Whether it’s via superannuation, a personal account or an exchange-traded fund, shares in Commonwealth Bank of Australia (ASX: CBA) are owned by most Australian investors.

Australia’s second-largest company is also considered the best big bank in the country, leading the likes of National Australia Bank Ltd (ASX: NAB), Australia and New Zealand Banking Ltd (ASX: ANZ) and Westpac Banking Corp (ASX: WBC).

Today, we’ll dive into the business and why CBA shares are worthy of a spot on your watchlist.

Going full circle

CBA has a rich history dating back to its foundation in 1911.

From 1920 to 1959, it acted as both a commercial bank for households and businesses and a central bank controlling the supply of money and interest rates.

After concerns of a conflict of interest were raised, central bank responsibilities were split out into what we now know as the Reserve Bank of Australia.

Subsequently, CBA went on a diversification (or diworsification depending on who you ask) spree, expanding into travel, broking, insurance and wealth management.

It went abroad and opened branches in North America, New Zealand, China and other parts of Asia.

However, the Royal Banking Commission in 2017 handed down a series of damning findings against CBA, and other financial institutions.

A simpler and leaner bank was needed.

CBA divested its non-core divisions to focus primarily on lending.

The company effectively went full circle, returning to its roots as a commercial bank lender.

Barebones

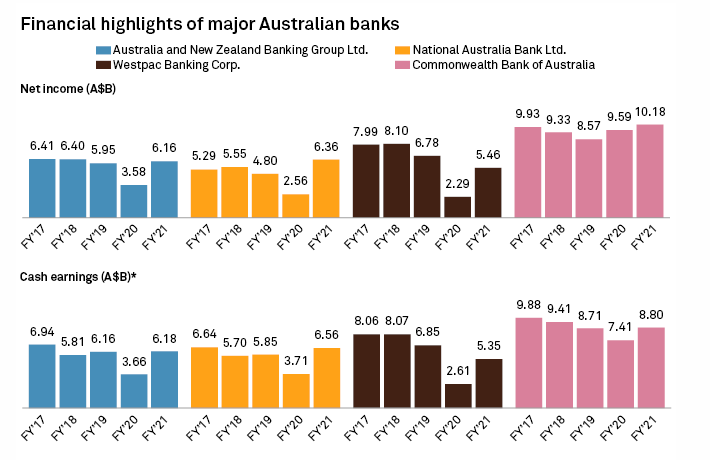

Since the divestment of non-core lending divisions, the earnings of the big 4 banks have effectively stood still for the last five years.

CBA shares are no exception.

Source: S&P Global Market Intelligence

To make matters even more difficult, competition has increased weighing on profitability.

Technology-led disruptors such as Athena and neobanks like Volt have also been nipping away at CBA’s millennial client base.

The outstanding question from investors is where will the next leg of growth come from?

The company has taken stakes in disruptors such as Amber and Little Birdie.

However, a material financial contribution from these ventures remains years away.

Glass half full

Despite concerns over growth and competition, there is cause for optimism.

Interest rates look to be on the way back up, which will benefit CBA’s net interest margin (NIM).

The NIM is the difference between what banks pay depositors (like you and me) on savings balances and the money it receives from lending.

As rates increase, CBA passes on the cost of the interest increase while rising at deposits at a relatively slower rate.

This increases the spread CBA achieves, raising its NIM and earnings.

It should also be noted CBA is universally considered the best big bank.

It leads the other big banks on financial metrics such as return on equity and market share.

On softer measures, it ranks first for its mobile app and business banking.

Independent of valuation, if you wanted to own a bank, CBA is largely considered the one.

Putting a price on CBA shares

With a trailing dividend of $3.50 fully franked, CBA shares currently trade on a yield of 3.7%.

Easy ways to research the CBA share price and ANZ share price

Given the risks around competition and growth, I’d argue today’s price appropriately values CBA shares.

Therefore I’m not jumping out of my chair to buy shares today.

But as Australia’s premier bank, it’s deserving of a spot on most investors watchlists.

If you’re looking to learn how to do your own ASX company valuations, take our free share valuation course, which takes you through 6 common share valuation techniques, step by step.

Or try our Beginner Shares Course if you’re just starting out. Both are free.