In the first edition of Watchlist Wednesday for 2022, we’ll be looking at one of the most well-known yet misunderstood companies on the ASX, Wesfarmers Ltd (ASX: WES).

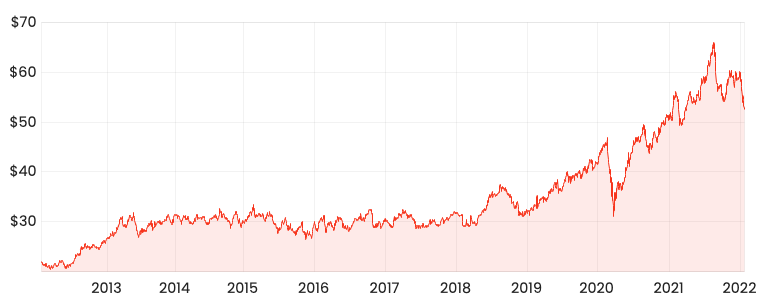

WES share price

Wesfarmers – more than just grains

It feels like Wesfarmers has been around for yonks.

Originally registered as Westralian Farmers Cooperative Limited in 1914, the company was a vehicle for West Australian farmers to demand better pay and working conditions.

But over time it moved away from its ancestral farming roots and towards new business ventures.

It established the nation’s first public radio station (now ABC Perth).

Distributed new commodities such as wool and livestock.

Wesfarmers even ventured into insurance underwriting.

Over time it acquired several businesses such as Bunnings in 1987 and divested interests including Coles in 2017.

Today’s Wesfarmers reflects a conglomerate, with six key divisions:

Bunnings (61%) and Kmart Group (19%) divisions account for the lions share of earnings.

The foundation rural business, later termed Landmark, was sold in 2003 and no longer contributes to the company today.

Back in vogue

The conglomerate structure has fallen out of favour in recent times.

Markets struggle to value one business, let alone 50 inside one.

Subsequently, conglomerates typically trade at a discount compared to if each business was separately listed (see News Corp, Johnson & Johnson or GE).

However, Wesfarmers has shown the resilience of a conglomerate structure.

Multiple divisions mean it can ride bumps through the cycle that a stand-alone company cannot.

For example, the recent struggles of Kmart and Target have been somewhat protected by the resilience of Bunnings.

This has reduced the volatility of Wesfarmers earnings and subsequent dividends. It hasn’t missed a payment since listing in 2006.

Let’s make some money

Nowadays, mission statements include buzzwords like empower, positive impact, better world… so on and so forth.

Conversely, Wesfarmers gets straight to the point. We’re here to outperform the market.

The primary objective of Wesfarmers is to provide a satisfactory return to shareholders… we measure our performance by comparing Wesfarmers’ TSR (total shareholder return) against that achieved by the broader Australian market.

Wesfarmers is the kind of company you buy, place in the bottom drawer and throw away the key.

And on that measure, it has excelled.

Over five, ten and fifteen-year time periods, Wesfarmers has beaten the S&P/ASX 200 (ASX: XJO).

The investment case

With a fully franked dividend yield of 3.4%, Wesfarmers isn’t going to light your world on fire.

But it won’t blow your portfolio up either. It’s dependable and defensive.

Remember, Wesfarmers primary objective is a satisfactory return to you, the shareholder.

For that reason, Wesfarmers is the kind of company I have on my watchlist for 2022 and beyond.

If you enjoyed this analysis, consider signing up for a free Rask account and accessing our full stock reports.