In the second edition of the Rask bulls and bears club, we’ll be taking a look at one of the most well-known companies on the ASX, Flight Centre Travel Group Ltd (ASX: FLT).

If you haven’t already, check out Value Downunder’s bull case for Flight Centre shares published yesterday.

Most people have been a customer, an investor or even both at some stage.

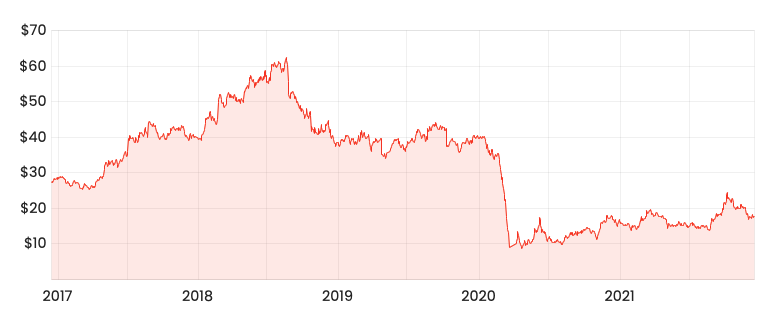

FLT share price

At the moment, the Flight Centre share price is looking very cheap relative to historical levels.

But I think the hype is overblown. Here’s why.

Less bang for your buck

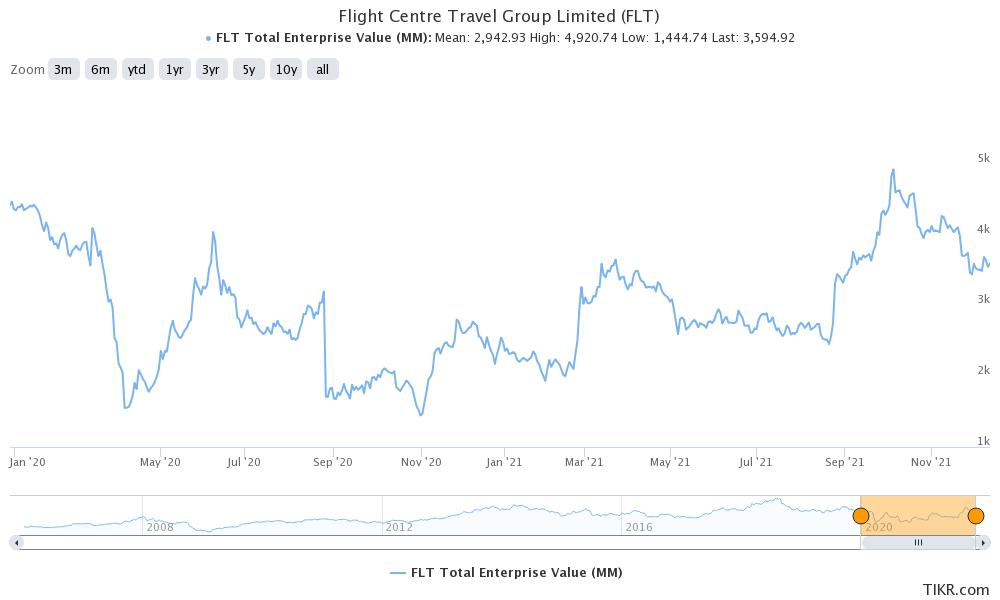

As mentioned, Flight Centre looks historically cheap. But share price charts fail to account for the dilution when a company issues new shares.

Over the past 18 months, Flight Centre has had to return to the market cap in hand asking for more money to support the business as travel came to a standstill.

In return for cash, the business has issued new shares.

Subsequently, Flight Centre’s share count has ballooned from 101 million shares in 2019 to 199 million shares by June 2021.

The business also has another 19 million shares waiting in the wings as a convertible note (debt instrument that is convertible into shares) to further dilute shareholders.

And only last month it had to come back to the market again to raise another $400 million.

This is not evident in the share price. In fact until very recently, Flight Centre was trading above its historical valuation pre-pandemic.

Flight Centre would have to double its profits to get back to a $40 per share price tag pre-pandemic. I think that’s highly unlikely in the near term.

Flying into the wind

Independent of the pandemic, there are two primary weaknesses in Flight Centre’s business model:

- its customers (mainly airlines) would love to cut them out; and

- the world is shifting to digital.

One question I like to ask myself about a business is if it’s going with or into the wind.

Is the average traveller going to want to spend more or less money with a travel agent?

I think the simple answer is no. Travel agents have and still serve an important role for people who want an intermediary.

But overall more people prefer to go direct.

Searching for low-cost flights has never been easier, and added ‘expertise’ provided by an agent is being eroded by travel blogs, social media and better direct-to-consumer offerings by airlines.

Add on top of that, the airline’s Flight Centre derives revenue from would love to take that margin back, the company is flying directly into the wind.

This isn’t a black swan event

The most common bull case for Flight Centre is that COVID-19 is a once in a 100-year event and everything will be cheerio once the borders reopen.

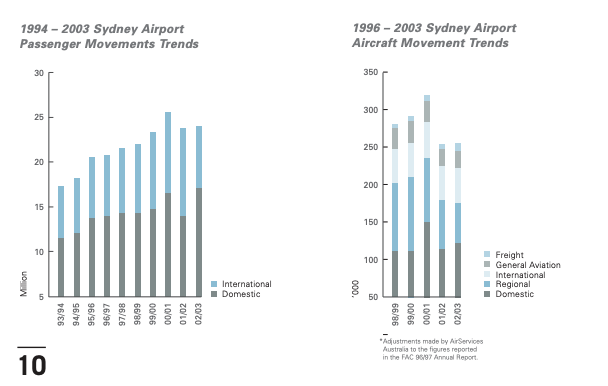

History suggests this is not the case.

Travel volumes declined to post the global financial crisis in 08/09 and were only saved by acquisition in the United States.

Go back to the tragedies of September 11 in 2001 and the Bali bombings in 2002 and the travel industry again suffered.

The travel industry is cyclical and therefore subject to peaks and troughs.

Subsequently, the next time someone says travel disruptions are a non-recurring event, you can point to the three times during the past 20 years that suggest otherwise.

Final thoughts

Flight Centre is a business I want to like.

But the pandemic has been a knockout punch for the business.

The share price currently reflects a travel agent at pre-pandemic growth rates.

Unfortunately, it’s only at 27% of pre-COVID levels.

If you enjoyed this comparison, consider signing up for a free Rask account and accessing our full stock reports.