The Corporate Travel Management Ltd (ASX: CTD) share price isn’t moving today while the business raises $100 million to fund the purchase of the Helloworld Travel Ltd (ASX: HLO) corporate and entertainment travel division.

The acquisition will cost $175 million, funded via the capital raising and $75 million in new Corporate Travel shares issued to Helloworld.

Corporate Travel buys up another rival

Corporate Travel has acted quickly to secure the divestment of Helloworld’s corporate division.

It’s not the first time the business has been opportunistic recently. Last year, it purchased North American rival Travel & Transport for US$200.4 million.

Today’s acquisition will build on Corporate Travel’s existing business by adding new verticals such as entertainment, film, music and arts.

It will also acquire a portfolio of new clients, including state and federal governments.

Helloworld Corporate has officers in nine cities across Australia and New Zealand (ANZ).

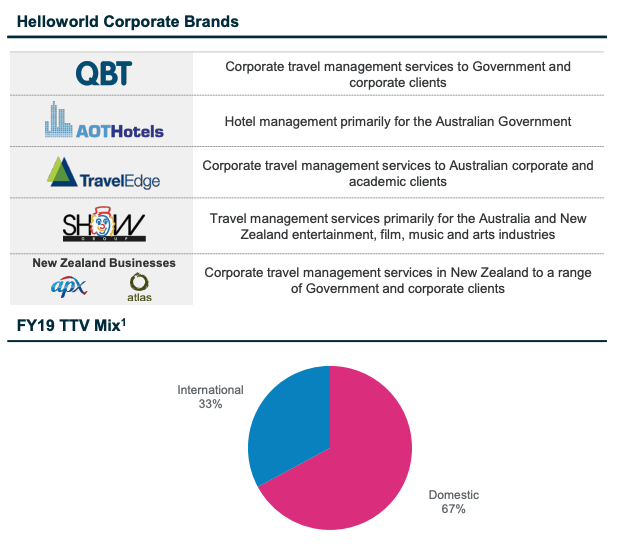

Notable brands include QBT, AOTHotels, TravelEdge, Show Group, APX and Atlas.

The deal remains subject to several conditions, including approval by the Australian Competition & Consumer Commission (ACCC).

Doubling down on pre-pandemic levels

The deal values the corporate and entertainment division on an enterprise value to FY19 EBITDA multiple of 8x excluding any synergies.

It will add an additional $90 million in revenue to the company and an estimated $30 million in EBITDA.

As a result, Corporate Travel’s revenue derived from ANZ will increase from 17% to 27%.

When accounting for expected rent, management and back-office synergies of $8 million, this multiple drops to 5.8x.

Corporate Travel will incur $5 million in one-off integration costs within the first 12 months post-acquisition.

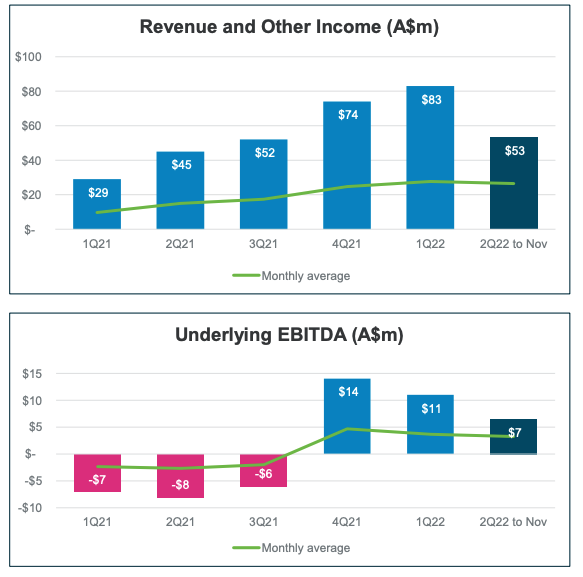

Notably, the deal assumes the division returns to pre-pandemic levels, which it is yet to achieve.

Helloworld Corporate achieved an EBITDA of $22 million in FY19. However, in the first quarter of FY22, it recorded just $1.6 million.

Capital raising details

Corporate Travel will now undertake a fully underwritten $100 million capital raising, split between:

- $75 million institutional placement

- $25 million share purchase plan to eligible shareholders

New shares will be issued at $21 per share, a 5.8% discount to Corporate Travel’s last closing price.

Trading update

In addition to announcing the Hellworld Corporate acquisition, Corporate Travel provided a trading update.

It’s maintained its underlying EBITDA trend. However, this has been somewhat impacted by the latest pandemic variant.

The business has $102 million in cash and is expecting a return to dividend payments in 2022.

If you enjoyed this update, consider signing up for a free Rask account and accessing our full stock reports.