The Australian Clinical Labs Ltd (ASX: ACL) share price is up more than 5% today to $5.26 after the business upgraded first-half guidance expectations.

The company operates 86 laboratories across Australia, providing pathology services including COVID-19 testing.

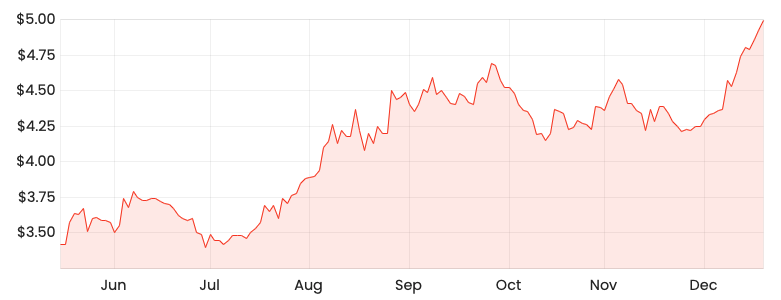

You could be forgiven for thinking the Australian Clinical Labs share price is a representation of COVID-19 cases, rising 54% since listing in April.

ACL share price chart

Pandemic testing boosts margins

Australian Clinical Labs has revised its financial guidance for the half ending 31 December to:

- Total revenue of between $497.3 million and $517.2 million

- Net profit after tax (NPAT) of between $116.3 million and $128.0 million

In its April prospectus, the business had predicted total revenue in the range of $437.5 million to $454.9 million, and profit of $86.3 million to $94.9 million.

At the midpoint of today’s and April’s guidance, this represents a revenue increase of 13% and a 36% profit jump.

Australian Clinical Labs has benefitted from a surge in new testing as the Omicron variant spreads. This testing is higher margin, leading to operating leverage and a notable jump in first-half profit.

Abnormal demand for COVID-19 testing is expected to continue for the remainder of the year.

This has been primarily driven by new variants, travel restrictions and increased commercial restrictions.

The company also noted it would benefit from 12 days’ contribution from the recent acquisition of Medlab Pathology.

“This upgrade to the 1H FY22 total revenue forecast reflects continued strong demand for COVID-19 testing, particularly in VIC and NSW, as well as a sustained resilient performance of the non-COVID-19 business with continued growth in 1H FY22 year to date revenues compared to the previous corresponding period”

– ASX announcement

What next for the ACL share price?

Pathology services have been one of the few direct beneficiaries of the pandemic.

And it doesn’t look liking slowing anytime soon, with testing likely to persist at higher levels for the foreseeable future.

It will be interesting to see if margins remain elevated, or if the government begins to clamp down on pathology providers and expect better bang for their buck.

The business itself is a great hedge against any pandemic-induced effects on the rest of the ASX.

However, longer-term I’m unsure if the business is able to continue delivering guidance upgrades in the absence of pandemic demand.

If you’re looking for new share ideas, check out 3 ASX growth shares I’d be willing to buy in a market pullback.