The share price of luxury online reseller Cettire Ltd (ASX: CTT) has taken a nasty dive today despite nearly tripling revenue for the first half of FY22.

Currently, shares in Cettire are down 21.19% to $2.38.

Revenue explodes, profit sinks

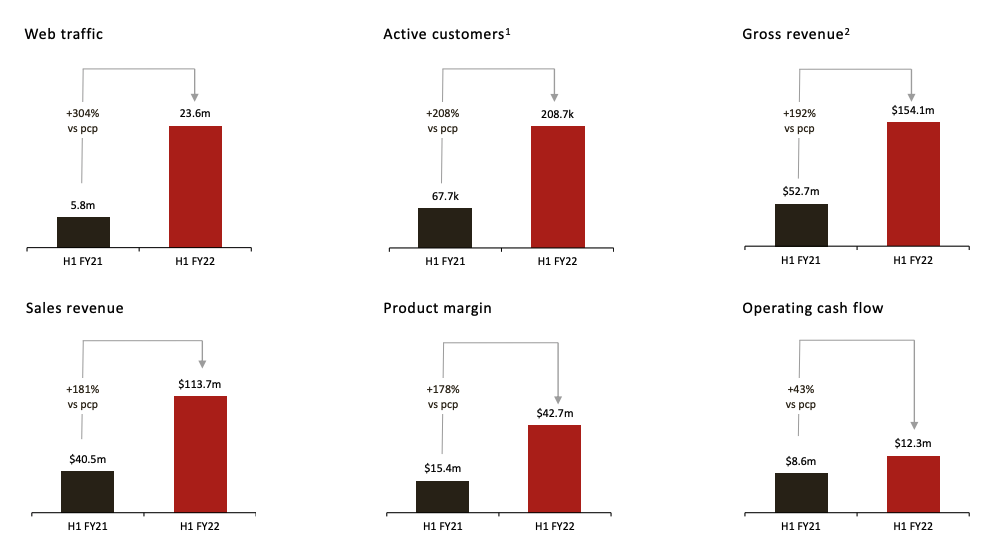

Key highlights from the first half of FY22 include:

- Gross revenue of $154.1 million, up 192% year-on-year (YoY)

- Sales revenue of $113.7 million, up 181% YoY

- Negative EBITDA of $9.9 million, a reversal from the positive $4.8 million in the prior corresponding period (pcp)

- Operating cash flow of $12.3 million, up 43% YoY

Cettire achieved explosive growth across almost all metrics, with the first half of FY22 surpassing all of FY21.

Website visits soared 304% translating into order numbers increasing 221%.

Customer loyalty is rising, with 46% of sales derived from repeat users, up from 34% a year ago.

Average basket size and conversion fell over the period, however, this is to be expected as the business scales and brings in new customers.

Cash flow flattered by ballooning liabilities

Notwithstanding the rapid growth, Cettire failed to translate its gains into profits.

EBITDA turned negative, as did net profit after tax.

Even the positive operating cash flow flatters the result, given payables increased $22 million over the half.

Cettire has pushed out its payments to suppliers for its cost of goods, therefore inflating current cash flow figures.

However, this money will need to be paid back to creditors at some point.

Moreover, marketing expenses of $25.8 million outpaced gross profit of $24.7 million.

In other words, Cettire is spending more on acquiring and retaining customers than what it is making from them.

The hope is that future gross profit growth will outpace marketing expenses, with that excess cash dropping to the bottom line.

But in its current form, the Cettire business is unsustainable.

What’s next for the Cettire share price?

Sales growth in January has continued the strong momentum from the first half, with gross revenue up 242%.

In response to 80% of its traffic coming from mobile devices, Cettire will launch its own mobile app to optimise the user experience.

The company will also introduce its beauty products to its website.

It doesn’t appear profits will be on the horizon anytime soon, with management signalling their attention to reinvest back into the business.

“Given the global growth opportunity available to Cettire, we will be running the business to maximise revenues by further investing in brand and customer acquisition, to drive long-term shareholder value”

Approximately 16% of Cettire shares will be released from escrow after today’s result. Therefore subsequent insider selling could weigh on the share price in the near term.

If you enjoyed this update, consider signing up for a free Rask account and accessing our full stock reports.

Alternatively, bookmark the Rask Media home page and February reporting season calendar to keep up to date with the latest company news.