With 2021 coming to a close, here are 3 ASX growth shares I’ll be keeping a close eye on in 2022.

1. EML Payments Ltd (ASX: EML)

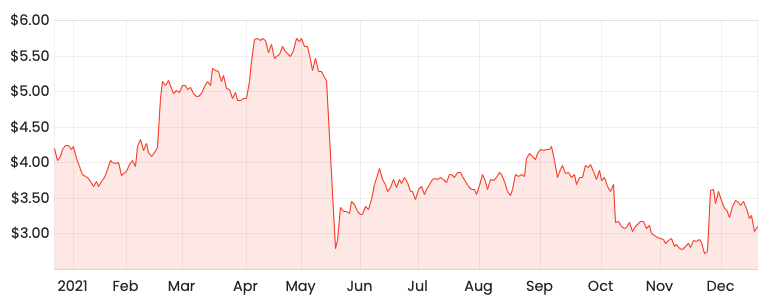

It was a year to forget for embattled payments provider EML, with its share price falling 45% in one day after the Central Bank of Ireland

(CBI) initiated an investigation into the company.

The CBI issue plagued the business for the remainder of the year, weighing on the share price and investor sentiment.

Fortunately, the business finished the year with positive momentum after announcing better than expected actions by the CBI, with the remediation to wrap up in March.

Will 2022 be the year EML finds its feet and puts the CBI investigation behind it?

If it can, the underlying growth in the business should shine through and lead to a potential rerating of the share price.

2. Zip Co Ltd (ASX: Z1P)

2022 could potentially be the most important year in Zip’s short history.

The share price fell 25% over 2021, with sentiment retracing on the buy-now-pay-later (BNPL) sector as competition intensified and meaningful profitability still some time away.

With Afterpay set to be swallowed up by Block Inc (NYSE: SQ) – formerly Square, Zip will take the mantel as the market leader in the space.

Afterpay (ASX:APT) shareholders give the green light for Block takeover

Will the business continue with its global rollout strategy? Or will it follow Afterpay’s path of joining with an existing payments disruptor?

Regardless, 2022 will be a formative year for the company and its shareholders.

3. Temple & Webster Group Ltd (ASX: TPW)

It’s not just online furniture retailer Temple & Webster that will be watched closely in 2022, but the remainder of the pure online plays such as Adore Beauty Group Ltd (ASX: ABY) and Kogan.com Ltd (ASX: KGN).

How much of demand was temporary? And how much was a structural shift to online?

Even the incumbent retailers such as JB Hi-Fi Limited (ASX: JBH) had online sales rocket over the past 18 months due to pandemic induced shopping centre closures.

But with the world slowly but surely moving towards more normalised shopping habits in 2022, time will tell if this was a fad or permanent shift to online.

If you enjoyed these share ideas, consider signing up for a free Rask account and accessing our full stock reports.