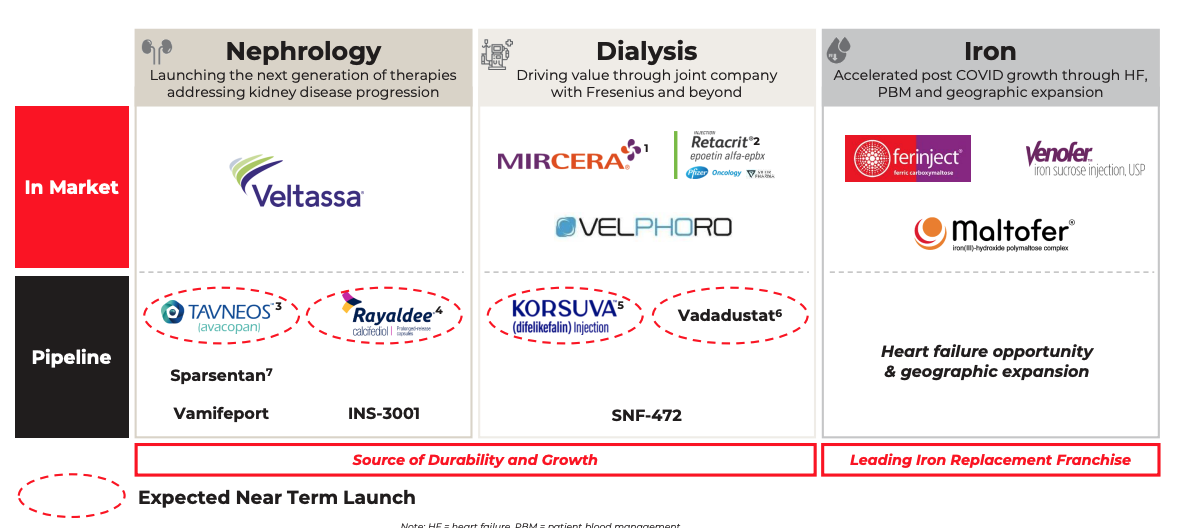

Vifor Pharma is a global leader in iron deficiency, nephrology and renal disease with a portfolio of current and future therapies.

The business complements the CSL existing product portfolio, adding seven commercialised products from day one.

From a financial perspective, the deal will be low-to-mid teens net profit accretive in the first full year.

Furthermore, Vifor will add $2 billion in revenue and an additional $400 million in free cash flow to CSL.

CSL expects to extract $75 million in synergies over the three years post completion of the deal.

“Vifor Pharma offers CSL near-term value along with a clear path to long-term sustainable growth…”

To keep up to date on all the latest news regarding CSL and the ASX, be sure to bookmark the Rask Media home page.