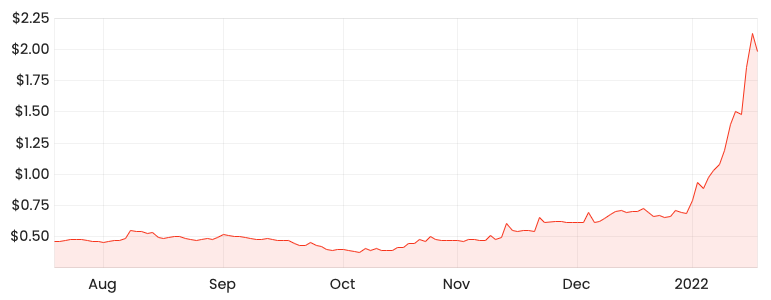

The Brainchip Holdings Ltd (ASX: BRN) share price has been on a tear recently, up 114% in 2022 (just 21 days) and 333% since October.

Despite the rapid rise, here’s why I’m avoiding the company for now.

BRN share price

Brainchip 101

Brainchip claims to have created a neuromorphic processing chip, which mimics the human brain (hence the name Brainchip) in artificial intelligence applications.

“The chip is high performance, small, ultra-low power and enables a wide array of edge capabilities that include on-chip training, learning and inference”

However, the company remains in its infancy.

Brainchip is unprofitable.

The company recorded just $112,000 in sales in its latest quarterly report.

And it only recently hired a permanent CEO.

In summary, much of the current hype is centred on what Brainchip could be, rather than its current achievements to date.

Mercedes deal buoys investor interest

The recent share price rise in 2022 is largely attributed to automobile-maker Mercedes announcing it will use Brainchip’s neural processing hardware and software in its Vision EQXX concept car.

The car giant was attracted to the energy efficiency of the chip to power artificial intelligence offerings such as its “Hey, Mercedes” voice control system.

Oddly, Brainchip chose not to disclose the partnership with the market.

Even when issued a ‘speeding ticket’ by the ASX (when a company’s share price moves rapidly on no news), Brainchip didn’t specifically mention the deal.

A word of caution

Brainchip is rather selective with its announcements and details.

The business has racked up 16 price-sensitive announcements over the past three months, with not much to show for it other than a partnership with MegaChips, a Japanese listed semiconductor manufacturer.

However, the initial announcement failed to provide any financial details until Brainchip later disclosed a $2 million upfront license fee.

Even Mercedes acknowledges Brainchip’s technology remains years from market adoption.

“Although neuromorphic computing is still in its infancy, systems like these will be available on the market in just a few years”.

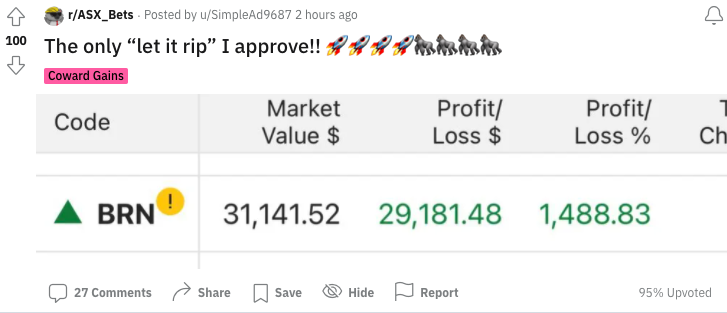

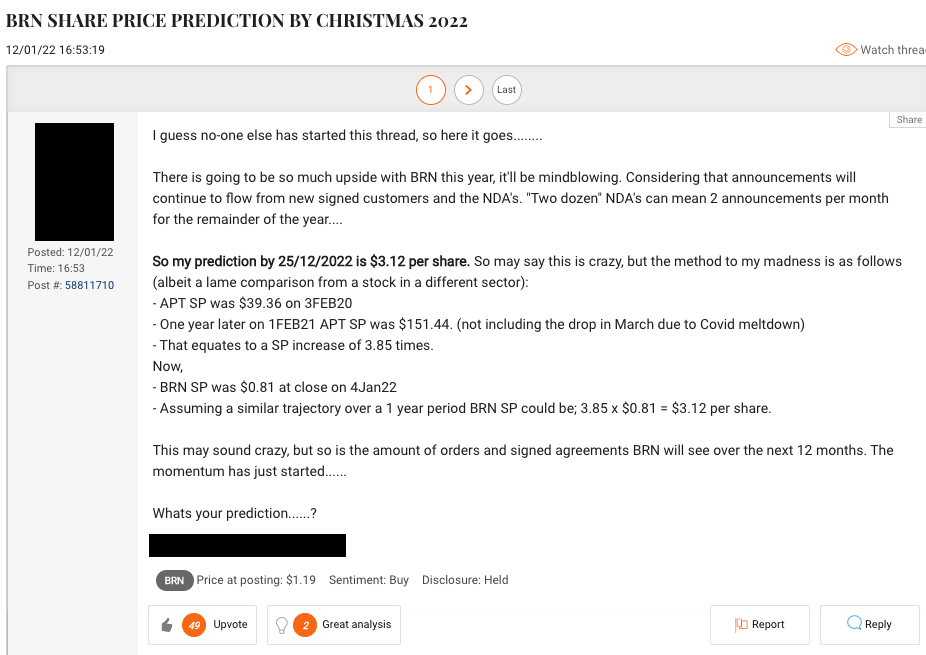

Retail favourite

It also seems to have caught the imagination of Australian retail investors across popular discussion boards Reddit and HotCopper.

It’s worth reminding oneself that contributors to these sites can have vested interests.

Many hold positions in Brainchip and are incentivised to entice other investors to bid the price up.

My take

It’s awesome to see home-grown ASX companies creating world-leading products.

But investors need to look past the hype and evaluate the business on its merits.

The fact is that a very limited number of people actually understand this technology.

Therefore, for the average investors, the ability to evaluate Brainchip’s probability of success is low. It’s a timely reminder of the importance of staying within your circle of competence.

If you’re one of these people, amazing.

But if you’re not (like me), tread with caution.