After being on hold since Wednesday, shares in Frontier Digital Ventures Ltd (ASX: FDV) has resumed trading after the company completed a $35 million institutional placement to purchase 100% of Encuentra24 (E24).

E24 is a general classifieds marketplace in Panama, Costa Rica, Guatemala, El Salvador and Nicaragua.

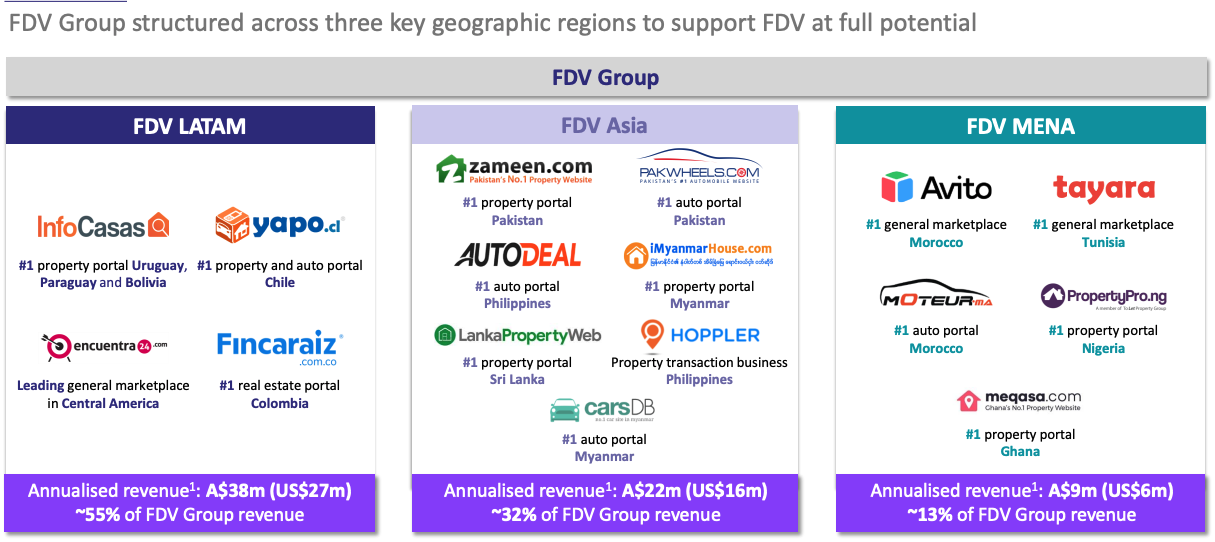

FDV takes equity stakes in emerging market online classifieds in the hope of following in the footsteps of REA Group Limited (ASX: REA).

Expansion into Central America

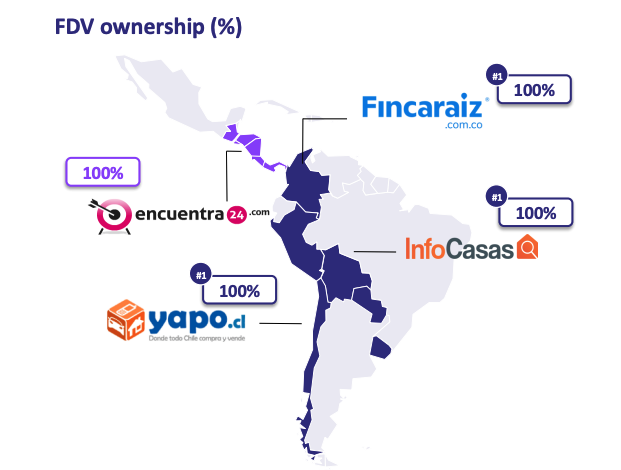

FDV already owns a 26% stake in E24. The raising will bring its ownership to 100%.

The business will purchase OLX Group’s 37.5% stake for $13.1 million.

The purchase price of the remaining 36.2% will be subject to E24 achieving certain revenue metrics in FY22.

Any remaining proceeds from the raising will be used to fund future merger and acquisition activity.

Retail shareholders will also be able to participate in a $5 million share purchase plan at a share price of $1.58.

The offer price is just a 5.1% discount to FDV’s last closing share price.

Commenting on the acquisition, founder and CEO, Shaun Di Gregorio said:

“We are excited to be increasing our ownership in Encuentra24, where we believe there is significant potential to accelerate its revenue growth. This transaction is expected to unlock the value of FDV LATAM with 100% ownership and control, enabling the sharing of our transaction model IP and technology across the region.

Integrated Latin America footprint

E24 derives a majority of Panama where it hosts classifieds for property, vehicles, jobs and shopping.

Overall, the company recorded annualised revenue of $8.8 million and a small EBITDA profit of $184,000 in the third quarter.

Bringing E24 onboard will enable FDV to share technology and data across its existing Latin America portfolio.

The region will also benefit from cost savings across finance, legal, HR and IT functions.

My take

Existing shareholders might be questioning why the business is raising capital for the fourth time in two years given in its latest quarterly update, FDV had $17 million of cash on hand.

The raising only increases the share count by 6.8%, but it looks like an unnecessary dilution based on current balance sheet flexibility.

“While always very mindful of dilution to existing shareholders, we saw this measured capital raising as an opportunity to broaden our shareholder base”.

Nonetheless, the acquisition on face value looks complementary to the remainder of the FDV classifieds portfolio.

If you enjoyed this update, consider signing up for a free Rask account and accessing our full stock reports.