Megaport Ltd (ASX: MP1) shares have fallen 12% in morning trade after providing a second-quarter business update.

Today’s selling in the cloud infrastructure provider has been amplified by a broader tech sell-off on the NASDAQ 100 overnight, which fell 2.57%.

Annualised revenue now $110 million

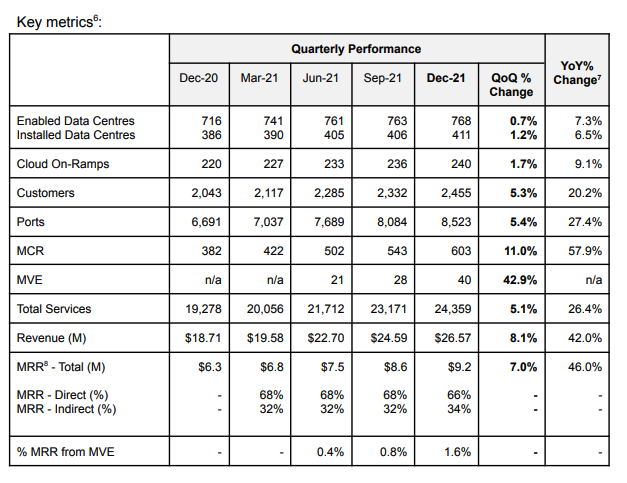

Key financial highlights from the second quarter (Q2) ending December 31 include:

- Monthly recurring revenue for December of $9.2 million, a 7% increase quarter-on-quarter (QoQ)

- Quarterly revenue of $26.6 million, an 8% improvement QoQ

- Annualised recurring revenue of $110 million

- Cash outflow of $10.3 million compared to $10.1 million in Q1

The quarterly revenue increase was spurred by the onboarding of 123 new customers.

Furthermore, Megaport added 1,191 new services in Q2, bringing total services to 24,362.

The majority of new deals were signed on long term contracts ranging from 12 to 36 months.

“This represents a growing trend of customers using Megaport to connect long-term IT solutions and taking advantage of the ability to rapidly connect those services”.

Megaport remains cash flow negative, as it continued its product development roadmap and invested in headcount.

Operational update

During the quarter, Megaport launched its PartnerVantage portal, VantageHub, for indirect channel partners.

It effectively allows indirect channel partners to sell and provide Megaport services through a single platform.

Earlier in the quarter Megaport announced that it had signed partnerships with Arrow and US-listed TD SYNNEX to use VantageHub.

“The PartnerVantage programme has enabled us to completely transform our ability to support indirect channel partners and be the first NaaS provider to integrate with leading [distributors]”

The integration of InnovoEdge remains on track and will showcase at the upcoming technology day.

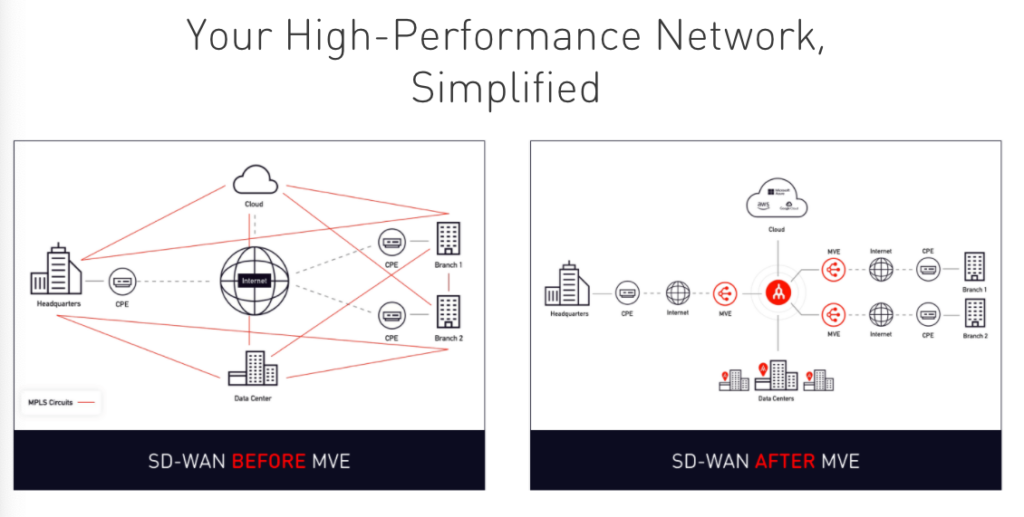

The Megaport Virtual Edge (MVE) product, which reduces latency and costs by bringing private networks closer to the edge, added 12 new services, a 42.9% increase.

MVE also increased SD-WAN partners over the quarter, adding VMware and Aruba thereby increasing its coverage to 70% of the market.

My take

Given overseas markets sold off overnight, it’s not much of a surprise to see the market react negatively to today’s update.

Investors may also be unimpressed with the headline 7% quarterly revenue growth.

However, annualising this number means Megaport is on track to record 31% yearly growth, a more palatable number for a growth company.

Overall, it’s a sound update with Megaport continuing to execute its strategy.

If you enjoyed this update, consider signing up for a free Rask account and accessing our full stock reports.