Specialist wealth platform Praemium Ltd (ASX: PPS) has announced it will sell its international business to Morningstar for $65.1 million (£35.0 million) in cash.

The market has reacted positively to the news, sending Praemium shares 1.42% higher to $1.43.

PPS share price

Morningstar pounces

Morningstar will acquire 100% of Praemium’s operations in the UK, Jersey, Hong Kong and Dubai.

The sale will unlock capital for Praemium and free up its leadership resources from the sub-scale international division.

“While enjoying strong sales momentum and technology leadership, the International Business has been operating at a scale disadvantage to its key competitors. Morningstar will bring its global footprint and investment scale to better serve the interests of international clients and better advance the career opportunities of our international employees”

The deal remains subject to regulatory approval and other customary conditions. It is expected to be completed in the second or third quarter of 2022.

Commenting on the deal, president of wealth management solutions for Morningstar Daniel Needham said:

“Praemium has a fast-growing UK and international business and a talented team we look forward to welcoming to Morningstar”

Surplus proceeds from the sales are expected to be returned to shareholders.

The Board also noted given the underlying profitability and international division sale that it introduce a dividend policy from FY23 onwards.

All chips in on Australia

The sale will enable Praemium to focus on its core Australian wealth platform, which has recently been under the eye of competitor Netwealth Group Ltd (ASX: NWL).

“It is a significant milestone in our journey to becoming one of Australia’s largest independent specialist platform providers”

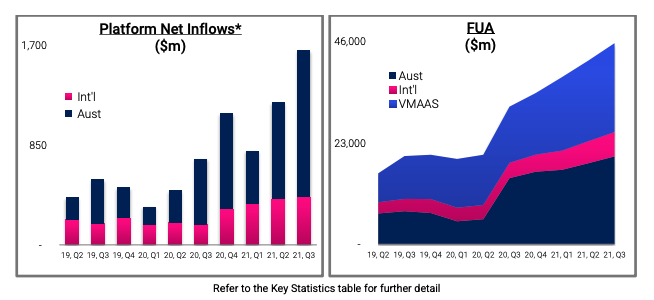

The company noted it continues to see a solid pipeline of inflows into its core market after recording a record quarterly inflow of $1.66 billion in the last quarterly update.

My take

The sale, which has been flagged for some time, is a dint in Netwealth’s plan to buy Praemium.

Netwealth had wanted to use excess proceeds from the sale to sweeten its $1.50 per share deal for Praemium shareholders.

However, with the Board specifically noting that it will return excess proceeds, it’s nullified Netwealth using Praemium’s own assets against them.

Overall, it’s a smart move by Praemium and enables it to better compete within Australia.

To keep up to date on all the latest news regarding Praemium and the ASX, be sure to bookmark the Rask Media home page.