Here are my five key takeaways for dividend growth investing as an epilogue to the 15 articles I penned in this series.

Dividend growth investing is not about high yield

My initial inspiration to undertake this series was based on the throng of articles recommending dividend stocks. I became incensed at how many were simply high dividend yield stocks, without considering the potential growth of a business.

A high dividend yield is not a necessary nor sufficient criterion for a company to form part of a dividend growth portfolio.

Earnings growth is more important than the starting dividend yield

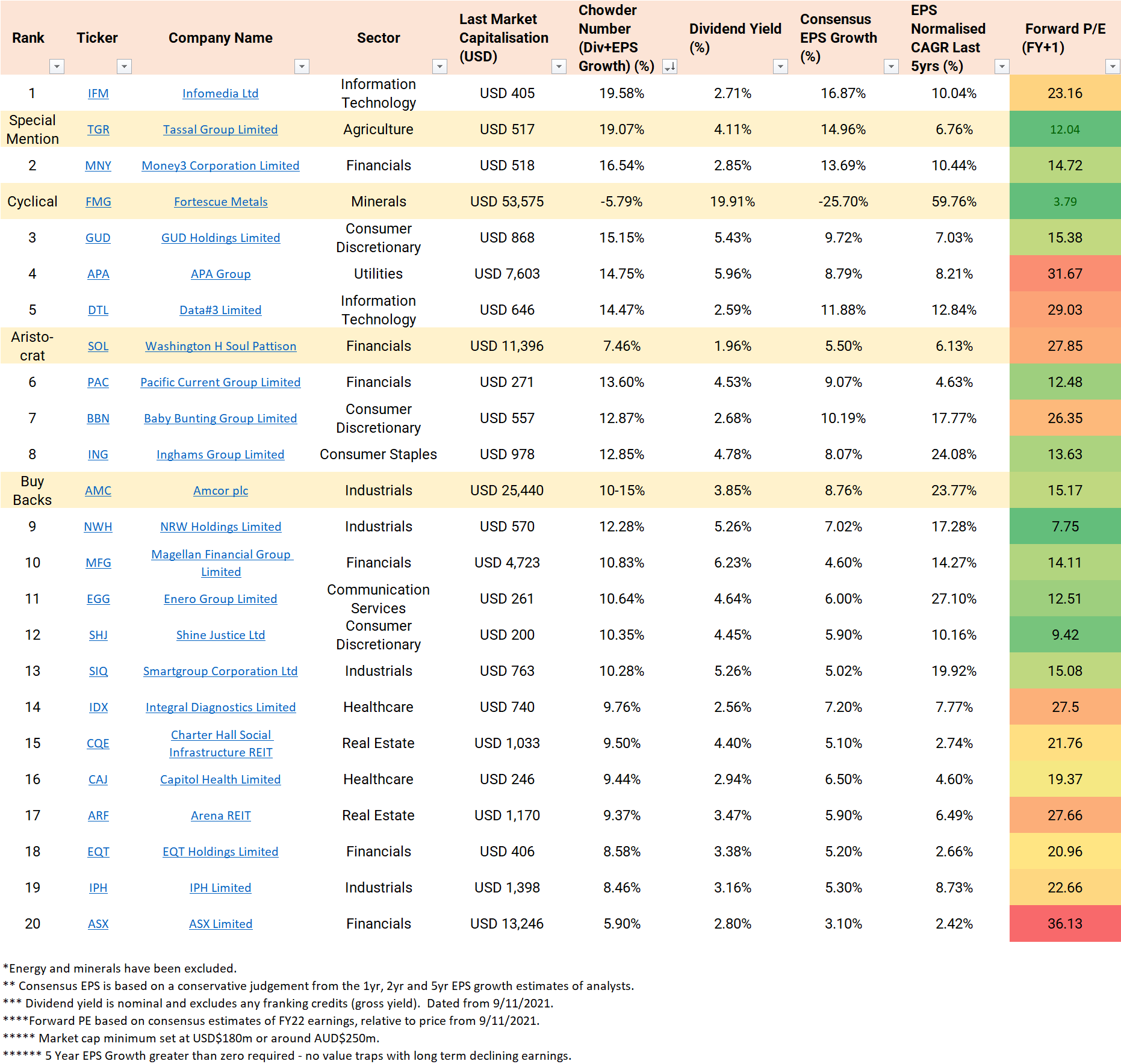

Looking at the composition of the Chowder Number across the top 20 companies, ~66% of the expected returns are from earnings growth. This is the power of compounding for the long term in growing companies.

Infomedia (ASX: IFM) topped the list, whereby ~85% of the expected returns were due to forecast growth. While I don’t advocate for looking in a rear-view mirror to forecast growth, the previous decade saw Infomedia compound north of 22% largely due to earnings growth and share price appreciation.

Beware of value traps

There is a fine line between value and value traps. Being able to identify the value traps is the difference between beating the market and under-performance.

Magellan (ASX: MGF) is a modern tug-of-war between the value and value trap camps having dropped 30% since coming in at Number 10. For a dividend growth investing portfolio, it’s better to avoid if you’re uncertain.

Valuation matters less than you think

If you bought Washington H Soul Pattison (ASX: SOL) over the last decade with a 3% dividend yield at a price to earnings of >20x, you would have done a lot better than buying AGL (ASX: AGL) with a dividend yield of 5% and a price to earnings of <10x.

The longer you buy and hold, the less the starting valuation matters. If one is paying relatively fair prices, the more important factor in your investment thesis is earnings growth.

For example, you may consider fair prices as -/+25% of the intrinsic value based on a discounted cash flow. Alternatively, you may consider +/-25% of the long-term historical valuation metrics based on price to earnings or enterprise value to free cash flow.

Screeners do not replace bottom-up research

Using a screener can be a useful addition to a research process. It can broaden your horizon by identifying companies you may not typically look at. Baby Bunting (ASX: BBN) at Number 7 is a super high-quality business that I wouldn’t ordinarily look at if it wasn’t for this screener.

However, by definition, a screener is providing a rear-view mirror perspective to investing. Even including consensus earnings per share (EPS explained) growth over the next 5-years didn’t provide the depth required for forecasting. Nothing replaces good ol’ fashioned bottom-up research on a company to provide an edge.

Final thoughts

This series was not intended for stock picking. Rather, it is focused on education, using one tool in an investor’s toolbox, as applied to today’s ASX companies. I sincerely hope you found this a useful exercise, as I intend to replicate this series in 2022.

Merry Christmas, Happy Holidays, and Happy New Year.

For more on Dividend Growth Investing, see my recent article that outlines the screener approach being used here.