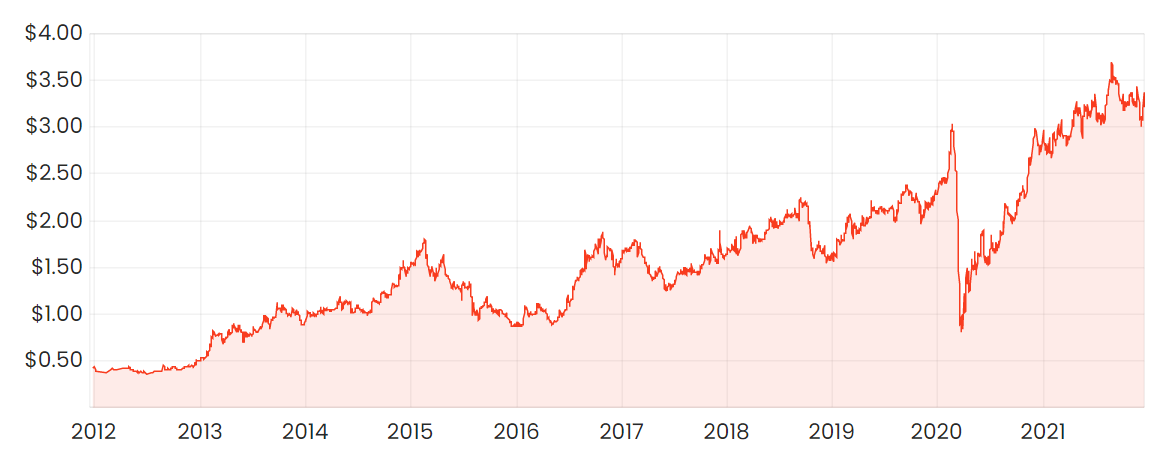

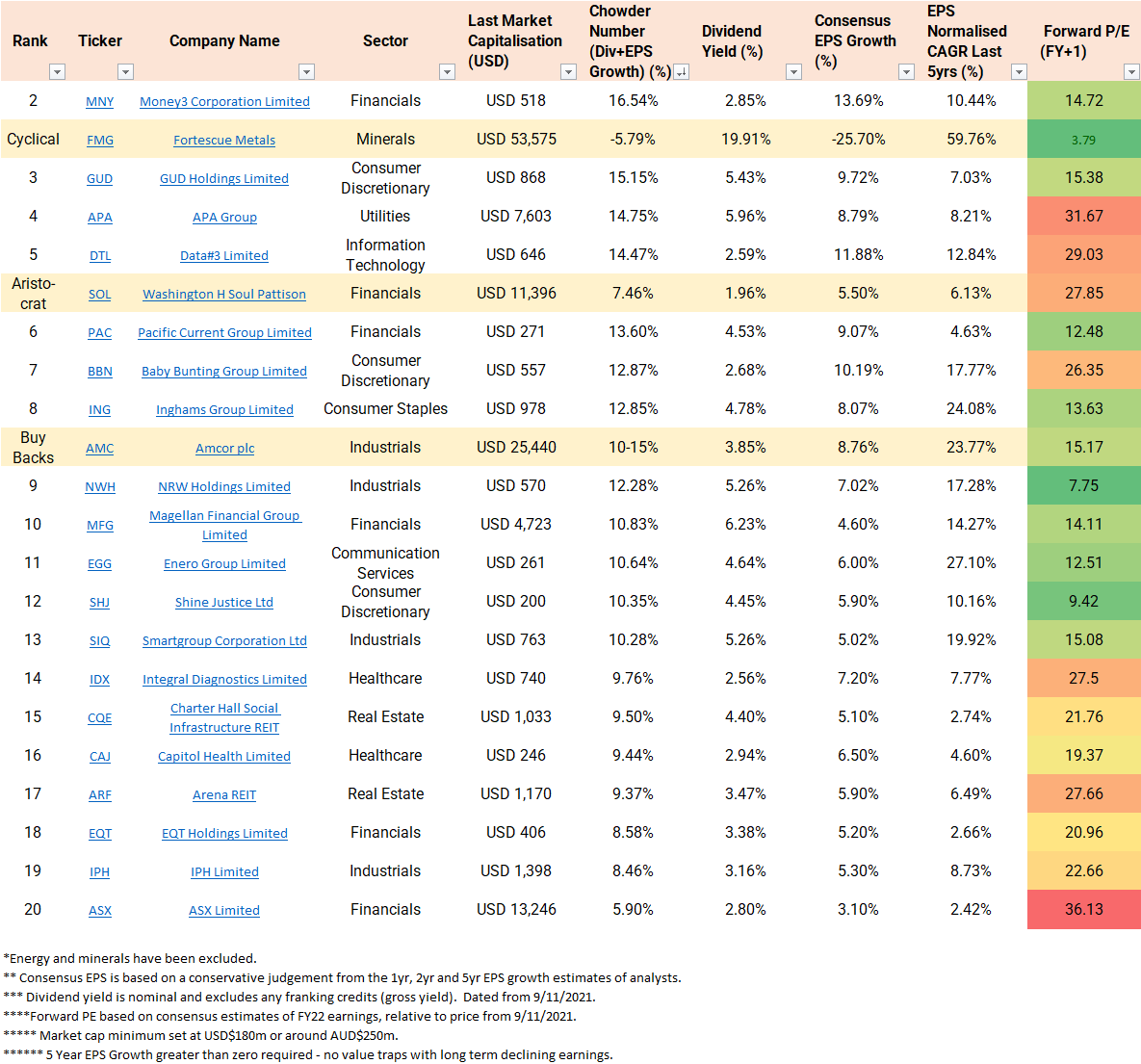

Money3 Corporation Limited (ASX: MNY) is a consumer-finance company that after 10 years of solid growth comes in at number two on the dividend growth investors list. Money3 is paying a respectable 2.85% fully franked or 4.07% gross dividends. Analysts are predicting 13.69% EPS growth, giving Money3 a rockstar 16.54% Chowder Number at a reasonable valuation.

MNY share price

What does Money3 do?

Money3 is a small lending and financing business with three subsidiaries. Money3 (payday lending, car loans, personal loans); AFS Automotive Financial Services (personal and commercial car loans); and Car Finance Limited (personal car loans in New Zealand).

To understand how Money3 earns profit, check out Raymond’s article explaining their loan book and access to credit.

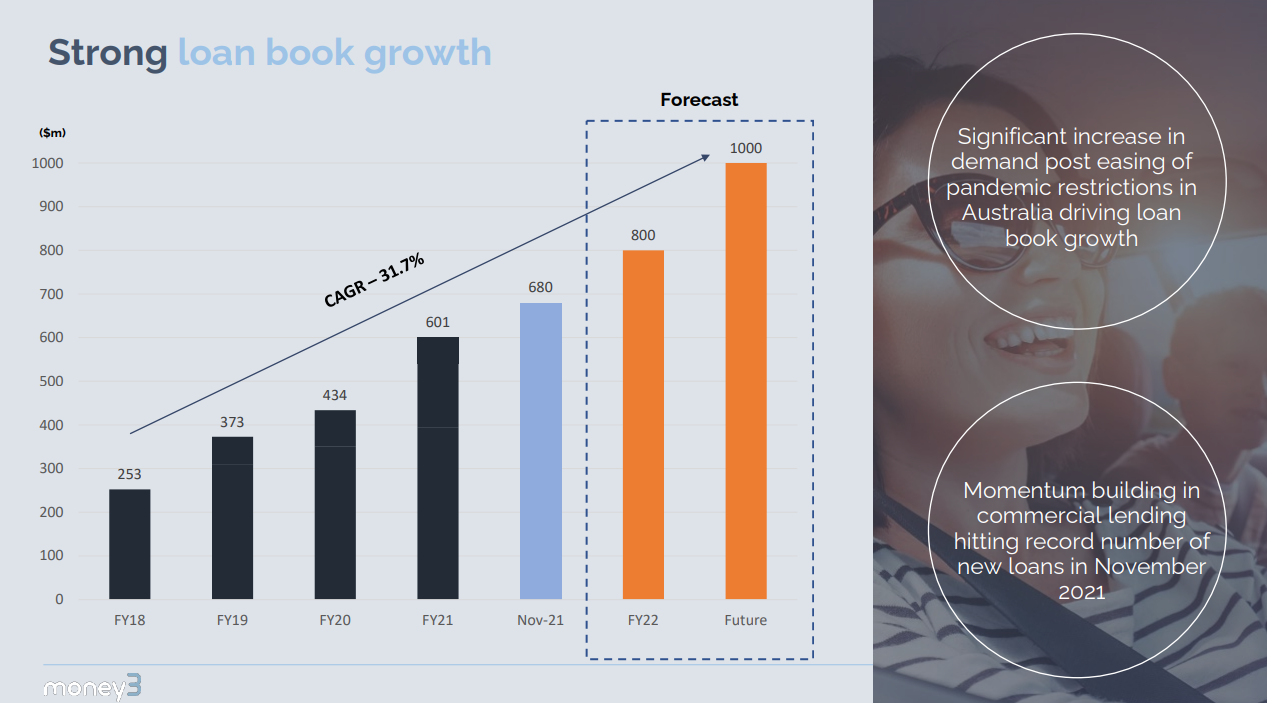

Money3’s loan book

Money3’s loan book has been increasing at an increasing rate. When they were first listed in 2007, they had $10 million in unsecured loans. By 2017 this had increased to $277 million, with around 80% secured auto financing. As of November 2021, Money3 has a portfolio of ~63,000 loans worth $680 million.

The loan book has been growing at increasing rates, and it’s not just Covid tailwinds. From 2015 to 2017, Money3 had been growing its loan book at ~20% compound annual growth rate (CAGR). From 2018 to 2020 (pre-Covid), this had increased to ~31% CAGR. And with Covid, this is expected to increase to ~35% CAGR by 2022. This seems to be the benefit of scale.

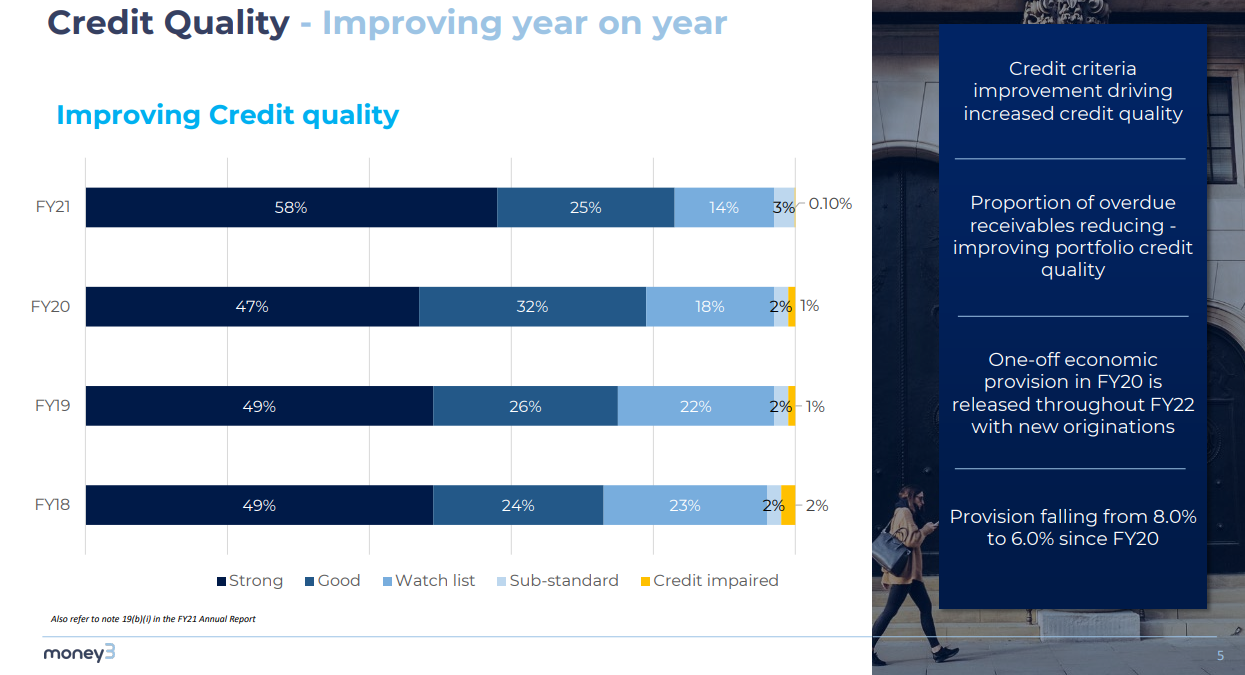

During this period, the quality of the loan book has also been increasing. Impairments have almost disappeared, while good and strong credit ratings have increased from 73% in 2018 to 83% in 2021.

Money3’s access to credit

Money3 is tapping the credit markets to support their expected growth to a $1 billion loan portfolio. To support this, Money3 has access to funding from a range of domestic and international banks. As recently as 8 December they announced a new credit strategy with MA Financial Group (previously Moelis Australia).

Money3 is ~50% leveraged with over $310 million of credit drawn and a further $140 million in headroom as of November 2021.

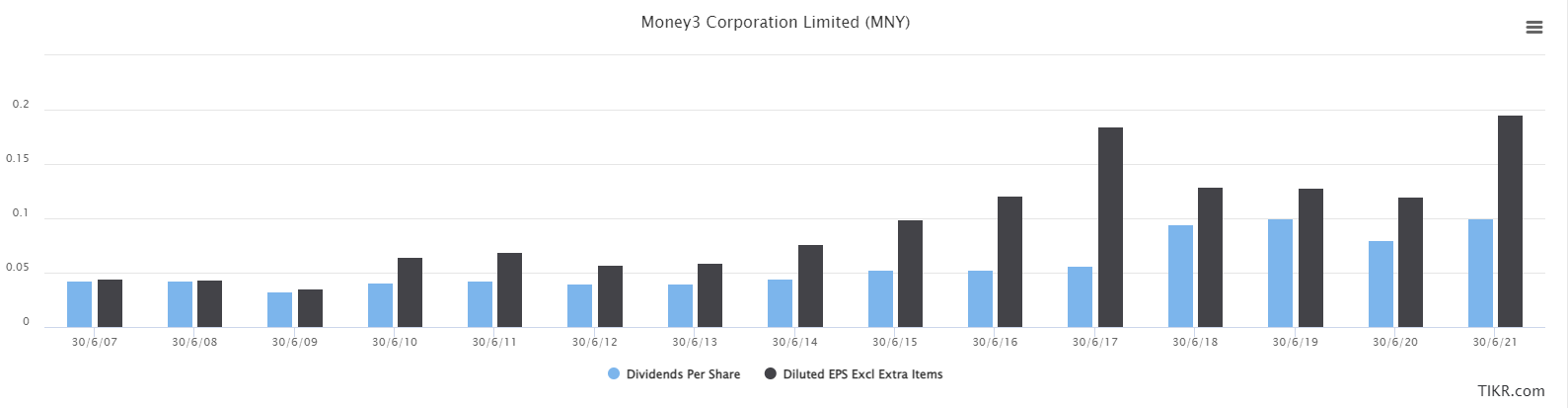

Money3’s dividends

Money3 has been materially increasing its dividends since listing – barring a risk-averse approach in 2020 due to the uncertainty of Covid. The current yield is 3.12% (14 December), and dividends have been increasing at 14.87% CAGR over the past five years. The payout ratio remains safe at 30% in 2021.

Looking to forward returns

Money3 has a range of options to expand its loan book. While analysts are bullish over the next five years with consensus EPS growth of 16.70%, I am using the lowest estimate of 13.69% for the Chowder Number.

Valuation

Money3 earned $39.17 million in FY21. With a market cap of $676 million, that gives a price-to-earnings ratio of 16.28. However, forecast earnings for 2022 are $50 million. The forward price to earnings ratio is a respectable 13.52.

Risks

There are two major risks for Money3. First, increasing interest rates could reduce their margins. Second, the quality of the loan book could deteriorate, resulting in increased impairments. Neither of these is unsubstantial in the short term.

Final thoughts

Money3 continues to transform from a high-risk payday lender towards a more secured loan provider. Earnings and dividends have been growing consistently, though an investor would need to feel at peace with the risks of the money markets.

For more on Dividend Growth Investing, see my recent article that outlines the screener approach being used here.