It’s been a roller-coaster day for the Brainchip Holdings Ltd (ASX: BRN) share price after the company posted its second-quarter trading result.

The Brainchip share price initially raced out of the gates up 15%. However, it has abandoned all of those gains and is now up 0.35%.

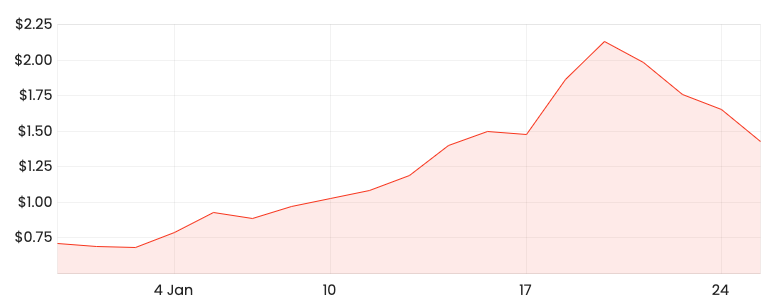

Today’s share price movement is somewhat illustrative of the past month for Brainchip shareholders.

Despite rising 114% in 2022, here’s why I’m avoiding Brainchip (ASX: BRN)

Brainchip’s share price started the year just below $0.37 before rocketing to a high of $2.34.

But it’s now retracted half of the share price rise to currently rest at $1.44.

BRN share price

Q2 update

Key highlights from the second quarter ending December 31 include:

- Cash receipts if US$1.1 million

- Net cash outflow of US$3.4 million

- Cash balance of US$19.4 million

- Appointment of new CEO Sean Hehir

- Addition of Non-Executive Director Pia Turcinov

Brainchip continues to be loss-making, recording just over $1 million in sales for the quarter.

Throughout the quarter, Brainchip began disseminating testing kits for its Akida AKD100 neuromorphic processors chips to potential partners.

“In the coming quarter, the Company will be focused on the Akida go-to-market strategy refinement and adding additional resources to our Sales and Marketing teams”

The company reiterated the US Patents and Trademarks Office had approved three key patents relating to Brainchips Akida technology.

It also repeated the previously announced MegaChips license agreement. Note that it will only contribute $2 million of revenue initially.

To America and beyond

Brainchip announced that it will be setting American Depository Receipts (ADRs).

Effectively, it allows North American investors to trade Brainchips shares on local exchanges, rather than needing to buy and sell on the ASX.

For current or future ASX investors, it does not impact your shareholding.

Raising on the cards in 2022?

Today’s release didn’t provide much colour on Brainchips operations that wasn’t already known by the market.

At the current burn rate, the company has about five quarters, or just over a year, of cash on hand to support its growth.

Subsequently, the business may look to raise capital for shareholders at some point in 2022.

This is especially true given the rapid share price appreciation. Although management has made no indication of a raising thus far.

Personally, I’m not that excited about the Brainchip share price.