In the second edition of 22 ASX shares for 2022, we’ll be taking a look at three former market darlings and the big banks.

If you haven’t already check out yesterday’s release of Part 1.

1. (ASX: BAP)

The Bapcor share price crashed in November after announcing the unexpected departure of its long-term CEO Darryl Abotomey.

Just two weeks later, the Board fast-tracked Mr Abotomey’s exit, as the relationship soured:

“…there has been a marked deterioration in the relationship between the Board and the CEO, such that Mr Abotomey’s position as MD and CEO has become untenable”

Mr Abotomey was popular with shareholders. Therefore the onus will be on the Bapcor Board to bring in a new CEO that will get the share price back on track.

2. Zip Co Ltd (ASX: Z1P)

2022 will be a formative year for Zip.

The share price soared to $14 early in 2021, before returning back to earth to now trade $4.16.

With Afterpay now gobbled up by Block Inc (NYSE: SQ), the company will take the mantle as the number one in the buy-now-pay-later (BNPL) sector.

But with competition ever-increasing, bad debts rising and investor scepticism over the viability of so many BNPL offerings, where does this leave Zip?

It could be a make or break year for the business.

3. Commonwealth Bank of Australia (ASX: CBA)

The big four banks had a bumper year, with an average share price increase of 20% before dividends.

CBA led the charge, increasing cash profit 19.8% to $8.6 billion.

But 2022 won’t be as easy as 2021.

Most banks, including CBA, benefitted from unwinding loan provisions throughout 2021 which flattered accounting profits.

Strip out the credit impairments and profit before tax was flat year-on-year.

Without the free kick of loan provisions, I suspect 2022 will be much tougher for CBA and its banking peers.

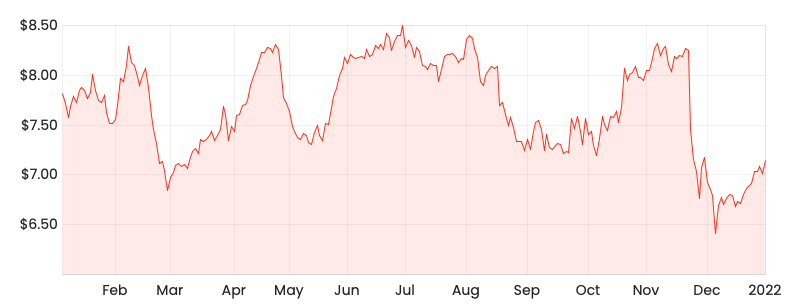

4. Nuix Ltd (ASX: NXL)

Embattled IPO Nuix had a shocker in 2021.

Insider trading allegations. AFP investigations into past dierctors. CEO and CFO resigning. And two guidance downgrades.

Subsequently, the Nuix share price lost three-quarters of its value of 2021.

With a new CEO at helm, could this be a turn around story?

Despite the internal turmoil, by all accounts the underlying software remains resilient.

If you enjoyed this comparison, consider signing up for a free Rask account and accessing our full stock reports.