The Pinnacle Investment Management Group Ltd (ASX: PNI) share price will be on watch today after announcing its first-half result for FY22 overnight.

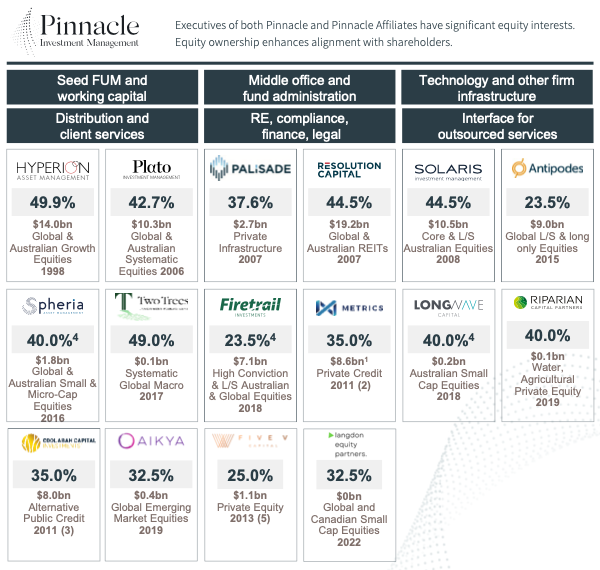

Pinnacle owns stakes in 16 fund managers including Hyperion, Firetrail, Spheria and Coolabah Capital.

The company then provides back office, administration and distribution to help grow each fund manager.

Profits up despite net outflows

Key financial results for the first-half include:

- Total affiliate funds under management (FUM) of $93.6 billion, up 33% year-on-year (YoY)

- Net profit after tax (NPAT) of $40.1 million, up 32% YoY

- Diluted earnings per share of 21 cents, a 26% YoY improvement

- Interim dividend fully franked of 17.5 cents per share, a 50% jump YoY

Despite retail achieving a record FUM increase of $2.9 billion, Pinnacle experienced net outflows of $1.7 billion over the half.

The loss of a large $3.9 billion passive mandate was the main culprit, while institutional rebalancing weighed on growth.

“Whilst we experienced institutional net outflows, we believe these reflect short-term factors including rebalancing, with the rate of gross inflows broadly consistent with the prior comparative half year…”

Fortunately, net outflows for the half were more than offset by the $4.7 billion in market movement, in addition to a $1.1 billion contribution from the recent Five V acquisition.

Regarding performance fees, five affiliates contributed a total of $6.4 million. This is down on the prior year, where four affiliates contributed $11.0 million.

Offsetting the slump in performance payments, base management fees were up 42% over the half aided by the growth in FUM.

Why the Pinnacle Investment Management (ASX: PNI) share price could reach new heights

Pinnacle’s fund managers continue to perform strongly, with 77% exceeding their 5-year benchmark.

Including its interim dividend, Pinnacle is now trading on a fully franked dividend yield of 2.9%.

Uncertain outlook for the remainder of FY22

Pinnacle did not provide any concrete guidance regarding FUM or inflows.

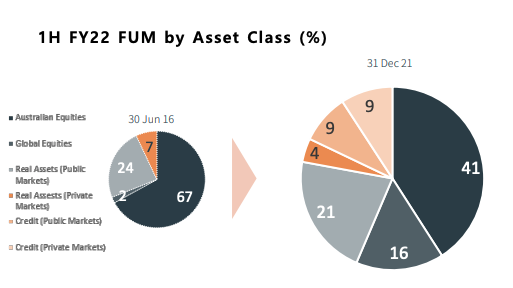

However, management believes it is well placed to weather current market volatility given its diverse range of asset classes.

“Pinnacle has an excellent platform in place to continue to prosper – driven by growth within existing Affiliates, incubating new Affiliates and strategies, domestically and offshore, as well as careful, but deliberate, acquisitive growth…”

If you enjoyed this analysis, consider signing up for a free Rask account and accessing our full stock reports.

Alternatively, bookmark the Rask Media home page and February reporting season calendar to keep up to date with the latest company news.