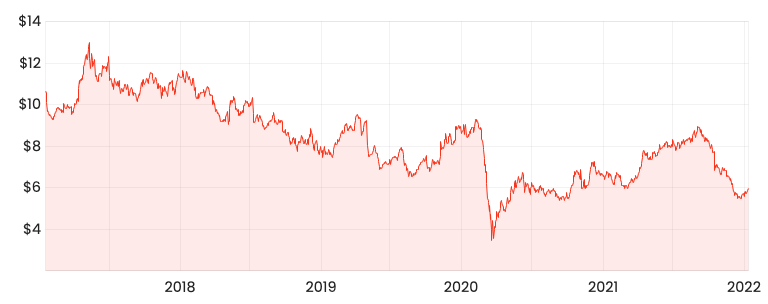

Australian fund manager Pendal Group Ltd (ASX: PDL) has seen its share price sink 18% today after the business announced funds under management (FUM) went backwards in the December quarter.

PDL share price

Outflows gain momentum

Outflows gained momentum over the December quarter., with Pendal losing $6.8 billion in mandates, more than double the past two quarters combined.

In June, the manager recorded an outflow of $0.7 billion. Then in September, outflows jumped to $2.3 billion.

The loss of FUM is directly related to a $5.1 billion redemption by two British clients flagged earlier at its annual general meeting.

“We were advised that the redemption was in relation to their recent portfolio restructure, not as a result of underperformance, dissatisfaction with our investment management or client relationship”.

Pendal isn’t the only Australian fund manager to lose a British based client in recent times.

Just last month, Magellan Financial Group Ltd (ASX: MFG) lost its largest mandate, St.James Place, resulting in a $23 billion reduction in FUM.

On a positive note, market movement of $3.8 billion somewhat offset the client losses.

To finish 2021, the company achieved FUM of $135.7 billion, down from $139.2 million in the September quarter.

Performance fee bumps profit

Despite FUM falling, Pendal will receive $22.4 million in performance fees after JOHCM (one of its affiliates) outperformed its benchmark over 2021.

Pendal runs on a September 30 financial year, therefore performance income will be recorded in its March 31 half-year result.

Commenting on today’s result CEO Nick Good, said:

“It has undoubtably been a disappointing quarter in terms of our flows. However, we are responding with a clear set of actions and have delivered strong performance fees in line with those recorded in the prior year”

To counter outflows, Pendal has launched new impact and thematic products, engaged with fund managers to improve performance and invested in its distribution to attract new and retain current clients.

My take

It’s been tough sailing for Australian active fund managers.

Even VGI Partners Ltd (ASX: VGI) announced today that it doesn’t expect to report any performance fees for its most recent half in addition to forfeiting 7% of its FUM.

Slowing outflows is incredibly difficult at the best of times. The only thing to turn it around is sustained periods of outperformance.

If you’re looking for new share ideas, check out four ASX shares I’m watching in 2022.