Emerging telecommunications provider Aussie Broadband Ltd (ASX: ABB) share price will be on watch today after announcing a second-quarter update.

Currently, the Aussie Broadband share price is up 0.24% to $4.23.

Growth across the board

Key highlights from the second quarter include:

- Residential internet connections of 422,034, up 6% quarter-on-quarter (QoQ)

- Business internet connections of 45,483, up 13% QoQ

- Mobile services of 32,207, up 9% QoQ

- Market share of 5.66%, up from 5.17% in September

- Revenue up 11% QoQ

The headline growth might not look that impressive. But looking out over a one-year horizon, Aussie Broadband is a much bigger business today.

The bull case for Aussie Broadband (ASX: ABB) shares

Total broadband connections are up 45% on the prior year. Moreover, mobile services are up 70%, albeit off a lower base.

“Demand for Aussie Broadband business services has continued to remain strong with ABB taking 15% of NBN enterprise ethernet service orders in FY22 year to date”

Aussie Broadband’s fibre rollout, which will reduce the cost of leasing Telstra infrastructure, remains on track with another 22 sites completed.

The business expects to complete 34 sites in Q3 and the final 10 sites in Q4, with cost savings from March 2022.

Aussie Broadband is also in discussions with the NBN regarding future pricing changes, which would positively impact its margins.

However, progress remains mixed. Popular plans are still priced unsustainably and there is no timeline for implementing the agreement.

Outlook for FY22

Based on the second-quarter results, Aussie Broadband expects:

- Revenue of $237.3 million for the first half, a 49% increase year-on-year

- EBITDA of $9.1 million for the first half, a 24% improvement year-on-year

- Net broadband additions of 85,000 to 95,000 for the second-half

- Full-year EBITDA between $27 million to $30 million

Both EBITDA forecasts exclude transaction costs and contributions from the Over the Wire acquisition.

EBITDA has been impacted by rising marketing costs, as Aussie Broadband encourages customers already on the NBN to switch plans.

In prior years, Aussie Broadband has been able to sign up customers straight onto NBN plans rather than needing to poach them from competitors.

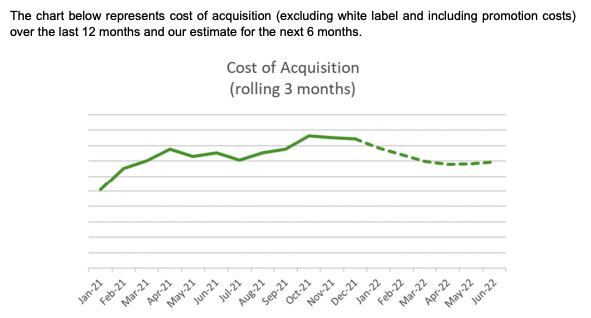

Subsequently, the company’s cost of acquisition has risen over the past six months.

Aussie Broadband also incurred higher CVC charges, particularly during Q1 when Victoria and New South Wales were in lockdown.

CVC is an extra expense charged by the NBN when resellers exceed their allocated bandwidth on the network.

“Whilst first half EBITDA has been impacted by increased promotional costs, and CVC expense due to lockdowns, we expect to see the benefits of operating leverage in 2H FY22 with employee, marketing and administration expenses expected to be lower as a percentage of revenue”

Aussie Broadband will release its audited half-year result on February 21.

To keep up to date with our coverage on Aussie Broadband and the ASX, be sure to bookmark the Rask Media home page.