Infomedia Limited (ASX: IFM) comes in at Number 1 on the dividend growth investing screener, providing a combination of historical performance, decent dividend yield, and plenty of growth potential.

It’s the global SaaS provider for auto parts that turned things around a decade ago and since has generated north of a 22% compound annual growth rate (CAGR).

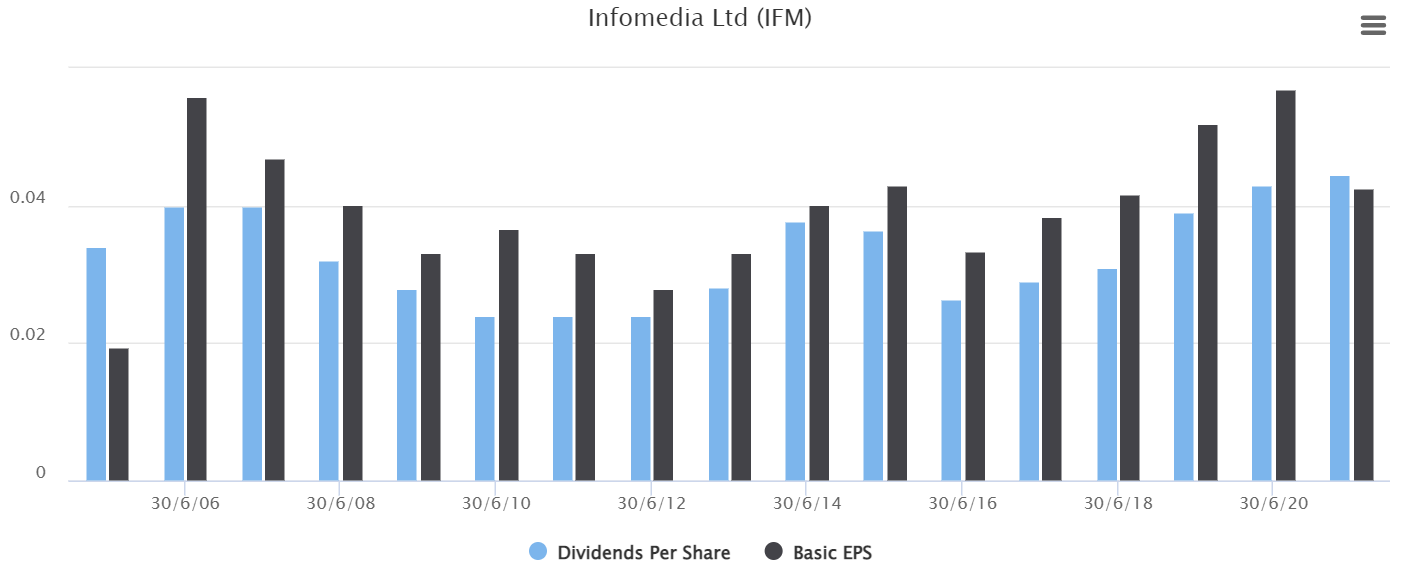

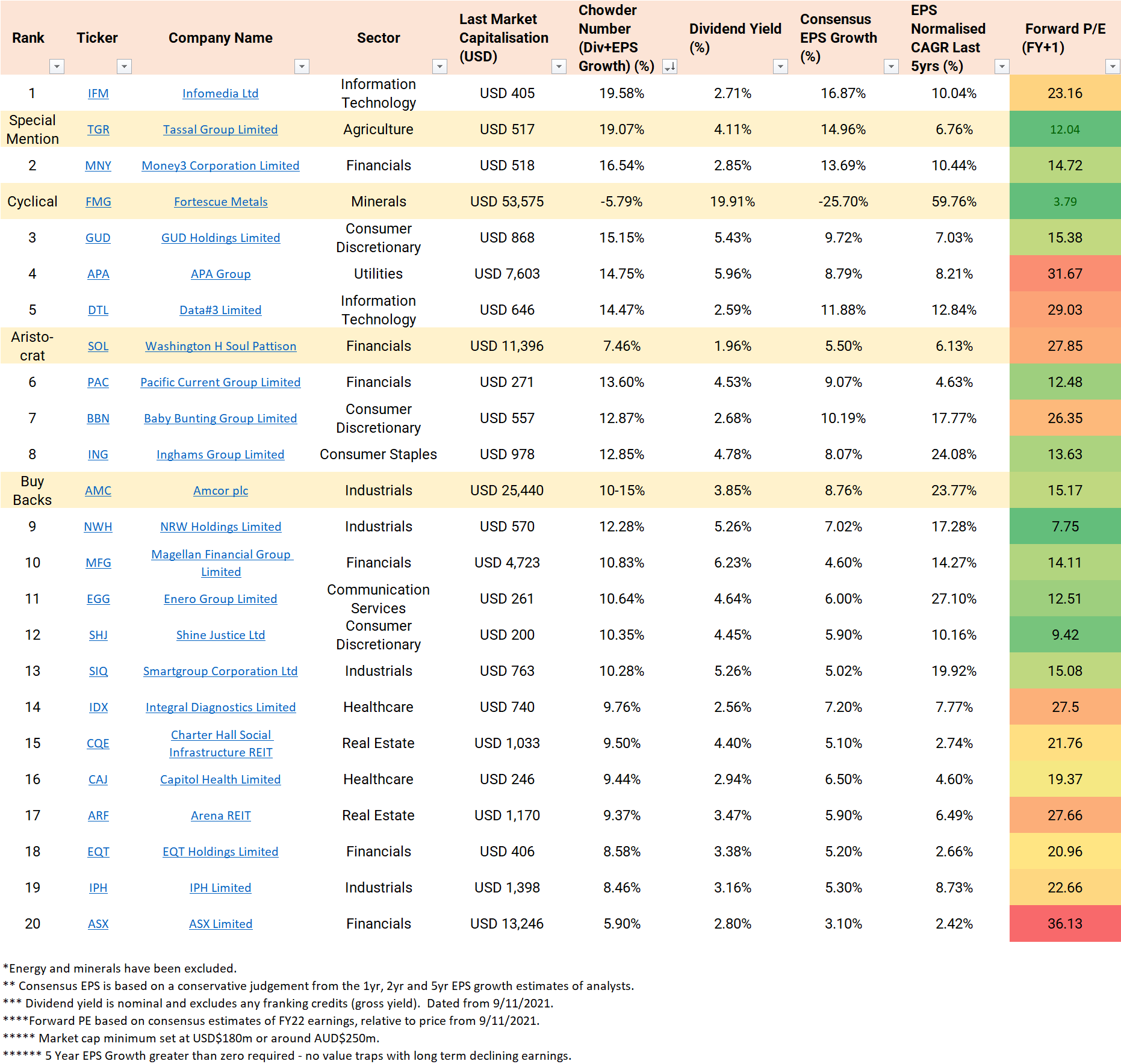

Infomedia is paying 3.15% fully franked or 3.86% gross dividends. Analysts are predicting 16.87% EPS growth, giving Infomedia an ASX-beating 19.58% Chowder Number.

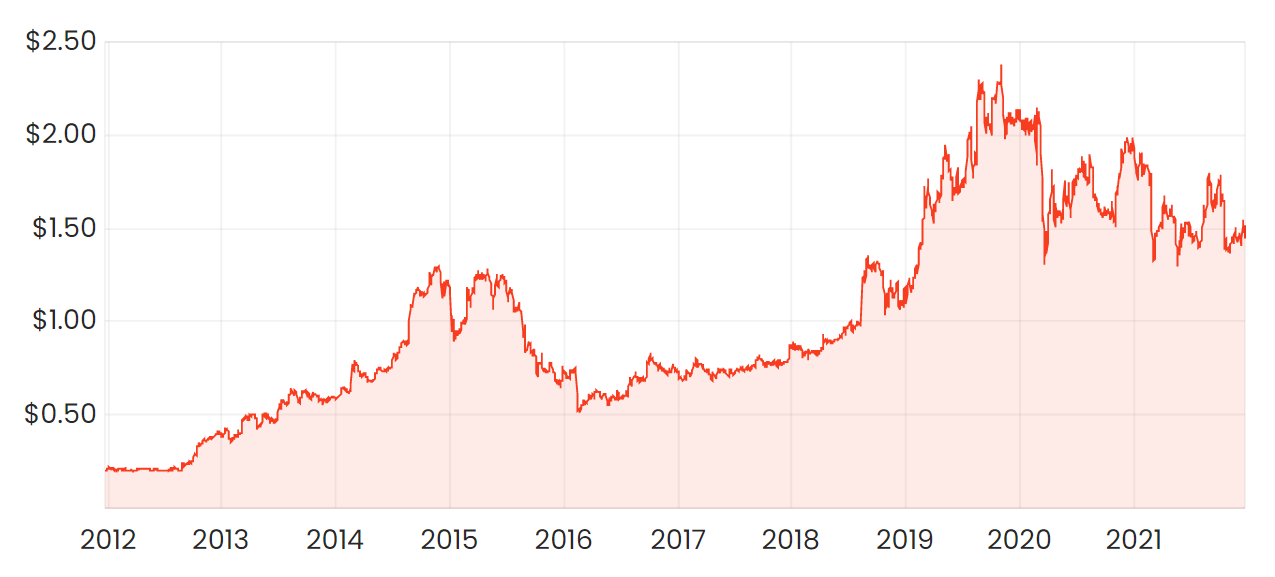

IFM share price

What does Infomedia do?

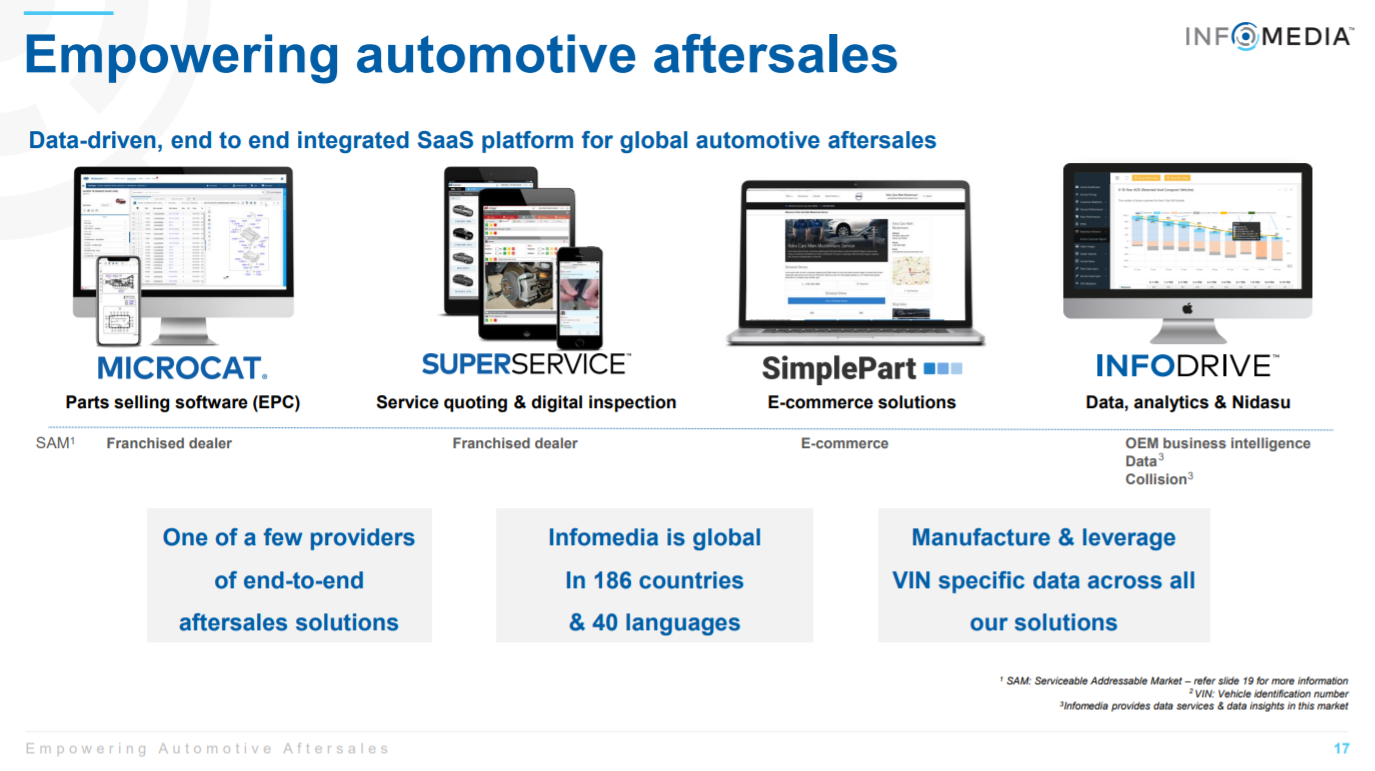

Infomedia helps mechanics and vehicle dealers catalogue and manage their car parts, products, and databases. They have become embedded into the lives of customers, helping mechanics and shops provide accurate pricing on repairs and aftermarket accessories. Infomedia was founded in 1987 and has grown to serve over 220,000 users across 186 countries.

Owen in 2020 highlighted Infomedia as one of ten ASX software shares under $1 billion, “which just seems to chug along, slowly compounding its top line (sales) and cash flow year after year”. It pays a modest dividend and reinvests the rest of its operating earnings in itself.

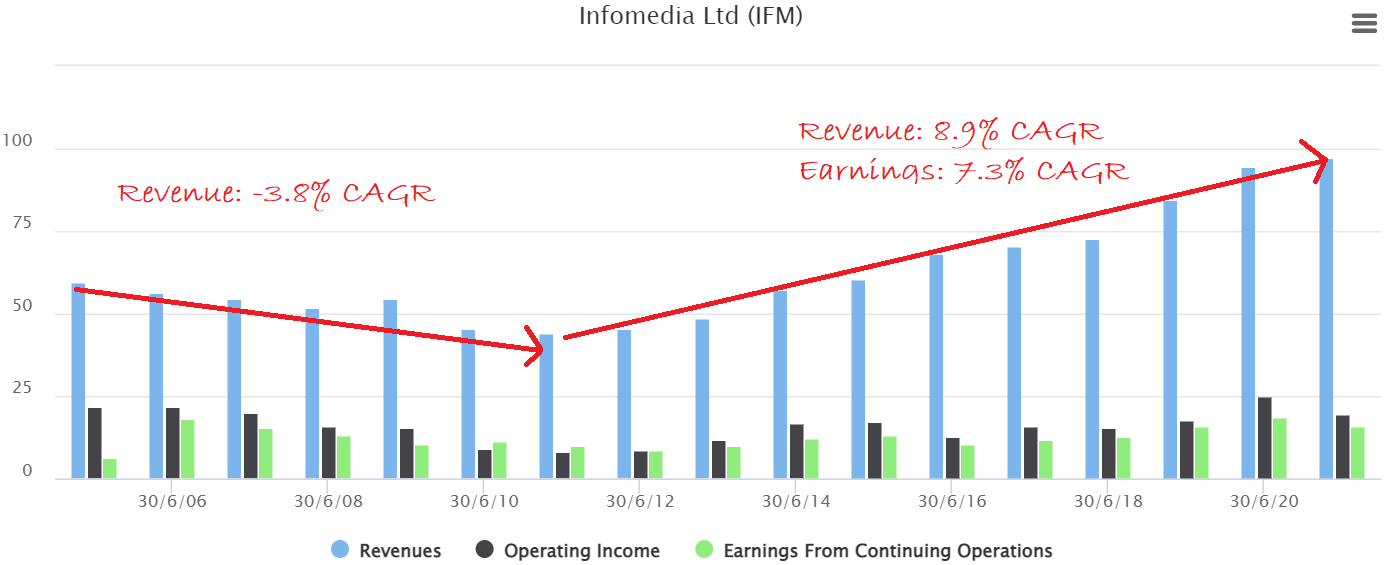

The 2010’s turnaround

In the early 2000s, Infomedia found growth hard to come by. Top-line revenue and bottom-line earnings had been declining since 2004. New competition, lack of innovation, and cyclical factors such as the global financial crisis impacted it.

The founder and chairman at the time, Richard Graham embarked on a revitalisation program. Infomedia developed a subscription-based model known as ‘Superservice’ that started making inroads in 2012.

“Superservice is the first automotive fixed operations product-line of its kind that provides global uniformity for automakers in the key areas of electronic parts catalogue, service menus, vehicle health check, online booking, and service history registration. Superservice combines realtime data, interoperability, business analytics and more to give a consistent, intuitive user experience.” Annual Report, 2012.

In 2013, the board and management undertook research interviews with leading original equipment manufacturers (OEMs) to consider “The Future of Afterservice I.T”. They constructed an industry composite view of 2020, identified industry trends and commitments, and defined Infomedia’s research and development (R&D) priorities.

Results in 2013 improved. Graham noted at the time that the “results we believe are sustainable and will create further financial and market leadership growth .. [and that] the research [will] guide Infomedia’s product and market development for the decade to come”.

Considering the terrible performance of the prior decade, it was hard to know how prophetic this comment was. Since then, total shareholder return (dividends and share price appreciation) has compounded at north of 22% CAGR for over a decade.

Growth for Infomedia

Infomedia’s current Managing Director and Executive Chairman Jonathan Rubinsztein has a two-pronged approach to future growth.

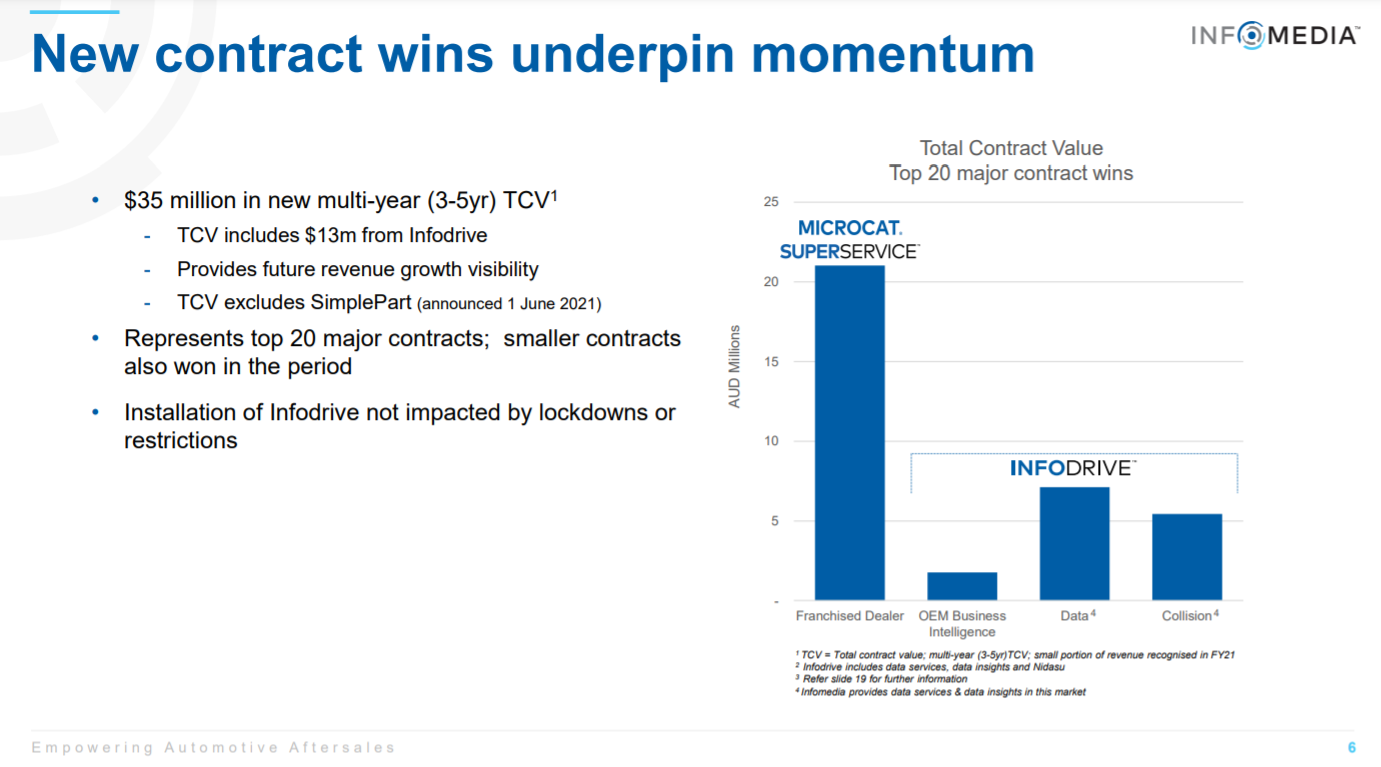

First, R&D investment to drive sales. The Next Gen platform of integrated parts service and data solutions allows Infomedia to drive a much stronger customer proposition and access a broader addressable market. This is leading to new contract wins across its SaaS platform.

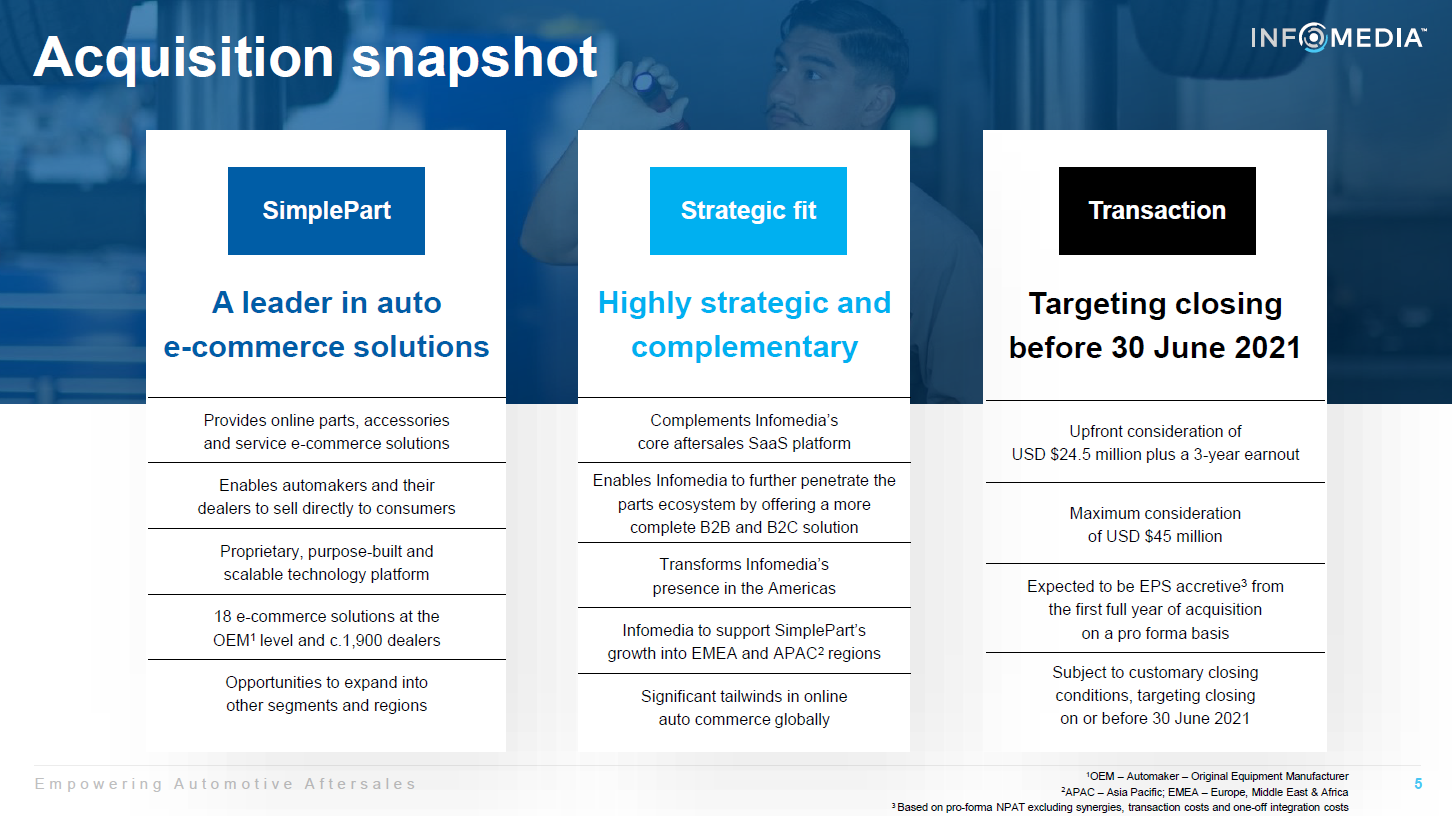

Second, acquiring assets that may enhance functionality, add customers and allow Infomedia to enter new geographies. In May 2021, Infomedia acquired SimplePart, a North American consumer-facing e-commerce platform for genuine automakers. This was paid from cash without diluting shareholders.

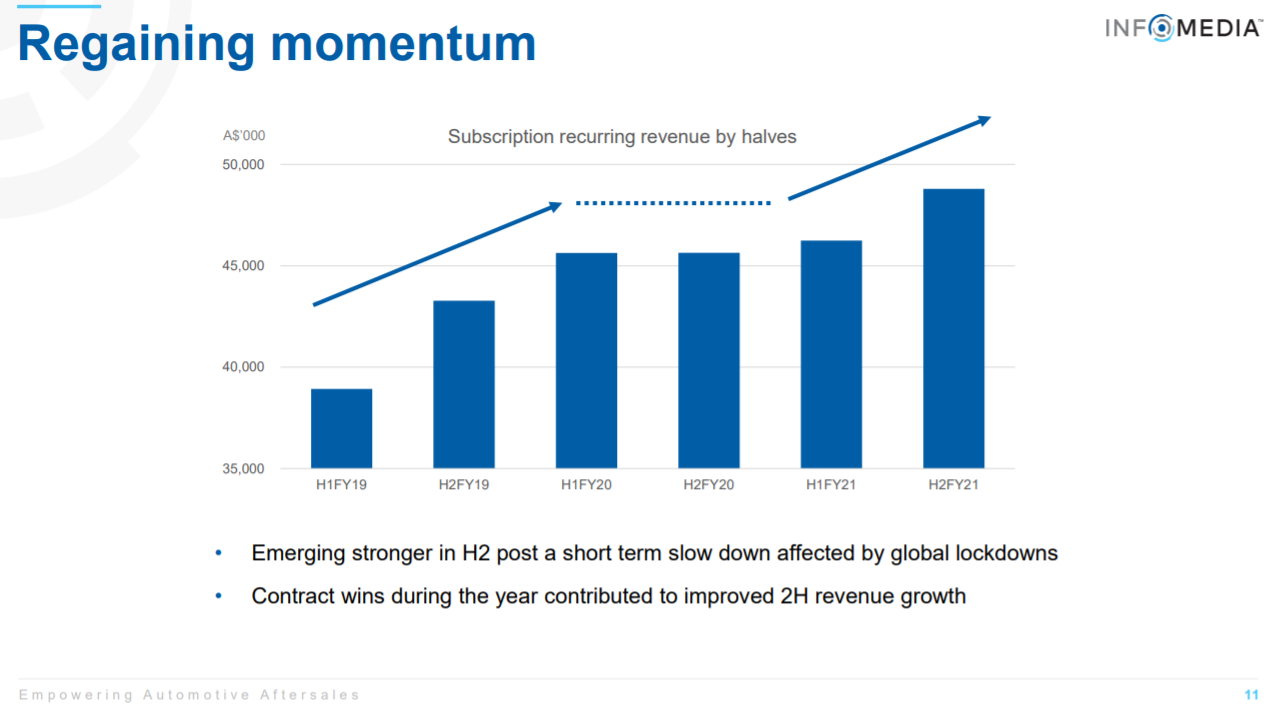

Notably, it is also worth mentioning that Covid headwinds are also unwinding. Management is forecasting ~20% growth in revenue in FY22 as Infomedia regains momentum.

Infomedia’s dividends

Infomedia has paid 4.45c in dividends over the last twelve months, ~85% franked. This provides a gross yield of 3.67% on the current share price of $1.45. Infomedia has a dividend reinvestment plan to save on transaction costs, though no discount is provided.

Valuation

Infomedia is trading at 2019 prices despite a ~25% improvement in the underlying business. However, it’s still not cheap. Forward enterprise value to EBITDA (8.36x) and forward price to earnings (23x) are both near their 10-year average. If growth meets consensus expectations, it may turn out to be fairly valued.

Risks

Infomedia has invested large sums into R&D to reignite its revenue growth. While this has dragged down its operating margins since 2014, it’s also a headwind on its free cash flow

. The continued need for capital expenditure on R&D or acquisitions creates opportunities and risks.

Final thoughts

Infomedia is on the cusp of the old and the new world, disrupting the automotive spare parts industry through its SaaS platforms. For over a decade it has outperformed the market by giving shareholders good dividends while growing the underlying business. Looking forward, Infomedia presents an ASX-beating 19.58% Chowder Number for dividend growth investors.

For more on Dividend Growth Investing, see my recent article that outlines the screener approach being used here.