Looks like I came back from holidays just in time for all the fun and games in the market at the moment. But in all honesty, I know seeing your share portfolio fall in value (for the first time in the case of many community members) is scary.

You’ll see a lot of content right now about focusing on long-term investing, how excited investors are to buy their favourite shares “on sale” and even commentators wishing for a much bigger crash. Most of this is well meaning, but it can discount the fear you’re feeling right now, which should be acknowledged.

I recommend watching this short video where Owen explains why the current stock market sell-off might not be a cause for concern and why now might be a good time to invest for the long run.

In this article, I’m going to help you get a bit of perspective on everything, along with some strategies that help me during challenging periods of investing. I do this in the hope that this article will act as a circuit breaker if you’re stuck staring at your portfolio and refreshing the headlines.

Let’s zoom out a bit…

The investment research team at Rask Invest can tell you the facts and figures behind the investment case for a particular company or ETF, alongside all the reasons why you should consider investing more right now, but let’s zoom out a bit and look at the bigger picture.

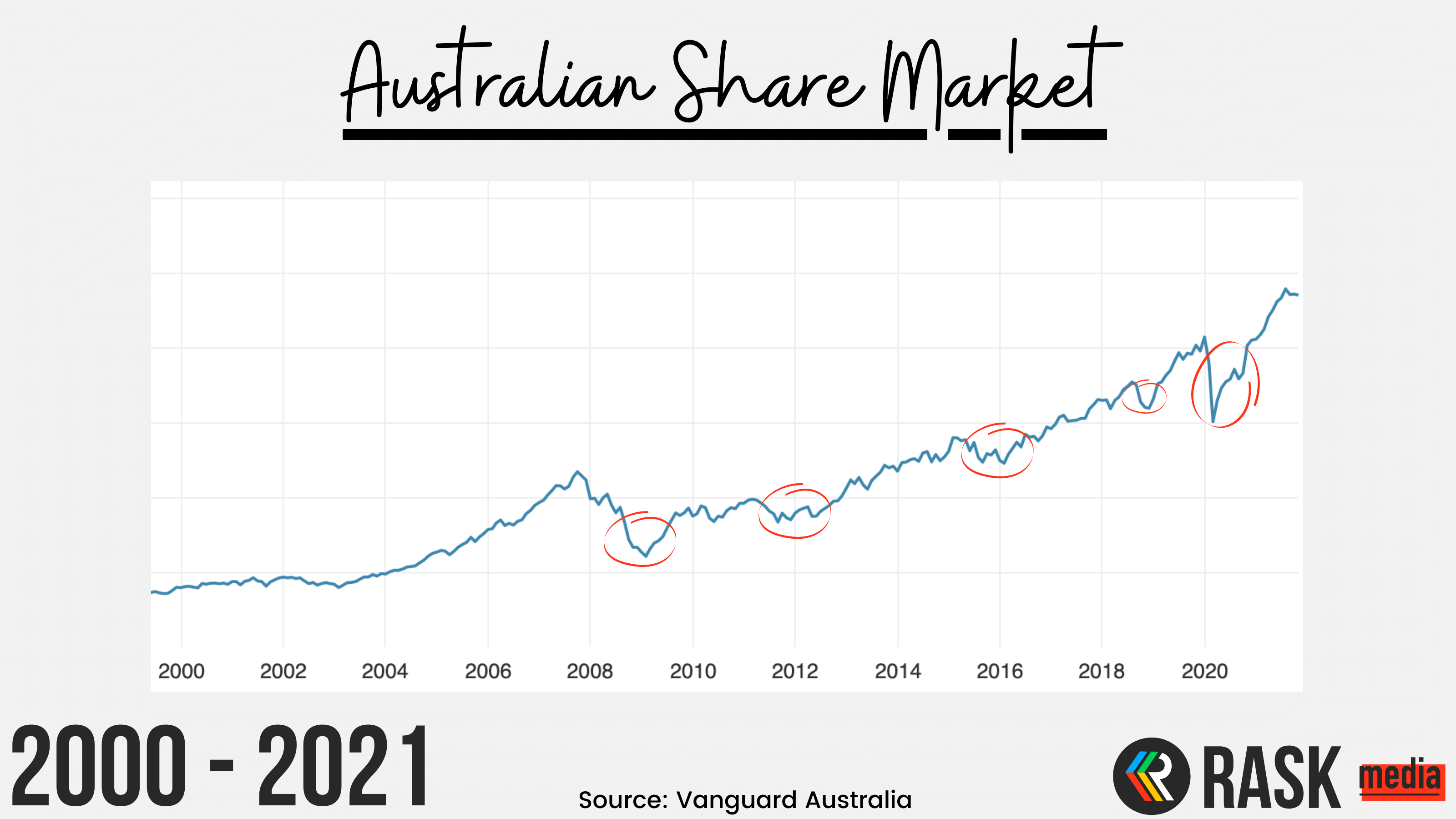

Take a look at this chart, showing the performance of Australian shares over the past 20 years. The red circles show periods of time when the market fell, and people were feeling the same way you are now. This is a normal part of investing.

Get your head out of the cloud

And by cloud I mean your devices.

Time for some tough love.

Staring at your portfolio all day isn’t going to change anything, and sometimes the simplest thing you can do is just switch off. The world isn’t going to end if you don’t check your brokerage account for a day, and if it does, then your portfolio won’t be able to help you anyway.

Understand what you can and can’t control

A piece of advice that can be implemented across all aspects of life, is to differentiate between what you can and can’t control, and then focus on the things that you can do something about.

You can control the way you plan your portfolio, what you invest in, and how you handle yourself during a period of market volatility, but you can’t control how the market behaves at any given time.

Get comfortable with uncertainty

The fun thing about investing is that you have no idea what’s going to happen tomorrow, but you can get a rough idea of what’s going to happen over a longer period of time.

Remember that chart above?

Even though there have been many challenging months and years for investors, at the end of the day,

history has rewarded investors for staying the course.

So it’s good to get comfortable with the idea that you’re never going to know the right day to buy and sell, but if you invest small amounts on a regular basis, you’ll be ahead of the game.

Revisit your investment plan

Check back in with your investment plan and the reasons why you invested in each company or ETF to begin with. Consider whether anything material has changed about your investments, outside of external market forces.

Don’t have one? Follow our 8-part plan

- How much money have you invested now?

- How much money can you add every month, rain, hail or shine?

- Important step: take your answers to #1 and #2, then use a 6% return and chuck it into this calculator.

- After 10 years how much do you have?

- After 30 years how much do you have?

- The simple part: keep investing your regular amounts.

- The hard part: keep investing your regular amounts into sensible ETFs and shares.

- Ask yourself: if you’re investing for 10 or 20 years from now, does it really matter if the stock market falls 10% or 20% for a few years? (The answer is: probably not!)

Use meditation and outdoor activities to ground you

Finally, get outside for a walk, call friends or family or do a guided meditation on an app like Calm.

Sometimes you just need a little perspective to remember that money is a tool and you should treat it like one. Getting overly attached to money can be harmful to your wellbeing, so take some space and remember to check in with yourself.

I hope this has given you some tools to help when you’re feeling anxious about your investments, and remember the bigger picture of why you’re investing.

Be sure to share your thoughts and experiences with our FB Community who are always happy to offer their perspective and wisdom.