The Hub24 Ltd

(ASX: HUB) share price is on watch today after the company announced a third straight quarter of record net inflows.

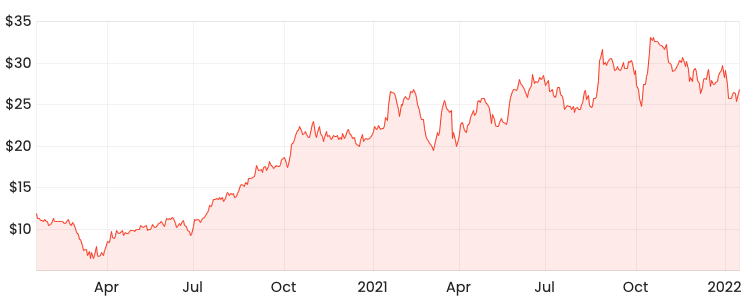

Currently, the Hub24 share price is up 2% to $27.39.

HUB share price

Inflows keep rolling in

Key highlights for the second quarter ending 31 December include:

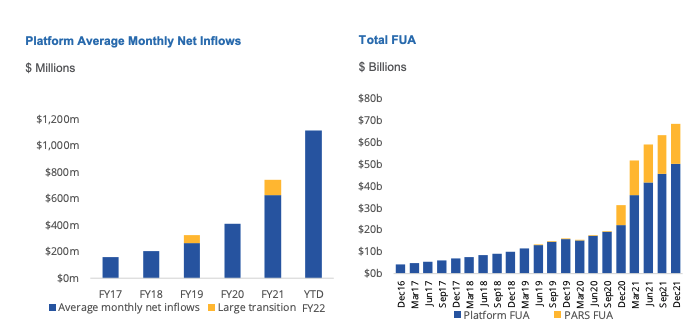

- Quarterly platform net inflows of $3.6 billion

- Total funds under administration (FUA) of $68.3 billion

- 181 new advisors on the platform

Hub’s momentum in attracting inflows and advisors has continued, with monthly net inflows now 68% higher than the same time last year.

Subsequently, Hub24 now ranks second for annual inflows, behind only competitor Netwealth Group Ltd (ASX: NWL).

Of the $3.6 billion in quarterly net inflows, $349 million was part of Hub24’s white-label platform product chosen by IOOF Holdings Limited (ASX: IFL) to replace existing legacy systems.

During the quarter, 28 distribution agreements were signed with new advisors and advice aggregators.

Your 3 minute guide to Hub24 (ASX:HUB)

As a result of the above growth, Hub24 has improved its market share from 4.3% to 4.6% over the quarter.

“HUB24 has delivered consistent growth with this result following three consecutive record quarters for net inflows and record FY21 net inflows”

PARS FUA increased $0.5 billion to $18.3 billion over the quarter, with the number of accounts increasing 4%.

Operational update

It was a busy three months at Hub24, with the company releasing several new features in addition to formalising two acquisitions.

- Online advice fee opt-in, a common pain point for advisors with clients previously needing to sign a paper document

- Enhanced record of advice generator improving regulatory obligations

- New Hub24 website with improved user experience

Regarding the Xplore acquisition, Hub expects to transfer superannuation FUA in the June quarter of 2022.

Further product migrations will occur over FY23.

The recently announced Class Ltd (ASX: CL1) acquisition will be voted on by Class shareholders on January 31.

A closer look at Hub24’s (ASX:HUB) acquisition of Class (ASX:CL1)

Accounting update

Hub also preempted two minor accounting adjustments in its upcoming February audited accounts.

The company will recognise a $3.5 million expense to reflect the increased likelihood of performance rights issued to employees.

Hub will also reduce the purchase consideration of Xplore by $1.5 million after finalising the purchase.

To keep up to date on all the latest news regarding Hub24 and the ASX, be sure to bookmark the Rask Media home page.