The share price of medical device company Polynovo Ltd (ASX: PNV), which develops burns and surgical wound treatments, has caught fire today after announcing a record month for sales in the United States (US).

The business also provided an unaudited update for the first-half ending 31 December.

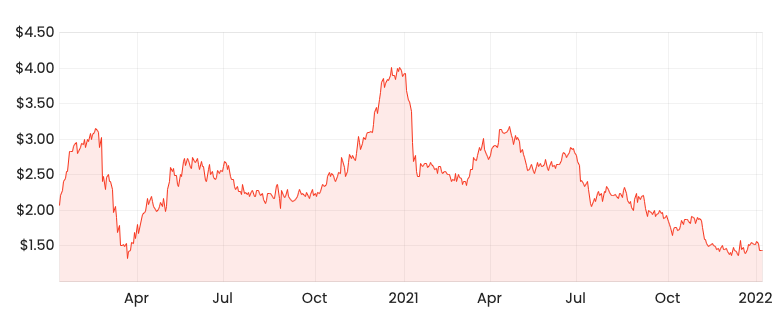

Subsequently, the Polynovo share price is up 25% to $1.80.

PNV share price

Record December buoys investors

Polynovo achieved a record sales month for its key US market, recording AU$3.4 million (US$2.4 million) in December.

The result was a 76% improvement compared to the same month in 2020 and is the first time the company has exceeded US$2.0 million monthly sales.

Justifying the recent departure of its CEO Paul Brennan, the company recorded AU$8.1 million (US$5.9 million) in second-quarter sales, a 105% improvement on the prior year.

Additionally, Polynovo recorded AU$14.2 million (US$10.4 million) US sales in the first half.

Mr Brennan resigned from his role in November over management disagreements.

“…in more recent times there have been increasing differences with the Board in relation to Paul’s interaction with the company’s senior management team and his management style.

To continue the positive second-quarter momentum, the business will add a further 10 sales reps.

Commenting on the result, Senior VP Sales & Marketing Americas, Ed Graubart said:

“We have recruited top talent and they in turn are transitioning new accounts at a record pace. We have also filled some critical internal positions that allow for a more efficient and effective organisation. The team are buoyed by the strong results and opportunities.”

Rest of the world weighs on results

Total group revenue for the first half (ex Barda) was AU$16.3 million, a 45% year-on-year improvement.

Including Barda revenue, Polynovo achieved AU$18.0 million in revenue, a 43% improvement.

The unaudited result implies rest of the world revenue was slightly down compared to the prior year:

“The major focus markets outside the US have been patchy, but initiatives are being undertaken to improve the effectiveness of our in-market programs, our direct sales force and distributor networks”

My take

December’s monthly sales infer an annualised US sales base of $28.8 million.

For a business with a market capitalisation greater than $1 billion, that’s a hefty multiple to be paying.

I really like the company, but today’s valuation isn’t compelling for me just yet.

Particularly after today’s share price jump.

If you’re looking to learn how to do your own ASX company valuations, take our free share valuation course, which takes you through 6 common share valuation techniques, step by step.

Or try our Beginner Shares Course if you’re just starting out. Both are free.